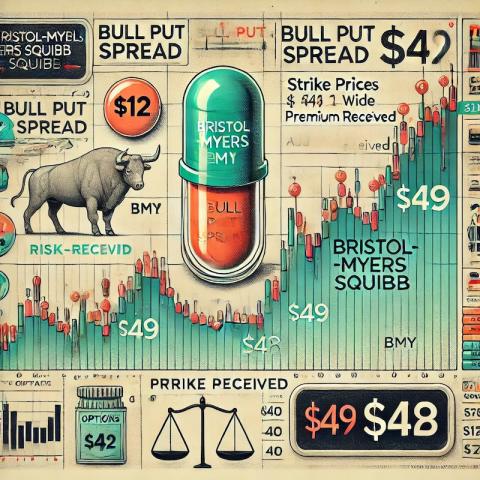

Today, I executed a bull put spread on Bristol-Myers Squibb (BMY), a stock I've been trading since 2020/2021. BMY is a global biopharmaceutical company that focuses on discovering, developing, and delivering innovative medicines that help patients prevail over serious diseases. It’s a stable, dividend-paying stock, and one of my long-term goals is to accumulate 100 shares in my portfolio.

For this trade, I purchased a bull put spread with strike prices of $49 and $48, creating a $1 wide spread. I received a $12 premium (before commissions) for each contract, and I decided to go in with five contracts, resulting in a total premium received of $60.

Here’s a quick look at the risk-reward ratio for this trade:

- Max Profit: $60 (the total premium received)

- Max Loss: $440 (the width of the spread minus the premium received: $500 - $60)

- Risk-Reward Ratio: 7.33 ($440 / $60)

This means that for every dollar I risk, I stand to gain $7.33 if the trade goes in my favor.

With the $60 premium, I bought an additional BMY stock to add to my dividend portfolio. This brings my total holding to 3.25 shares of BMY. While this might seem like a small step, it’s part of a larger strategy to build up my position in BMY over time.

If this bull put spread expires worthless, meaning BMY remains above $49 at expiration, I’ll pocket the premium and may pause trading BMY for a while. However, if the trade becomes troubled, i.e., BMY drops below $49, I’ll look to roll out the spread, preferably for a credit, to avoid assignment and keep the strategy going.

The goal of accumulating 100 shares remains a long-term objective, and these options strategies are helping me to get there, albeit slowly. Each successful trade allows me to add more shares to my portfolio, getting closer to the point where I can consider covered call writing to further enhance income.

Trading BMY with a bull put spread has been an interesting experience. While the risk-reward ratio shows that there’s more to lose than to gain on a dollar-for-dollar basis, the strategy aligns with my long-term goal of accumulating shares in a stable, dividend-paying company like BMY. As always, managing the trade and having contingency plans in place is crucial to success in options trading.

I’ll continue to monitor BMY and see how this trade plays out. Whether it expires worthless or I need to roll it out, every move brings me one step closer to my goal. Stay tuned for more updates as I navigate the market with BMY and other stocks in my dividend portfolio.