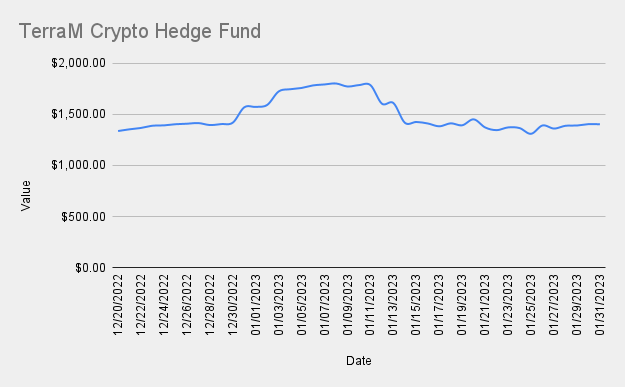

On December 12, 2022, we minted 10,000 TerraM coins on the Solana network with an aim to raise $10,000 capital for options trades on Ethereum via the Deribit trading platform.

We didn't raise the capital yet, but we did have quite an interesting month.

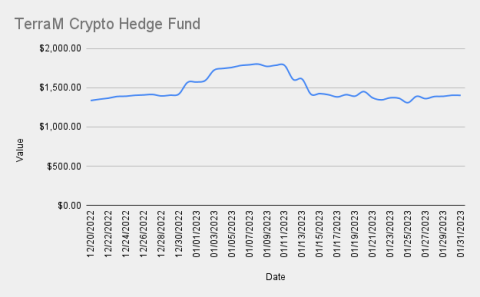

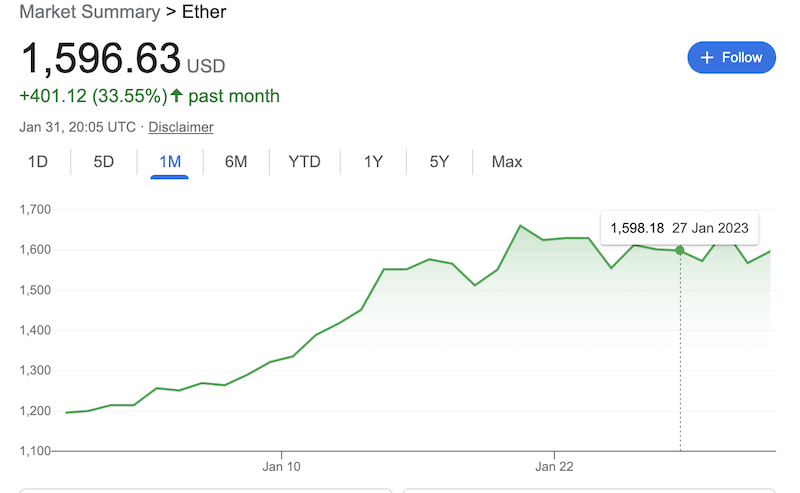

It didn't go as planned, actually, it went totally wrong and despite ETH gaining more than 30% last January, the TerraM token actually lost -10.59% from the value it had at the end of December.

Bad luck with futures trading (we were hedging every trade with futures) is to blame for about 2/3 of the value drop.

The problem with hedging with futures is price oscillation.

My original plan was to hedge each open position with futures, for example, selling a 1600 call option and additionally creating trigger-based trade entry, if ETH reaches 1600, go long with futures buying at 1600 (market price).

In theory, it is a zero-sum game, but in practice - not so easy. Yes, indeed all our trigger-based trades worked as expected, except the price oscillation made some headaches. going long on 1600 and then the price dropping back to 1500, making it painful to adjust. It was agreed close these trades (roll-out) and pause hedging with futures for a while. I'm not against hedging with futures, but for now, let's say - I see it as the last resort if the market goes against us.

From the option trades with Ethereum on the Deribit trading platform last month, we were able to book 0.2052 ETH / $298.05 USD profit.

Profit was distributed in form of additional TerraM coins to the token holders from the TerraM token address with balances larger than 20 TerraM. Any uninvested token profit was kept on the Deribit trading platform to increase buying power.

When losing a trade, we try to roll it out for a profit, sometimes it can take a week or two, sometimes longer, sometimes never. We don't book a loss, until we are in recovery mode, also we don’t book a profit if there is a profit in some particular week, but the trade itself yet is underwater.

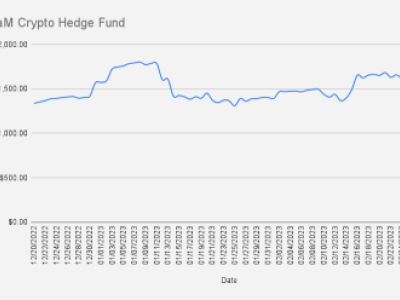

Since the inception of the TerraM crypto hedge fund, we have already made and distributed $474.14

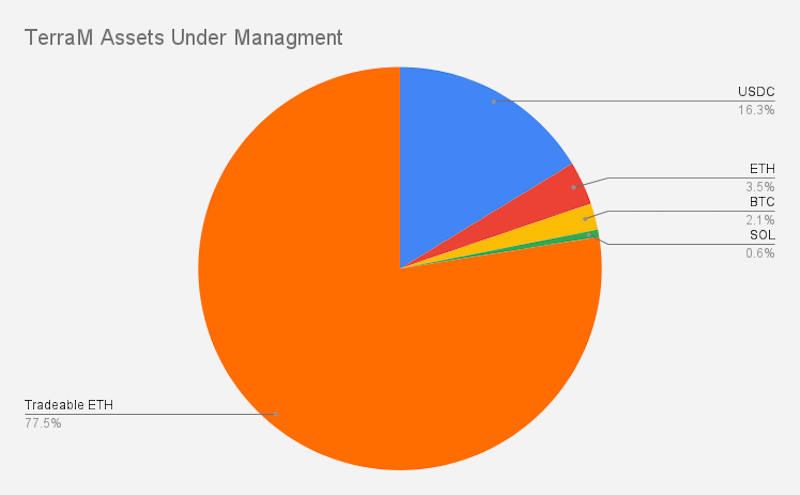

Assets under TerraM management

Asset | Count | Rate | Value |

USDC | 226.27 (+94.84) | $1.00 | $226.27 (+94.84) |

ETH | 0.0309 (-0.055) | $1,592.85 | $49.22 (-53.82) |

BTC | 0.00127086 (+0.00079037) | $23,123.40 | $29.39 (+21.43) |

SOL | 0.347339148 (+0.347339148) | $23.83 | $8.28 (+8.28) |

Tradeable ETH | 0.6837 (--0.4253) | $1,592.85 | $1,089.03 (-241.29) |

$1,402.18 (-170.57) |

Because of the mismanagement with futures, we lost some valuable ETH coins, which we still hope to recover in the foreseeable future.

On the last day, of January 2023 TerraM crypto hedge funds' total value was $1,402.18 (-$170.54 if compared to December 2022), which makes the value for one TerraM coin = $0.1402

As we are still in fundraising about 7,390 TerraM coins are available for investment

Open options trades

At the time of writing, we are holding 6 options trades open on Ethereum, with the following strikes and expiry dates

- February 03: 2x 1700/1900 call spread (recovery trade); 1x 1500/1400 put spread

- February 24: 1x1700 call (recovery); 1x1500 put; 1x1500X1300 put spread (recovery trade)

The total ETH amount in recovery: -0.6 ETH

Price

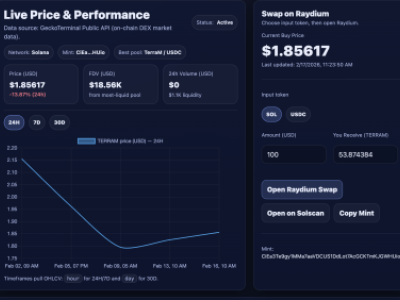

While we have set the 1:1 ratio exchange ratio between TerraM and USD, on the Raydium network 1 TerraM was trading at $0.82579218 (-0.065).

Forecast / Goals For February 2023

I've no idea where the price of Ethereum will head in February 2023, but I'm looking to grow TerraM crypto hedge fund value by at least 5%, which would ask for either additional investment or rock-solid performance.

When focusing on growing naturally. I will be happy if will manage to take a 5% yield in the month of January. On 14 hundred that would be about +$70

You too can become part of the TerraM community - Swap USDC for TerraM