The financial markets can be unpredictable, especially when unexpected developments disrupt trading strategies. Recently, NVIDIA (NVDA), a major player in the AI sector, faced significant volatility due to news about the Chinese DeepSeek AI platform, sparking concerns about a potential AI bubble in the U.S. Here’s how I adjusted my NVDA trade and planned my next steps.

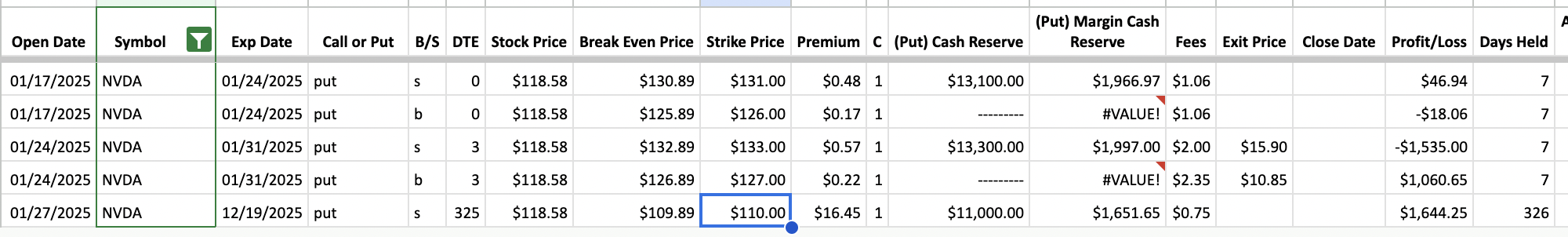

On Friday, January 26, 2025, I opened a bull put credit spread on NVDA with strike prices of $133/$127 while collecting premium of $32.46 The plan was expecting NVDA to stay above $133 at expiration. However, by Monday, January 27, 2025, news about China’s DeepSeek AI platform caused NVDA’s stock to drop sharply to $117, forcing me to adjust the trade.

To manage the situation, I decided to roll the trade out to a December 2025 expiry. Here’s what I did:

- Bought the $133 Put for $15.90.

- Sold a $110 Put for $16.45, collecting a substantial premium.

- Sold an additional $127 Put with expiry on December 19 for $10.85 to increase the net credit.

This adjustment allowed me to collect a net credit of $11.40 per share while reducing the immediate risk. The new structure gives me time to wait for NVDA’s recovery while maintaining some downside protection.

- Net Credit Collected: $11.98 per share (Since January 17, 2025)

- Break-Even: $98.02

- Max profit: $1,198 (10.89%)

I’ve decided to pause options trading until March 2025, when my Morgan Stanley (MS) put options expire. In the meantime, I’ll focus on the following:

- Monitoring NVDA Stock: Watching for earnings reports, AI industry news, and general market sentiment.

- Building Equity Positions: Buying 0.1 shares of NVDA stock weekly to dollar-cost average into a long-term position. This strategy helps me build exposure to NVDA over time without taking on excessive risk all at once.

- Diversifying My Portfolio: Looking at other high-quality stocks or ETFs to balance my holdings and reduce sector-specific risks.

Lessons and Takeaways

- Stay Flexible: Rolling trades to longer expiries and adjusting strike prices provides time and space to manage volatility.

- Protect Capital: Pausing options trading during uncertainty helps preserve capital and avoid unnecessary risks.

- Invest Gradually: Dollar-cost averaging into stocks like NVDA allows me to take advantage of market dips without overcommitting.

Adjusting this NVDA options trade was necessary to manage the unexpected drop in the stock price. By rolling out the bull put credit spread and implementing a disciplined strategy, I’ve positioned myself to weather the volatility and potentially benefit from NVDA’s recovery. These steps are part of my approach to navigating the financial markets with a smaller portfolio while managing risk effectively.