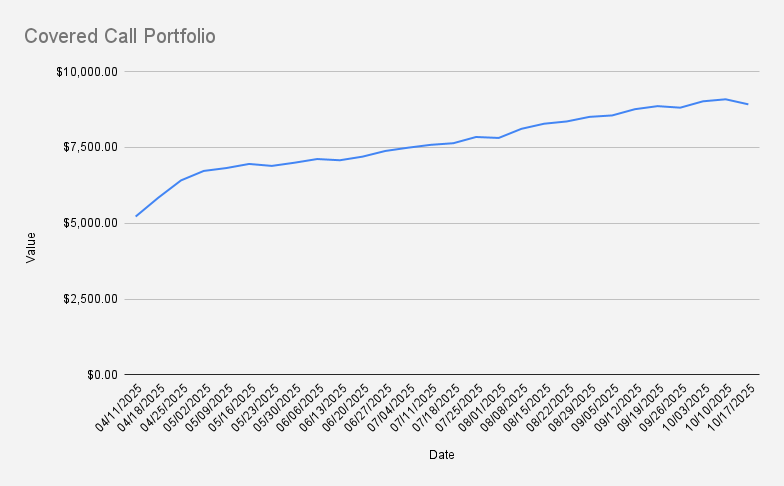

As of October 17, 2025, our covered call stock portfolio has dipped to $8,917, what is a decrease of -1.83% (-$166) if compared to the previous week. In our Terramatris crypto hedge fund, this week has been much rougher, with a sharp drop of more than 20% following the U.S. tariff announcement on China.

Due to increased volatility in the stock market earlier this week, I rolled down and forward our NVDA $182 put to a $180/$160 bull put spread with next week’s expiry, while still collecting a premium of $66. That was the only adjustment made to the portfolio last week.

Current positions

- NVDA Oct 24, 2025 180/160 Bull Put Credit Spread

- 2X BMY Oct 31, 2025 44/41 Bull Put Credit spread

- UBER Oct 24, 2025 89/85 Bull Put Credit Spread

- NVDA APR 17, 2026 $115 Covered Call

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $66 in options premium this week. If we can consistently average that amount, it would take approximately 72 weeks to fully eliminate our margin debt of $4,810.

Looking ahead to next week, I will be closely monitoring the NVDA $180 put spread and our Uber trade, depending on result I might enter additional Uber trade( if expires worthless) Should any of our positions come under pressure, the plan is to roll them forward—ideally for a credit.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter