Greetings from India. This holiday season we’re in South Goa, staying near Palolem Beach — our third year in a row returning here. With temperatures above 30 °C and Kingfisher beer under $2 per bottle, the place is hard to beat. With a portfolio our size, one could comfortably enjoy life here living off options income alone.

That said,

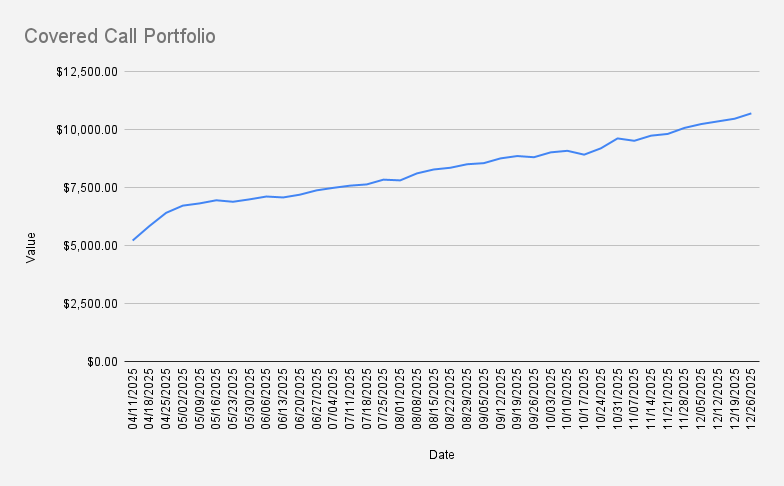

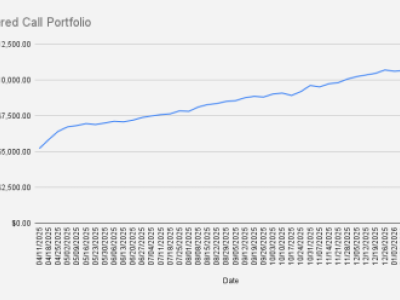

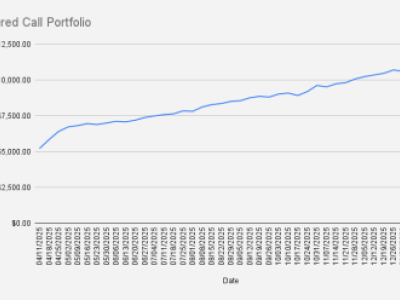

As of December 26, 2025, our covered-call stock portfolio has grown by an additional 2.21% and reached $10,696. As this is the final options expiry Friday of the year, I’m pleased to be closing 2025 with the portfolio above $10k.

One of our short- to medium-term goals is to grow the portfolio to $25k using options trading alone. With a systematic approach — and some persistence (plus a bit of luck) — reaching that level in 2–3 years is realistic. See: Road to a $25,000 Stock Portfolio with Options Trading.

With $10,696 on the books, we’re already 42.78% of the way there.

Before diving into this week’s options trades, I want to compare our performance against the S&P 500 and our anchor stock, NVDA.

Year to date, we’re up 35.82%, outperforming the S&P 500 by a wide margin (+18.09%), while lagging slightly behind NVDA (+37.94%). Overall, it’s been a strong year for the stock market.

Options trades:

This week, we only opened a new weekly NVDA credit spread and used the collected premium to buy fractional NVDA shares, gradually increasing our long-term holdings.

Current positions

- NVDA JAN 02, 2026 185/175 Bull Put Credit Spread

- 2X BMY JAN 30, 2026 51/47 Bull Put Credit spread

- SHELL FEB 20, 2026 29 Cash-Secured Put

- NVDA APR 17, 2026 $115 Covered Call

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $67 in options premium this week. If we can consistently average that amount, it would take approximately 64 weeks to fully eliminate our margin debt of $4,315. I’d be quite happy to eliminate this margin debt in 2026 without selling any stock—let’s see how it goes.

Looking ahead to next week, I will be closely monitoring the NVDA $185/175 put spread. Should any of our positions come under pressure, the plan is to roll them forward—ideally for a credit.

That said, Merry Christmas, Happy New Year — and we’ll talk again in 2026.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter