It has been several days since I'm playing again with crypto options, more precisely selling covered calls with Solana coin on the deribit trading platform.

Disclosure: This article contains affiliate links to deribit.com bitcoin options trading website, by clicking on links on this page and by investing with deribit, I will earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Seems I have learned my lesson from the mistakes I've made in the past, and now I'm trading fully funded covered calls, not naked, the ones powered by leverage. When trading Solana coin, it's enough with just one coin to start selling covered call options. Sure it won't get you far, as premiums are too small, but if you want to dip your feet in the water, why not?

Book my Covered Calls Course | How to Generate Income from Options

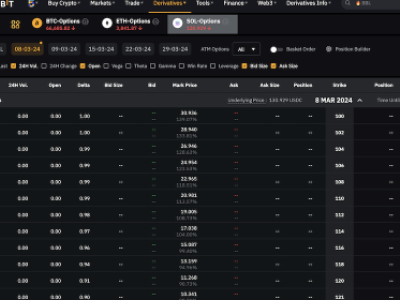

On September 12, 2022, I bought 1 Solana for $34.80 I sold 1 out of the money covered call option with a strike price of $36, and just 1DTE, for what I got, 0.006 SOL, or about 0.6% potential income yield, if this options contract expires worthless.

0.006 SOL = $0.21

What happens next?

On the expiry date, September 13, 2022, SOL is trading under $36 per share - options expire worthlessly and I keep the premium and start over - if SOL trades above $36 on the expiry date, I pay the difference in crypto. Say SOL trades $37 on expiry, I need to pay the difference between the spot price and strike price, which is $1, in crypto which would equal 0.027027 SOL.

I would be left with 1+0.006-0.027027= 0.978973 SOL

But as the SOL price increased from $34.80 to $37, my coins would be worth $36.22. I would need to exchange them back on exchange. My profit would be $1.42 or about 4.08% in just one day. Quite a good outcome. Especially if done with more coins, say some 100.

My goal is to slowly increase my total investment to about 5 - 10 SOL coins in the next 2-3 months and try to make about $1/daily from selling covered calls on this coin.

Ideally, I would love to hold 100 coins with SOL in the next 12 months. With today's prices that would equal about $3,700 investment and could generate about $21/daily. Now, let's wait and see, where this journey will take me in the next 12 months.

Interested to learn more? I'm offering paid - online live course Selling Covered Call Options on Crypto (BTC/ETH/SOL)