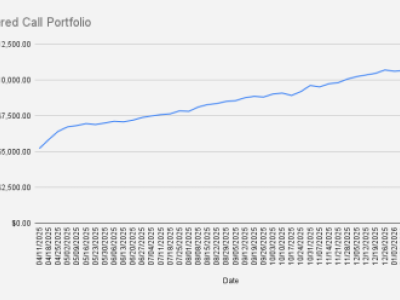

Greetings from South Goa, Palolem Beach, India. I hope you had a great New Year’s party - we certainly did.

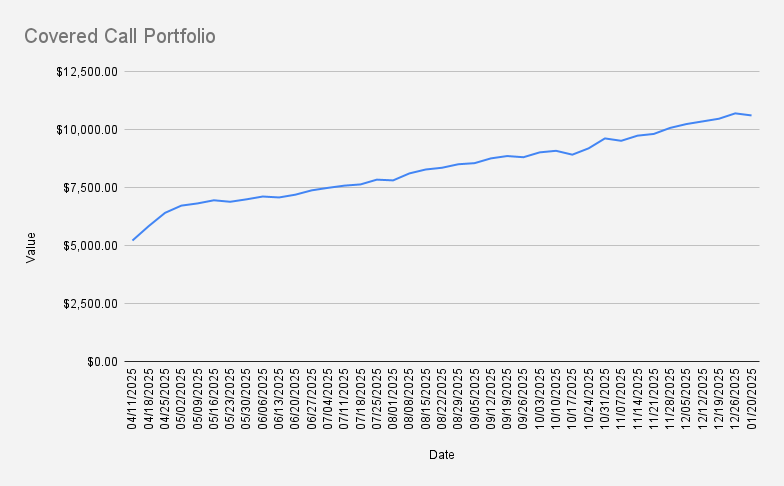

As of January 2, 2026, our covered-call stock portfolio has decreased slightly by -0.84% and closed at $10,607. For the sake of transparency, it’s worth noting that the slight decline is due to USD/EUR exchange rate movements. The U.S. dollar appreciated modestly against the euro, which reduced the total value when expressed in EUR and back.

This marks the first options week of 2026; however, all position adjustments were made back in 2025.

One of our short- to medium-term goals is to grow the portfolio to $25k using options trading alone. With a systematic approach — and some persistence (plus a bit of luck) — reaching that level in 2–3 years is realistic. See: Road to a $25,000 Stock Portfolio with Options Trading.

Options trades:

This week, we adjusted our NVDA covered call, rolling the April $115 strike out to June while slightly increasing the strike to $116. We’ve been in this position since March 2025.

At the start of the week, I also adjusted our NVDA bull put credit spread, rolling it down and forward to next week’s expiry for a net credit. If you’ve been following my journey, you already know this is my favorite strategy—and it continues to work well.

Current positions

- NVDA JAN 09, 2026 182.5/172.5 Bull Put Credit Spread

- 2X BMY JAN 30, 2026 51/47 Bull Put Credit spread

- SHELL FEB 20, 2026 29 Cash-Secured Put

- NVDA JUNE 18, 2026 $116 Covered Call

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $142 in options premium this week. If we can consistently average that amount, it would take approximately 29 weeks to fully eliminate our margin debt of $4,172. I’d be quite happy to eliminate this margin debt in 2026 without selling any stock - let’s see how it goes.

Looking ahead to next week, I will be closely monitoring the NVDA $182.5/172.5 put spread. Should any of our positions come under pressure, the plan is to roll them forward—ideally for a credit.

That said, Happy New Year — hopefully with fewer adjustments and more growth ahead.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter