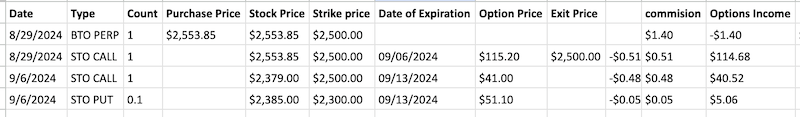

On August 29, 2024, I initiated a covered call strategy by purchasing a long ETH perpetual futures contract at $2,553. To generate income, I sold an in-the-money (ITM) call option with a $2,500 strike price, expiring on September 6.

With ETH trading at $2,383 today, my call option expired worthless. Although the current market price is below my breakeven of $2,438, I decided to roll the position forward to a new expiry date of September 13, 2024, keeping the same $2,500 strike price and receiving $41 in premium for the new option.

Here is the trade setup:

- SLD 1 CALL SEP 13 '24 2,500 Call Option 41 USD

Adjusting the Strategy: Selling a Put for Additional Flexibility

Originally, I planned to buy an additional 0.1 ETH perpetual futures contract at the market price of $2,380 to start building up my position, but after careful evaluation, I decided to sell a short put instead.

I sold 0.1 short put option with a $2,300 strike price, earning $5.1 in premium. This decision allows me to accumulate ETH at a lower price point if the market continues to decline. If ETH recovers, I still benefit from the premium collected.

Here is the trade setup:

- SLD 0.1 PUT SEP 13 '24 2,300 Put Option 51.1 USD

This approach is similar to the "wheeling" strategy, where I plan to continuously adjust my position by selling puts if the market declines further. If ETH stabilizes or rises, the premiums I collect will compound the profits, making this a flexible way to manage the volatility.

What Happens Next: Evaluating Scenarios

Scenario 1: ETH Rallies Above $2,500

If ETH rallies above $2,500 by September 13, 2024, my call option will be exercised. The maximum profit scenario in this case is calculated by:

- Selling ETH at $2,500 (the strike price), which is below my initial purchase price of $2,553, but with the added benefit of the premiums received:

- $115 from the initial call option sale

- $41 from the rolled call option

- $5.1 from the short put option

This brings my total premium earnings to $161.1. My breakeven point drops to $2,391.9 ($2,553 - $161.1), meaning I still end up in profit if ETH closes above $2,500, with a maximum potential gain of $108.1 ($2,500 - $2,391.9).

Scenario 2: ETH Drops Further Below $2,383

If ETH continues to decline, I’ll keep rolling my call options and adding more put trades. By selling short puts with lower strike prices, I can generate more premium and potentially accumulate ETH at even lower prices. If ETH drops below $2,300, my short put may get assigned, allowing me to purchase additional ETH at that lower price.

I’ll keep this rolling strategy in place while incrementally building my ETH position. The goal is to grow the contract size to 2 ETH over time, adding 0.1 ETH every week either through direct market buys or by letting short puts get assigned.

By rolling my covered call and selling puts, I’m adding layers of flexibility to my ETH strategy. In the event of a rally above $2,500, I can still lock in a profit thanks to the premium collection. If ETH drops further, I can accumulate ETH at better prices while generating additional income through put sales. This method allows me to manage risk while keeping upside potential intact, aligning with my long-term goal of growing my position to 2 ETH.

- In total:4 trades since August 29, 2024

- Options premium: $158.86

- Break Even: $2,394.99

My plan is to close the trade with max profit, but in case ETH trades under strike price of $2,500, will keep rolling it forward. No matter the result, next week I'm planing to increase total trading contract size to 1.2 ETH.

This trade is another step in my ongoing journey with TerraMatris Crypto Hedge Fund, where calculated risks and strategic planning are essential to navigating the volatile crypto markets.