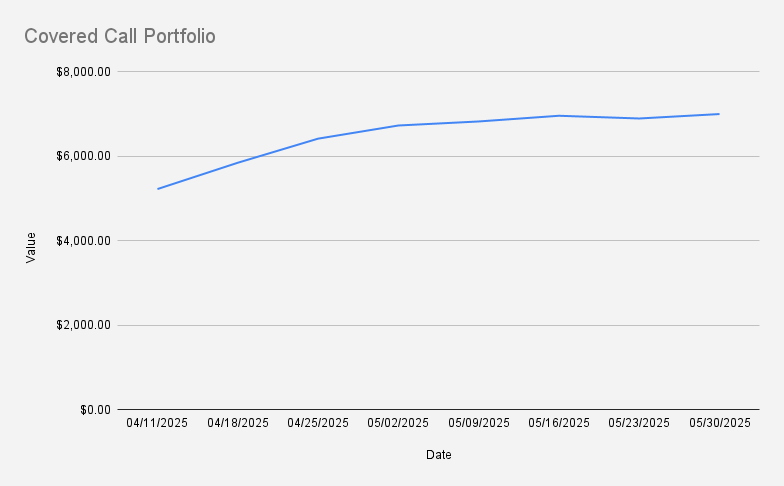

As of May 30, 2025, our covered call stock portfolio stood at $6,993, showing a +1.53% week-over-week increase (+$105). While Year-to-date, we are still down -7.26%, as we navigate volatility while optimizing our options income strategy.

This week was particularly interesting—there was NVDA earning report and I discovered another options trader who is documenting his journey to $100K through weekly blog updates. I highly recommend checking it out. Since our portfolio sizes are currently similar, I find it both motivating and insightful to follow along and compare strategies as we grow together.

We successfully closed a credit spread on NVDA that expired worthless, allowing us to retain the full premium. Continuing our premium collection strategy, we've initiated a new credit spread set to expire next week.

Following NVDA’s stronger-than-expected earnings report, the stock at one moment surged past $140, with dipping back to $134 at the end of week. We currently hold a covered call with a $109 strike expiring on June 27, which is now significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $2,500.

Open Positions:

- NVDA 128/119 Put Credit Spread (Weekly)

- NVDA Jun 27, 2025 $109 Covered Call

While we aim to hold NVDA shares for the long term, we use weekly put credit spreads to generate additional income. Ideally, we plan to manage the covered call by rolling it out over time, preserving our position while continuing to collect premiums.

There’s now an increased risk that our call option will be assigned. If that happens, I’m fine with it—we’ll shift focus to put selling. That said, the goal is to hold this call option for at least a few more weeks before adjusting or rolling it out. Ideally, we’d like to roll it significantly higher to capture more of the upside.

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Importantly, this week we earned $47 in options premium. If we can consistently average $47/week, it would take approximately 130 weeks to fully eliminate our margin debt of $6,160

Next week, I’ll need to closely monitor the NVDA 128 put. If it’s challenged, I may need to either roll it out or consider closing the 109 covered call position.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter.