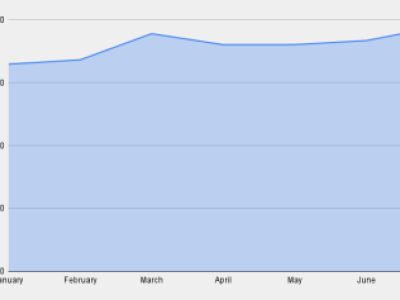

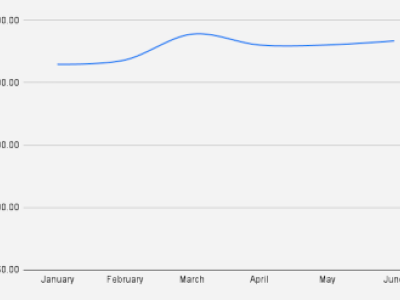

At the end of January 2025, the total value of our stock portfolio was USD 7,936 (€7,611 ). What is about 14.17% increase or USD 984 gain, if compared to the previous month. Despite few troubled options trades our small but aspiring dividend stock portfolio ended strong.

Most of the month we spent in Georgia, just at the start of the month we returned from our almost month long trip to India. While in Georgia, we did a few roadtrips to places like Gudauri and Sighnaghi last month, spending quality time with family. Also at the end of January, my mom visited me here in Tbilisi.

Now, back to the stock portfolio

Stock Portfolio

YTD our stock portfolio has gained 14.39%, what outperforms SP500 significantly (3.22%). In our case the growth actually comes from recovering options trade on MS stock, I rolled a few months ago. with MS stock price soaring well above $140 our short $125 March expiry put option is loosing value, this increasing total value.

Stock buys

In January I mostly invested in fractional shares, with following buys.

- Bristol-Myers Squibb (BMY): Acquired an additional 1.25 shares, bringing my total to 5.25 shares.

- Deutsche Bank (DB): Increased my position by 5 shares, totaling 17 shares.

- Alphabet Inc. (GOOG): Added 0.1 shares, now holding 1.1 shares.

- McDonald's (MCD): Purchased 0.1 shares, totaling 2.3 shares.

- Nike (NKE): Acquired 0.1 shares, bringing the total to 1 share.

- NVIDIA (NVDA): Increased holdings by 1.85 shares, totaling 4 shares.

Options trades

This January, I was selling both puts and calls with BMY, NKE, and NVDA. Our biggest failure this month was credit spread with NVDA stock, which I had to roll forward to December 2025 expiry, after DeepSeek AI sent shockwaves across the markets. The biggest gain, recovering from MS put trade with expiry in March. Because of the NVDA trade decided to be extra careful with additional options trades just not to blow up our small, but growing portfolio.

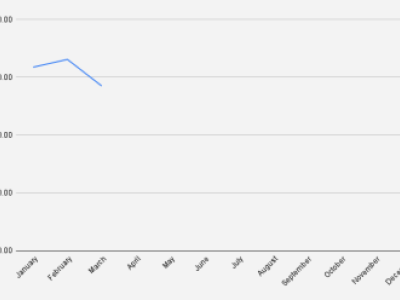

Dividend Income

Last January, in dividend payments we received $15.15, which is about $0.48 daily. Following tickers paid us dividend in January

- AGNC Investment Corp (AGNC): $0.51

- Bristol-Myers Squibb (BMY): $2.24

- Altria Group Inc. (MO): $0.87

- Medical Properties Trust Inc. (MPW): $7.34

- Nike, Inc. (NKE): $0.31

- Philip Morris International Inc. (PM): $3.44

- Thermo Fisher Scientific Inc. (TMO): $0.02

- U.S. Bancorp (USB): $0.42

Our current yearly dividend from the portfolio stands at USD 212.69, yielding 2.88%

While the total dividend is not yet enough to retire comfortably, it is a solid foundation upon which we can build.

I believe by the end of the year we should be able to push our dividend portfolio to $300-$350/yearly

Plans for February 2025

For the month of February, I'm looking to dollar cost average buying shares on BMY and NVDA and maybe some other ticker. Not planning lots of options trades as we are still recovering few options.

How was your investments performing in the month of January? Leave a comment!