In 2024, I adopted an aggressive strategy to acquire BP stock, utilizing one of my preferred options trading tactics: selling put options on stocks I aim to own. BP's appeal lies in its optionable status, consistent dividend payouts, and its position in the oil industry. Despite the global shift towards green energy, I believe oil will remain indispensable for years to come.

However, following a disappointing earnings report, BP's stock experienced a significant decline, leaving me with deep in-the-money short put options. To manage this, I chose to roll the position forward, postponing the option's expiration to a later date. During this period, I paused additional BP stock purchases.

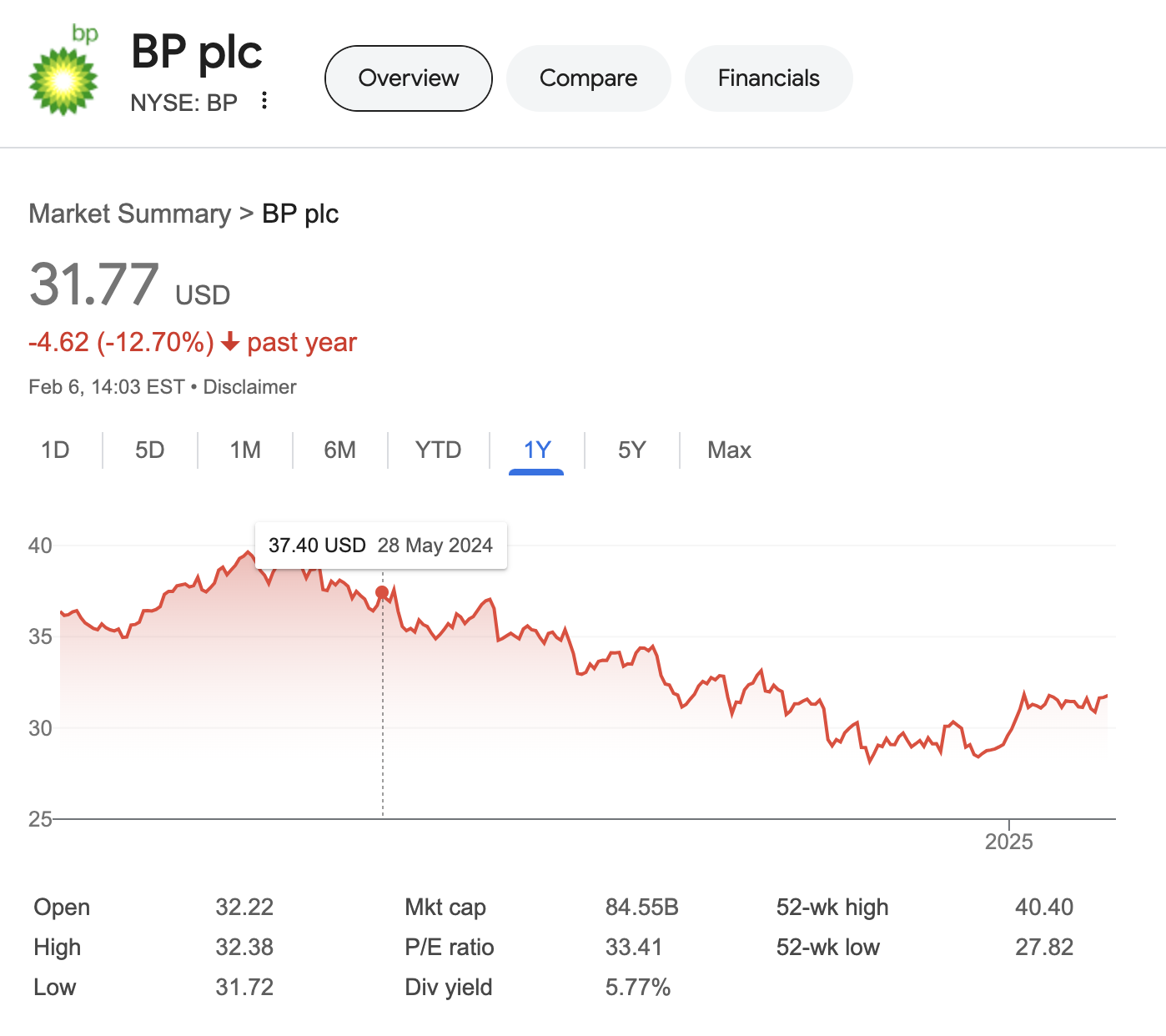

As of February 6, 2025, I held 15 BP shares with an average purchase price of $36.74. I also maintained a short put option expiring on June 21, 2025, with a strike price of $33. With BP's stock showing recent recovery, I aimed to enhance returns by selling a partially covered call option expiring on March 21, 2025, selecting a strike price of $35 and collecting a premium of $0.37 per share. The premium received allowed me to purchase an additional share of BP, increasing my total holdings to 16 shares and reducing the average purchase price to $36.46.

Since November 5, 2024 we have collected $44 in options premium, thus lowering our potential break even for put options to $32.56

BP plc is a British multinational oil and gas company headquartered in London. As one of the world's seven oil and gas "supermajors," BP operates in all areas of the oil and gas industry, including exploration, production, refining, distribution, and marketing. The company is listed on the London Stock Exchange and the New York Stock Exchange under the ticker symbol BP.

Despite the challenges faced in 2024, my strategic approach to managing BP options and stock holdings has positioned me to benefit from potential future gains. BP's strong presence in the oil industry and its significant investments in regions like Georgia reinforce my confidence in the company's long-term prospects.