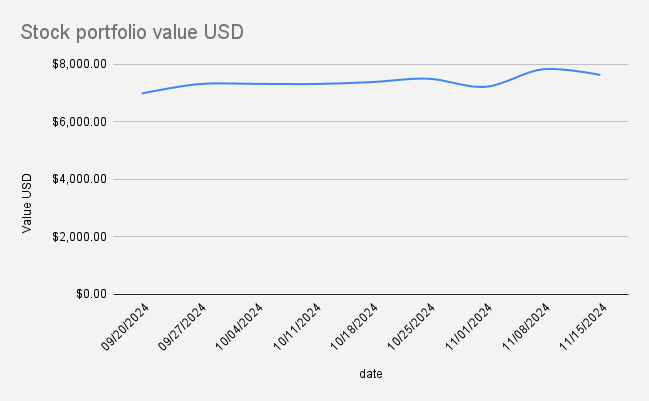

This week, our portfolio experienced a slight downturn, with its value decreasing to $7,632.45, marking a -2.53% drop from the previous week. While such fluctuations are part of the investing journey, we remain focused on our long-term strategies and opportunities.

What Happened This Week?

- Portfolio Value Decline:

The drop in portfolio value can be largely attributed to two key factors:- Currency Movements: The strengthening of the USD against the EUR, now at 1.05, played a significant role. For portfolios denominated in USD, a stronger dollar often means reduced value when converted to euros or other currencies.

- Stock Fluctuations: Some movement in individual stock prices added to the week's dip, but nothing unexpected for an active portfolio.

- Options Expiry:

All our options positions for this week expired worthless, which is a positive outcome for us as options sellers.- Credit Spread on MS (Morgan Stanley): The spread reached expiration without any issues, adding the premium to our account.

- Put on MAT (Mattel): Similarly, the put option on MAT expired worthless, allowing us to keep the premium collected when the trade was opened.

- New Trades Opened:

- Weekly Credit Spread on MS: We initiated a new credit spread on MS, collecting a premium of approximately $70. This trade aligns with our ongoing strategy to generate consistent income through options selling.

- MS Stock Purchase: In addition, we took advantage of the current price levels to add 0.25 shares of MS to our stock portfolio. These incremental purchases help build a stronger position over time.

While this week reflected a minor setback in portfolio value, it's essential to zoom out and focus on the broader picture. Currency fluctuations and market volatility are natural, and as long-term investors, our strategies are designed to weather these ups and downs.

Looking ahead, we plan to continue executing well-researched options trades and steadily adding to our stock holdings. Our primary focus remains on maximizing income and growth opportunities while managing risks effectively.

Market movements, whether up or down, present valuable lessons for investors. This week, despite the dip, we successfully navigated our options positions and expanded our portfolio with additional MS shares.

Since September 17, 2024, the total income generated from our options trading has reached $697.87. This income stream continues to provide additional cash flow, which we use to reinvest into stock buys to accelerate portfolio growth.