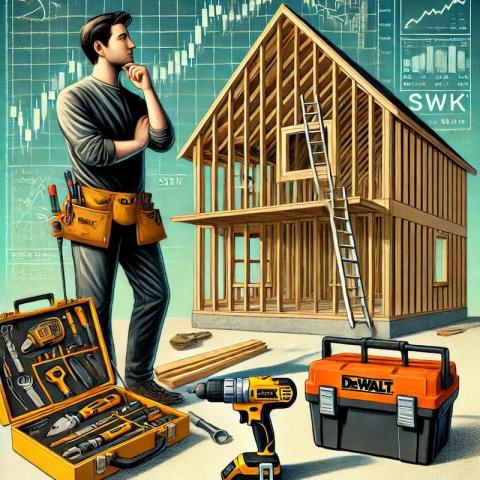

As an investor and DIY enthusiast, I recently embarked on a journey to slowly acquire shares in Stanley Black & Decker (SWK), leveraging my fascination with their renowned DeWalt power tools.

The decision to invest in SWK came after a conversation with my brother, who expressed high praise for DeWalt tools. This sparked the idea of investing in a company whose products we use and trust. As I near the completion of building our own frame house, predominantly with no-name power tools and even a hand saw, I am considering the future benefits of owning top-quality tools from a company like DeWalt. Here's a detailed look at my investment strategy, focusing on selling monthly put options and credit spreads.

Why Stanley Black & Decker (SWK)?

Stanley Black & Decker, a leading global provider of hand tools, power tools, and related accessories, is an attractive investment for several reasons:

- Brand Reputation: DeWalt is renowned for its high-quality, durable tools, making it a preferred choice among professionals and DIY enthusiasts.

- Market Position: SWK's diverse product portfolio and strong market presence position it well for long-term growth.

- Dividend Yield: SWK offers a solid dividend yield, providing an additional incentive for long-term investors.

Investment Strategy: Selling Put Options and Credit Spreads

To systematically acquire SWK stock, I am focusing on selling monthly put options and credit spreads. This strategy not only allows me to potentially buy SWK at a lower price but also generates income through premiums.

Selling Put Options

Selling put options involves giving another investor the right to sell SWK stock to me at a predetermined price (strike price) by a specific date (expiration date). This strategy is ideal if I am willing to buy SWK at a price below its current market value.

Example Strategy:

- Sell 1-month put option with a strike price slightly below the current market price of SWK.

- Premium Income: Collect the premium from selling the put option.

- Potential Outcome:

- If SWK stays above the strike price, I keep the premium as profit.

- If SWK drops below the strike price, I purchase the stock at the strike price, effectively buying it at a discount.

Selling Credit Spreads

A credit spread involves selling a put option and buying a lower strike put option with the same expiration date. This limits potential losses while still allowing for premium income.

Example Strategy:

- Sell 1-month put option at a higher strike price.

- Buy 1-month put option at a lower strike price.

- Premium Income: The net premium received is the difference between the premiums of the sold and bought options.

Potential Outcome:

- If SWK stays above the higher strike price, both options expire worthless, and I keep the net premium.

- If SWK falls below the higher strike price but stays above the lower strike price, the maximum loss is limited to the difference between the strike prices minus the net premium received.

Long-Term Goals

By using these options strategies, my goal is to accumulate SWK shares gradually while generating income from option premiums. This approach aligns with my belief in investing in what I use and trust. Over time, as I continue to build and improve our home, I may invest in DeWalt tools, further solidifying my connection to Stanley Black & Decker.

Conclusion

Investing in Stanley Black & Decker (SWK) through selling put options and credit spreads is a strategic way to acquire shares at a potentially lower cost while earning income. This approach not only aligns with my practical experiences and trust in the brand but also provides a disciplined investment strategy. As I near the completion of our frame house using no-name tools, I look forward to the day when I can equip my toolbox with DeWalt products, knowing I have a stake in the company that makes them.