Welcome to the third (#3) dividend income report, covering earnings I've made from dividend paying stocks, peer to peer lending (both fiat and crypto currencies) in July 2017.

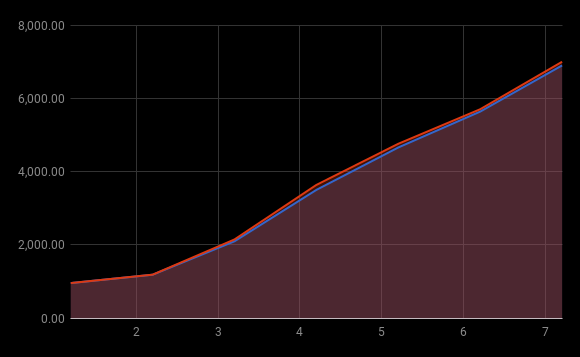

I started my wealth building adventure (portfolio) in January 2017 with a simple goal to invest $8,561 this year in several batches. First months of the year didn't generated me nothing much, but starting May it has started slowly pick up.

Make sure you check out my previous two dividend income reports:

In todays article you will learn both how much I've received in dividend income in July 2017, also I will publish my net worth, with a few tables.

About Portfolio in July 2017

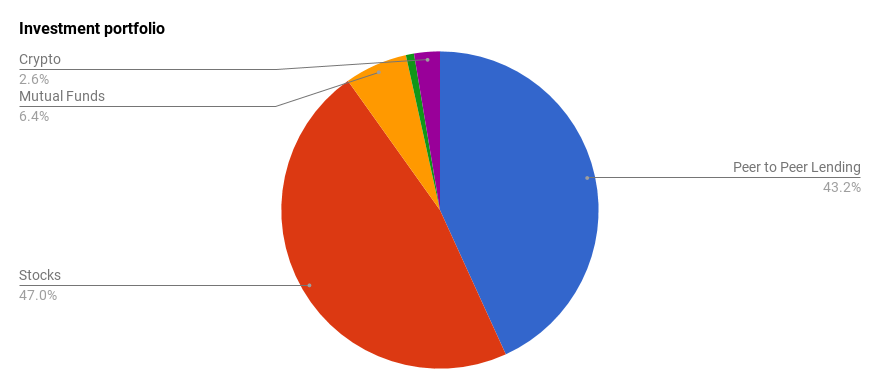

My investments right now are spread across few different investment types - stocks, peer-to-peer lending, mutual funds, cash and latest addition to my portfolio - crypto currencies. The vast majority is invested in Nasdaq Baltics and Mintos.com peer to peer lending loans (in EUR and GEL currencies)

For the sake of this and all future dividend income articles I've converted all final/total currencies to the US dollar, although currently there is just crypto currency investments from my portfolio in US dollars.

At the end of July I've invested in total $6,907.02 what equals to 80.68% from my 2017 planned investments. I've reached 0.70% from my ultimate one million dollar goal by the time I will turn 60 (in 2045)

Net Worth July 2017

The total value of my portfolio (without dividends) was $7,006.49, making difference between invested and value: + $99.47 or +1.44%

About Investments in July 2017

Last month I invested additional EUR 741 in Nasdaq Baltics stock market, EUR 52.31 cash and EUR 200 in crypto currencies. My total investment in July 2017 = EUR 993.31

Investment portfolio July 2017

From money invested in Baltic equity market I bought following shares:

- SILVANO FASHION GROUP AS (SFG1T) - 140 shares

- Amber Grid (AMG1L) - 250 shares

I bought Silvano Fashion Group just a few days before dividend record date, and because of that paid high price (2.9 EUR per share), after dividend payment, price dipped down to 2.6 EUR per share

Amber Grid promises dividend payment in next year (probably in May), as I had spare funds I decided to increase my next years dividend payments, hopefully it will give a nice boost in next May.

There are two new additions to my portfolio: Cash and Crypto currencies.

I feel really glad I have them both now in my portfolio. I plan to keep about 5% from both in portfolio for the future months. Cash provides liquidity.

Speaking about crypto currencies, this is the new thing for me, and as a hot trend in 2017, I had the so called FOMO (fears of missing out) and decided to incorporate crypto currencies in portfolio, just not to miss out. I'm using Dollar cost averaging to acquire more coins each month. See: Dollar-Cost Averaging as part of Crypto currency Portfolio

Currently I hold bitcoin, ethereum, litcoin and ripple coins

Dividend and Interest income July 2017

From equities bought in the past and from investments in peer to peer lending marketplace Mintos.com and from crypto currency lending on Poloniex.com I got following income last month

- Latvijas Gāze - EUR 46.03

- Ekspress Grupp - EUR 10.08

- SILVANO FASHION GROUP AS - EUR 25.02

- Mintos.com - EUR 29.72

- Poloniex.com - EUR 0.29

Total: EUR 112.04 / USD $124.51

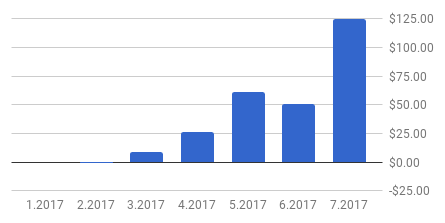

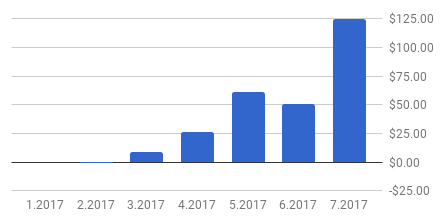

Monthly income to the date

During past six months, dividend income from my portfolio have produced a whooping $271.13, or 3.92% year to date yield

Monthly income chart July 2017

As you can see from graph above, July has been the best in terms of dividend and interest payments so far. High dividend yields from Latvijas Gāze and Silvano Fashion Group contributed the most.

Speaking of upcoming months - August, September - right now I don't see to earn more than $50 per month here. Actually I doubt I will earn more than $40 in August, as currently there are no dividend paying stocks in my portfolio for August. I hope to acquire more dividend paying stocks for October, November and December.

Right now it looks I won't crack $100 anytime soon and if, then most probably in December, as I already hold few stocks with historical dividend payments in December.

Goals for July 2018 Dividend Income

I'm looking to get about $200 in July 2018 dividend income