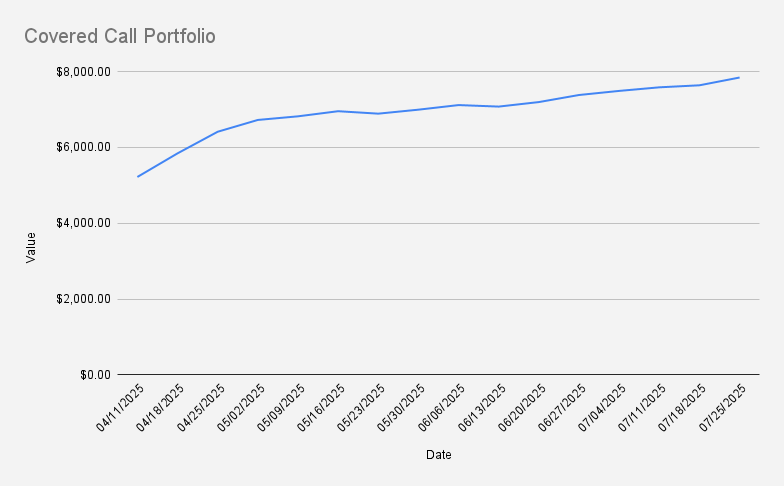

As of July 25, 2025, our covered call stock portfolio stood at $7,841, another +2.69% week-over-week increase (+$205). Year-to-date, we are finally in positive territory with +0.37%. Awesome!

This week, I rolled forward and up our August 15 expiry covered call on NVIDIA, extending it to the December 19 expiry.

With this rollout, I increased the strike price by $3 and collected an additional premium of $0.60 per share. Given our long-term strategy to hold NVDA stock, I'm quite pleased with this adjustment - it aligns well with our overall goal of maximizing premium while maintaining upward exposure.

This week, we collected $101 from selling options, what is slightly above my goal to generate at least 1% weekly in options premium (1.28 % this week).

Our portfolio remains concentrated around NVDA stock.

I'm currently holding one covered call on NVDA with a $113 strike price expiring on December 19, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $6,100.

Current positions

- NVDA Aug 1 165/155 Put Credit Spread

- NVDA Dec 19, 2025 $113 Covered Call

While our long-term intention is to hold NVDA shares, we utilize weekly put credit spreads to generate additional income. Ideally, we plan to manage the covered call by rolling it out over time, preserving our position while continuing to collect premiums.

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $101 in options premium this week. If we can consistently average that amount, it would take approximately 56 weeks to fully eliminate our margin debt of $5,743. .

Looking ahead to next week, I’ll need to closely monitor the NVDA $165 put.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter