This week has been exceptional for my stock portfolio, and I'm excited to share the progress. The approach I’ve adopted is heavily inspired by the successful TerraMatris Crypto Hedge Fund, which has seen substantial growth through disciplined weekly trades. I’ve taken a similar path with my stock portfolio, focusing on options trades and dividend stocks as key strategies for long-term growth.

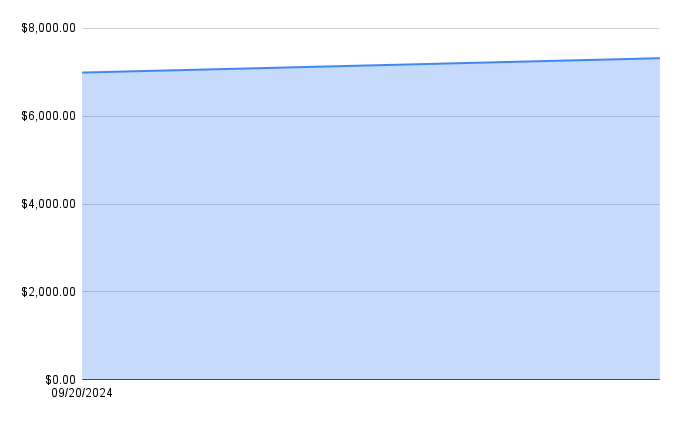

My ultimate goal is to grow this portfolio to $100K, using options trading as the primary vehicle to get there. By consistently selling puts and covered calls, I aim to generate steady income, which will be reinvested into quality dividend stocks. Since the start of this challenge (September 20), I’ve already generated $172.26 in options premium income, helping to boost the portfolio’s growth.

This week, the portfolio surged by 4.68%, reaching a new total of $7,314.72. In dollar terms, that’s a gain of $327.14. One of the main contributors to this rise was the recovery in my short put options trades, particularly with Intel (INTC) stock. Holding a November 29 short put strike, I regained about $200 on this position as INTC continues its rebound.

Another important move this week was rolling down and forward a $39.50 short put on Bank of America (BAC). This adjustment was made to optimize my positions and lock in additional premium income. As a final highlight for the week, I allowed my 100 shares of Bristol-Myers Squibb (BMY) to be called away. This decision freed up capital, and I immediately sold a new put option with next Friday’s expiry, receiving a $25 premium.

On the stock-buying front, I continue to build my dividend portfolio. This week, I purchased 0.1 shares of Apple (AAPL) and 1 share of Morgan Stanley (MS). These small but steady additions will contribute to the long-term growth of the portfolio as I aim to gradually accumulate positions in high-quality dividend stocks.

The journey to $100K won’t happen overnight, but with consistent trades and a solid strategy, I’m confident that we’ll achieve that goal. For now, the steady income from options premiums, along with the growth in underlying stock values, is paving the way for future success.