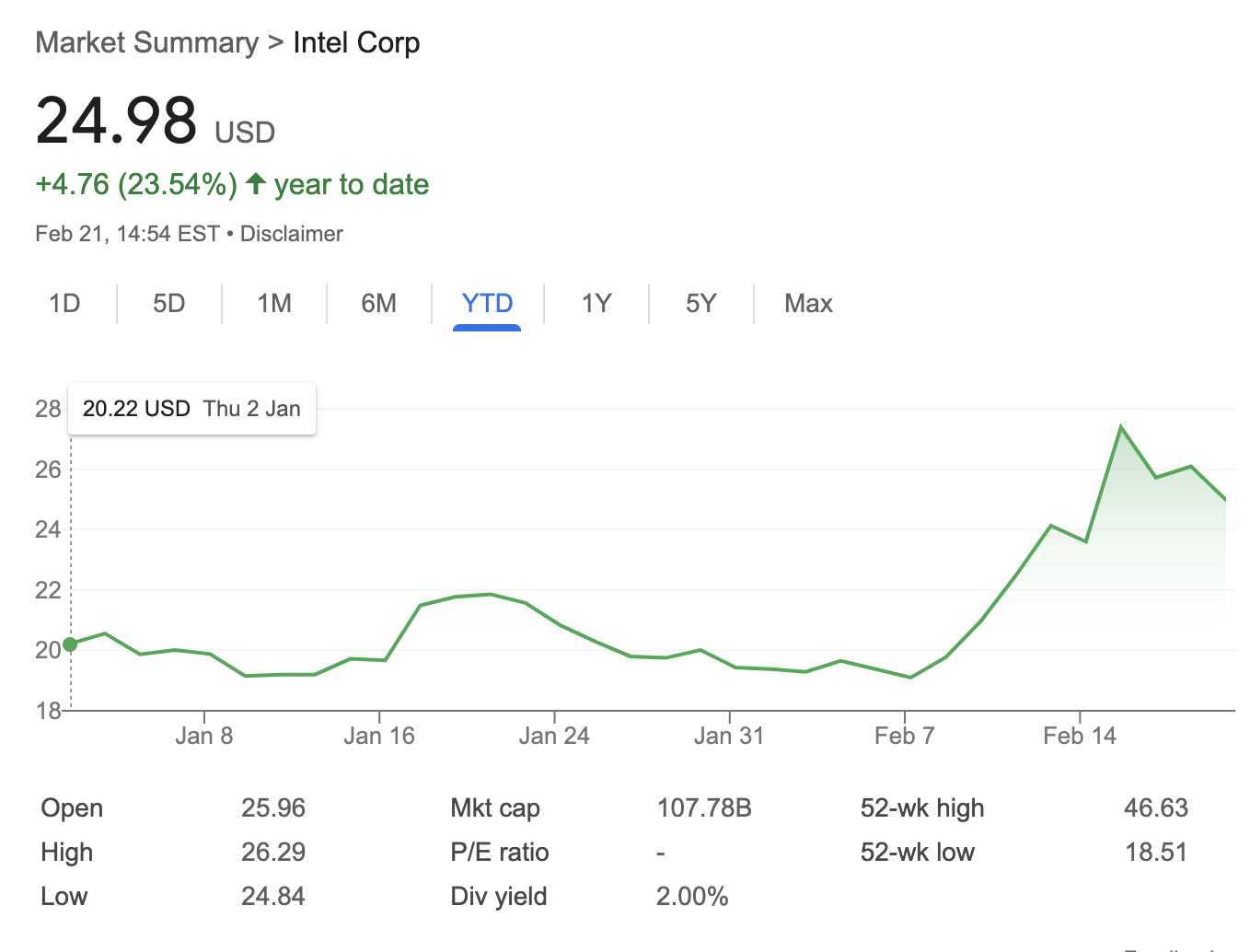

On February 21, 2025, I executed a covered call strategy on Intel Corporation (INTC) stock by purchasing 101.7 shares at $25.56 per share while simultaneously selling a covered call with a strike price of $25, expiring on February 28, 2025. This transaction generated an options premium of $1.28 per share, resulting in an effective breakeven price of $24.28.

Intel has faced significant challenges in recent months, with persistent volatility and a downtrend in its stock price. While the stock has shown some recovery due to speculation around a potential acquisition, the underlying fundamentals remain uncertain. Given these risks, I opted to sell an in-the-money (ITM) call to secure a higher premium and protect against another potential price drop.

Selling an ITM call provides an immediate return through premium collection, while also ensuring that the position benefits from a partial downside cushion. If the stock remains below $25 at expiration, the call will expire worthless, and I retain the premium. If the stock price rises above $25, the shares will likely be called away, locking in a modest profit.

This trade aligns with my broader options positioning on INTC. I am currently holding a September $27 strike price short put, as well as a May $26 long call. Given these existing positions, I decided to reinvest the collected options premium into additional INTC shares, further strengthening my exposure while maintaining a hedged approach.

Expected Outcomes

- If INTC stays below $25 by February 28, I keep the premium and retain the shares, allowing for potential additional covered call writing.

- If INTC rises above $25, my shares will be called away, locking in a small gain on the underlying stock while still benefiting from the collected premium.

- Regardless of outcome, the $1.28 per share premium provides an immediate return, improving the trade's overall risk-reward profile.

This trade is an example of how strategic covered call writing can help manage risk and enhance returns in a volatile stock while leveraging existing portfolio positions for optimal capital deployment.