NVDA

Week 44 / $94 Options Premium Earned Amid NVDA Volatility and Tech Sell-Off

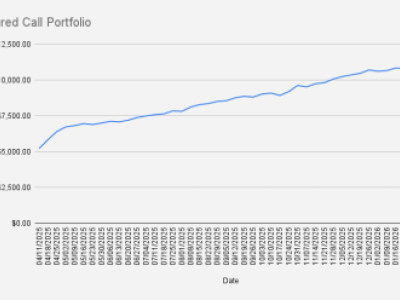

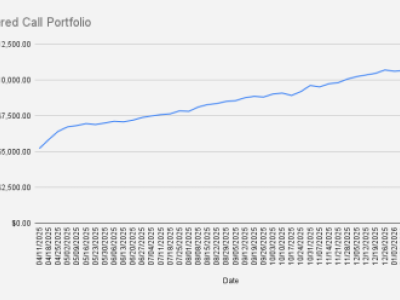

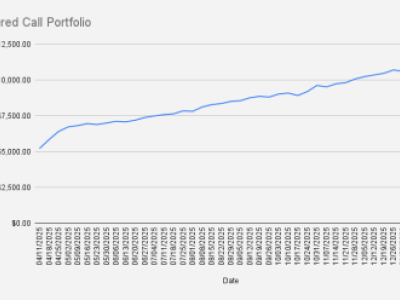

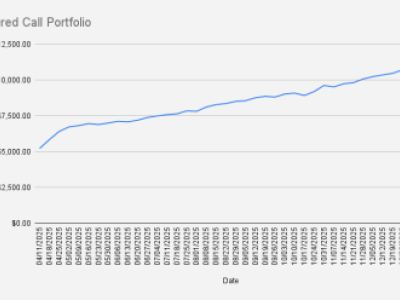

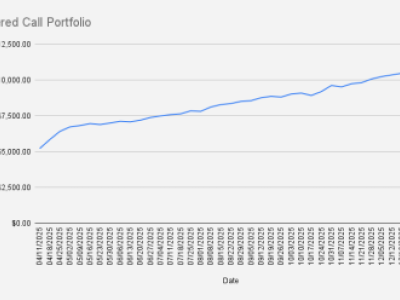

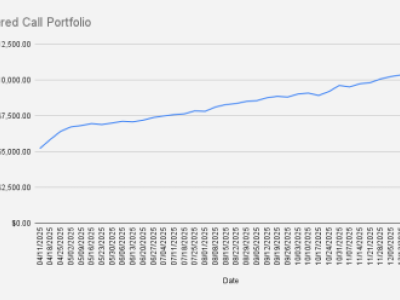

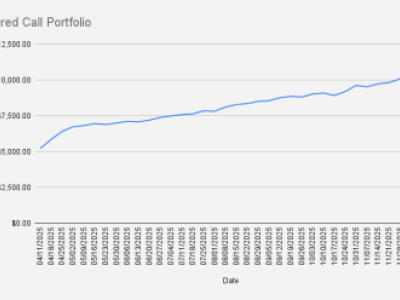

| 75 viewsAs of February 6, 2026, our covered-call stock portfolio has increased by another +0.51% and closed at $11,106. Wow, what a week - this has been a very tough week for tech stocks and crypto. Our…

How the NVDA Strategy Became the Backbone of Our Stock Portfolio

| 37 viewsThe NVDA strategy didn’t start as a master plan. It emerged out of necessity.About a year ago (2025), after the DeepSeek-related volatility shock that briefly crushed NVDA and other AI names, our…

Week 42 / $107 Options Income From Rolling NVDA Credit Spreads During the Greenland Shock

| 85 viewsAs of January 23, 2026, our covered-call stock portfolio has dipped slightly by -0.43% and closed at $10,788.The previous week was highly turbulent. As the market opened on Tuesday, NVDA briefly…

Week 41 / NVDA Credit Spread Strategy: 0.43% Weekly Return if Expires Worthless

| 71 viewsGreetings from Tbilisi. After more than three weeks in India, we are finally back—welcomed by temperatures below 0°C and already missing Goa and its +31°C.Last week, we also held our annual office…

Week 40 / NVDA Strategy, $65 Premium Income, and Margin Reduction

| 52 viewsGreetings from Mumbai, India. For the past three years, we’ve spent our winter holidays in India, usually traveling to Goa via New Delhi. This time, however, we arrived and departed through Mumbai…

Week 39 / Road to $25K: Rolled Up and Forward NVDA Covered Call, Adjusted Credit Spread

| 107 viewsGreetings from South Goa, Palolem Beach, India. I hope you had a great New Year’s party - we certainly did.As of January 2, 2026, our covered-call stock portfolio has decreased slightly by -0.84% and…

Week 38 / Road to $25K: Closing 2025 Above $10K with Covered Calls and NVDA

| 135 viewsGreetings from India. This holiday season we’re in South Goa, staying near Palolem Beach — our third year in a row returning here. With temperatures above 30 °C and Kingfisher beer under $2 per…

Road to a $25,000 Stock Portfolio with Options Trading

| 122 viewsWith the new year of 2026 fast approaching, I’ve decided to start another challenge.This one is deliberately smaller than my previous ambitions of building a $100K or even a $1M portfolio. Not…

Week 37 / NVDA & BMY: Portfolio Up +1.11% as We Head from Tbilisi to India

| 121 viewsAs of December 19, 2025, our covered-call stock portfolio has grown by an additional 1.11% and reached $10,465. It’s genuinely exciting to be above $10K for the fourth week in a row. I was expecting…

Week 36 / Defensive Roll on SHELL, New NVDA Weekly Spread

| 116 viewsAs of December 12, 2025, our covered-call stock portfolio has grown by an additional 1.12% and reached $10,350. It’s genuinely exciting to be above $10K for the third week in a row.Still, I’ve been…

Week 35 / NVDA Spreads + McDonald’s Buys: Covered-Call Portfolio Hits $10,235

| 158 viewsAs of December 5, 2025, our covered-call stock portfolio has grown by an additional 1.65% and reached $10,235. It’s genuinely exciting to be above $10K for the second week in a row.Still, I’ve been…

Week 34 / Covered Call Portfolio Breaks $10K and Beats the S&P 500

| 108 viewsAs of November 28, 2025, our covered-call stock portfolio has surpassed the $10K milestone for the first time, closing at $10,069 — a weekly gain of +2.64% (+$269 versus last week). We reached the $…

Week 33 / How We Earned $166 in Options Premium This Week with NVDA and BMY Credit Spreads

| 154 viewsAs of November 21, 2025, our covered call stock portfolio has slightly increased to $9,810, what is another minor weekly increase of +0.77% (+$74 if compared to the previous week. $10,000 feels…

Week 32 / Weekly NVDA Options Income: $75 in Premiums and a 2.32% Portfolio Rise to $9,735

| 154 viewsAs of November 14, 2025, our covered call stock portfolio has slightly increased to to $9,735, what is a minor increase of +2.32% (+$220 if compared to the previous week. $10,000 feels within reach.…

April 2025 Stock Portfolio Update ($6,629)

| 39 viewsAt the end of April 2025, the total value of our stock portfolio stood at $6,629 (€6,594), down from $7,124 a month earlier. That’s a -6.94% decrease in portfolio value, or -$495 in dollar terms.Yes…