At the end of February 2025, the total value of our stock portfolio was USD 8,271 (€7,953 ). What is about 4.19% increase or USD 332 gain, if compared to the previous month. Despite very turbulent month, our small but aspiring dividend stock portfolio ended in pluses.

We spent whole month Georgia, mostly staying in Tbilisi, kiddo got sick for almost two weeks, fun time at home. During last February we discovered the museum of Illusion in Tbilisi, which was quite amazing experience.

now, back to the stocks:

Stock Portfolio

YTD our stock portfolio has gained 19.05%, what outperforms SP500 significantly (+1.24%). In our case the growth actually comes from recovery in options positions. In February few of our in the money options recovered quite significantly. Just a few to name, DB, INTC and BP

Stocks Bought in February:

In February I mostly invested in fractional shares, with following buys.

- Apple Inc. (AAPL): Acquired an additional 0.9 shares, bringing my total holdings to 1.9 shares.

- AGNC Investment Corp. (AGNC): Increased my position by 1.4 shares, now holding 6.4 shares.

- Bank of America (BAC): Added 1 share, bringing my total to 5 shares.

- Bristol-Myers Squibb (BMY): Purchased an additional 1.75 shares, now holding 7.25 shares.

- BP plc (BP): Increased holdings by 3 shares, bringing my total to 18 shares.

- Deutsche Bank (DB): Acquired an additional 4 shares, totaling 21 shares.

- Barrick Gold Corp. (GOLD): Added 2 shares, increasing my position to 3 shares.

- Intel Corp. (INTC): Significantly increased holdings by 104.7 shares, now holding 106 shares. (part of buy/write covered call)

- McDonald's Corp. (MCD): Expanded my position by 0.6 shares, bringing my total to 2.9 shares.

- NVIDIA Corp. (NVDA): Added 1 share, increasing my total holdings to 5.25 shares.

- Zoom Video Communications (ZM): Initiated a position with 0.2 shares.

Stocks Sold in February:

To better oversight portfolio and focus I decided to sell of positions which have generated profit but are rather small in position size, thus not potential candidates for covered call writting. Most are great names and will definitely return back to some of them in the future.

- Amazon (AMZN): Fully exited my position, selling all 1.2 shares.

- Altria Group (MO): Sold all 1 share, closing my position.

- Medical Properties Trust (MPW): Liquidated my entire holding of 108 shares.

- Morgan Stanley (MS): Sold all 4.85 shares, exiting my position.

- Netflix Inc. (NFLX): Sold my entire position of 0.3 shares.

- Philip Morris International (PM): Closed my position by selling all 3 shares.

- Roblox Corp. (RBLX): Fully exited, selling all 3 shares.

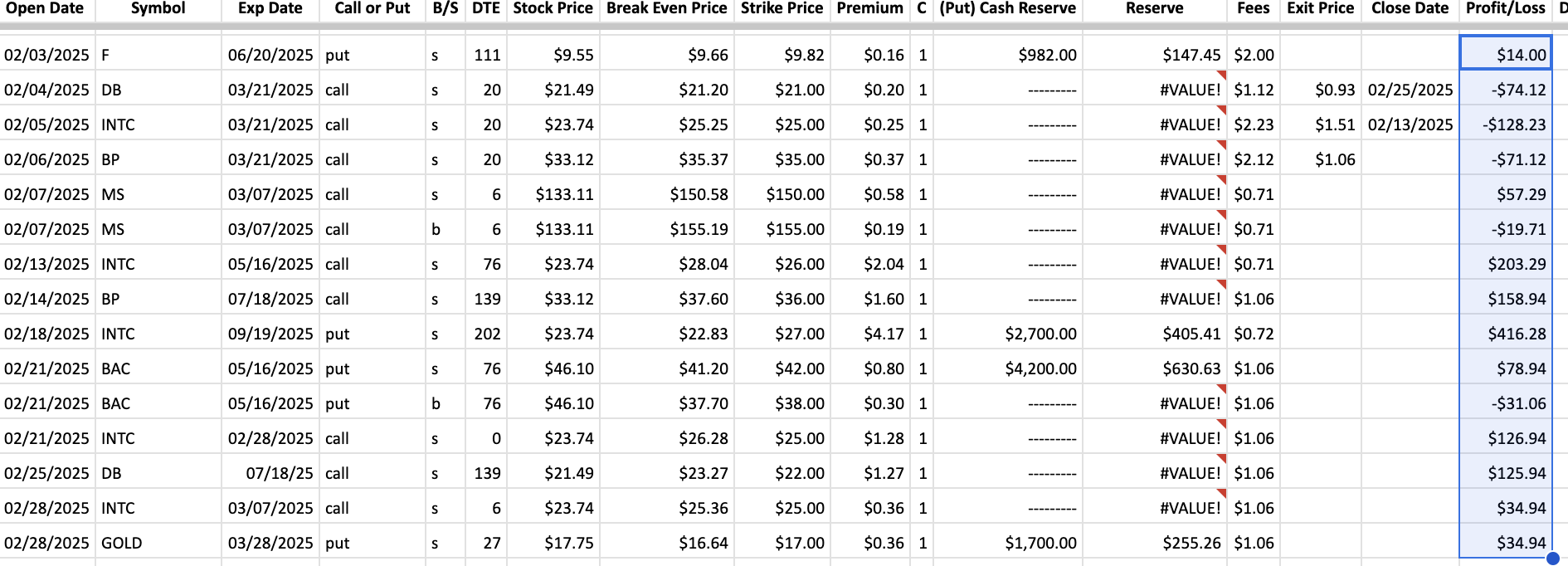

Options Trades

This February, I was selling both puts and calls on F, DB, INTC, BP, MS, BAC and GOLD.

As we have some significant positions already established with DB and BP i decided to sell partly covered calls during the month of the February, it helped to generate extra premium, but also left gave us some extra risk, as the stock prices actually started to appreciate.

One of the biggest comebacks this month - INTC, Intel stock recovered nicely, for one moment, above 25 per share. We even initiated covered call (reason for increased shares in the portfolio)

Gross total from options premium in February: $927

Dividend Income

Last Febaruaru, in dividend payments we received $8.82, which is about $0.31 daily. Following tickers paid us dividend in February

- Bristol-Myers Squibb (BMY): $2.64

- British American Tobacco (BTI): $0.73

- Apple Inc. (AAPL): $0.30

- Morgan Stanley (MS): $4.49

- Starbucks Corp. (SBUX): $0.06

- AGNC Investment Corp. (AGNC): $0.60

Total: $8.82

Our current yearly dividend from the portfolio stands at USD 184.53, yielding 2.29%

While the total dividend is not yet enough to retire comfortably, it is a solid foundation upon which we can build.

I believe by the end of the year we should be able to push our dividend portfolio to $250-$300/yearly

Plans for March 2025

For the month of March, I'm looking to dollar cost average buying shares on BMY and NVDA and maybe some other ticker. Not planning lots of options trades as we are still recovering few options. Considering selling more aggressive puts/credit spreads with BMY.

How was your investments performing in the month of February? Leave a comment!