Greetings from Kakheti’s Alazani Valley! This weekend we came here to enjoy the beauty of the region and to host a small office party with Caulingo, where I sometimes work when I’m not focused on fund operations at Terramatris or managing our covered call portfolio.

Jokes aside:

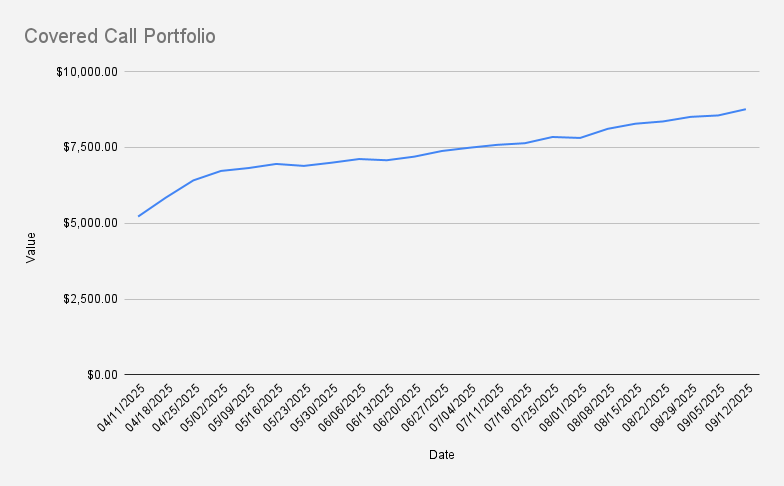

As of September 12, 2025, our covered call stock portfolio has reached $8,757, marking another weekly gain of +2.4% (+$205). Year-to-date, the portfolio is up +12.12%. Technically, we’re slightly underperforming the S&P 500 (+12.365), but I’m very satisfied with the progress - the $10K milestone feels just around the corner.

This week, we collected $122 from selling options, what is slightly above my goal to generate at least 1% weekly in options premium (1.39% this week).

Our portfolio remains concentrated in NVDA stock. This week turned out to be a bounce-back, though at one point we were concerned about adjusting the $162.5 put we had sold last week—until NVDA suddenly surged past $177.

Our position in BMY didn’t perform as well as expected, so today we decided to roll it down from $46.5 to $46 with next week’s expiry—luckily, for a credit.

We keep holding one covered call on NVDA with a $113 strike price expiring on December 19, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $6,400.

Current positions

- NVDA Sep 19, 2025 172.5/166 Bull Put Credit Spread

- 2X BMY Sep 19, 2025 46/44 Bull Put Credit spread

- NVDA Dec 19, 2025 $113 Covered Call

I have to admit, I may have been a bit aggressive with options selling this week, which increases the risk that I’ll need to adjust one or even both positions during the upcoming week.

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $122 in options premium this week. If we can consistently average that amount, it would take approximately 43 weeks to fully eliminate our margin debt of $5,265.

Looking ahead to next week, I will be closely monitoring the NVDA $172.5 puts. BMY will also require attention, as I was selling ATM puts there. Should any of our positions come under pressure, the plan is to roll them forward—ideally for a credit.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter