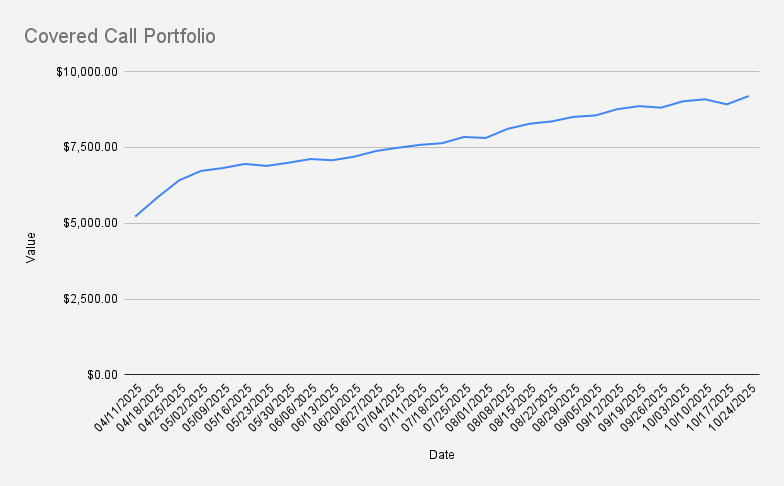

As of October 23, 2025, our covered call stock portfolio has grown to $9,190, what is a significant increase of +3.08% (+$272) if compared to the previous week.

Besides our activities in the equity markets, last week I had the honor of attending the Tbilisi Silk Road Forum. During the event, I had the opportunity to meet the Prime Ministers of Armenia, H.E. Nikol Pashinyan; Georgia, H.E. Irakli Kobakhidze (twice); and Azerbaijan, H.E. Ali Asadov.

Georgia truly is a wonderful place to be. I also had the chance to connect with the Governors of the National Banks of Georgia and Kazakhstan, and to befriend the former Minister of Economy of Armenia, among others.

One of the highlights of the forum was meeting and befriending a chess prodigy who has defeated Garry Kasparov and even played against my fellow Latvian, Mikhail Tal. Options trading and chess share a remarkable resemblance — both require strategy, patience, and precise timing.

Now, turning to the equity markets and derivatives — last week I made a few smaller purchases of McDonald’s and NVDA stock, providing a solid boost to our long-term portfolio. On the options side, I rolled forward and down the 180/160 NVDA bull put spread to next week’s expiry.

The outcome of this roll: additional credit collected and reduced overall risk. Also, our UBER bull put spread expired worthless. Due to increased volatility in the markets, I decided not to open new positions until there’s more clarity regarding our NVDA stock.

Current positions

- NVDA Oct 31, 2025 177.5/160 Bull Put Credit Spread

- 2X BMY Oct 31, 2025 44/41 Bull Put Credit spread

- NVDA APR 17, 2026 $115 Covered Call

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $66 in options premium this week. If we can consistently average that amount, it would take approximately 73 weeks to fully eliminate our margin debt of $4,803.

Looking ahead to next week, I will be closely monitoring the NVDA $177.5 put spread and our BMY trade. Should any of our positions come under pressure, the plan is to roll them forward—ideally for a credit.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter