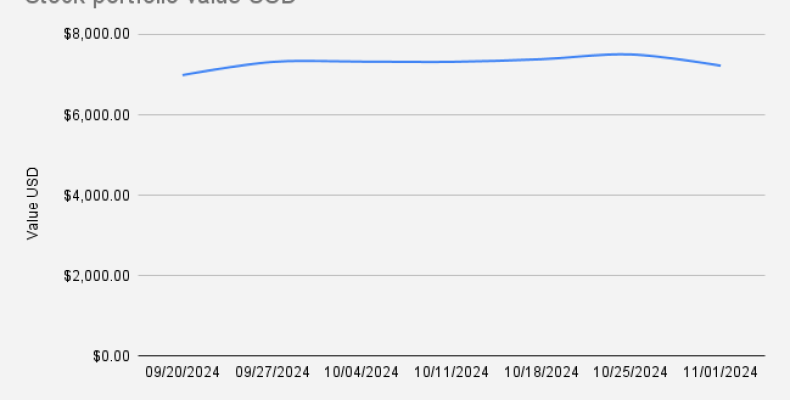

This week, our stock portfolio experienced a decrease, closing at $7,221.25, marking a -3.74% change compared to the previous week.

The drop reflects some longer-term options strategies we’ve been implementing, particularly involving BP, alongside a recent dip in Ford (F) stock, both of which contributed to this week's overall decline.

Despite this setback, we took the opportunity to add to our holdings strategically. This week, we purchased one additional share of Deutsche Bank (DB), adding to our existing position in the financial sector.

Additionally, today we executed three credit spreads on Bristol-Myers Squibb (BMY), with a 54/51 strike expiring next week. By selling these three credit spreads, we generated premium income, which we promptly reinvested into one more share of BMY, further strengthening our commitment to this position within our portfolio.

As we navigate through current market conditions, we’ll continue refining our approach by blending tactical options trades with strategic stock acquisitions. This combination of income generation and long-term growth remains central to our investment philosophy, helping us mitigate risks and capitalize on new opportunities.

Options Income

Since September 17, 2024, the total income generated from my options trading has reached $550.81. This income stream continues to provide additional cash flow, which we use to reinvest into stock buys to accelerate portfolio growth.