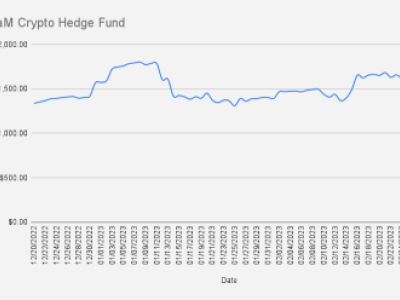

On December 12, 2022, I minted 10,000 TerraM coins on the Solana network with an aim to raise $10,000 capital for options trades on Ethereum via the Deribit trading platform.

We didn't raise the capital yet, but we did have a quite good month.

Besides minting and listing tokens for sale on the Raydium network, from the capital raised (I'm the single largest investor) we were able to book a $176.09 profit. That would give about an 11.38% yield.

We were able to grow TerraM by 11.38% despite Ethereum actually dropping by more than -5% last month

All profits were distributed back to the token holders

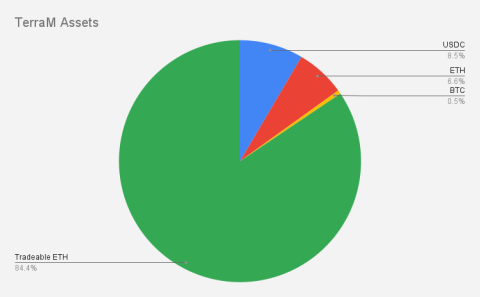

TerraM Assets

Here are the assets under TerraM control (as of December 31, 2022)

| Asset | Count | Rate | Value |

| USDC | 131.43 | $1.00 | $131.43 |

| ETH | 0.0859 | $1,199.57 | $103.04 |

| BTC | 0.00048049 | $16,560.00 | $7.96 |

| Tradeable ETH | 1.109 | $1,199.57 | $1,330.32 |

| $1,572.75 |

On the last day, od December TerraM crypto hedge funds' total value was $1,572.72, which makes the value for one TerraM coin = $0.1572, but as we are still in fundraising and more than 7,700 TerraM coins are available for investment, the base value for 1 TerraM coin is $1 or let's say this TerraM crypto hedge fund was invested at about 15.72% at the end of December 2022.

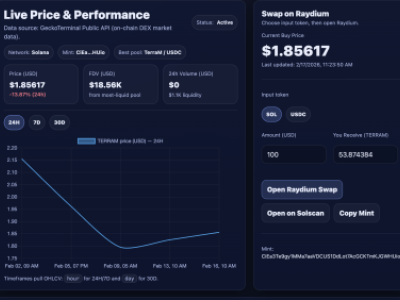

Price

While we have set the 1:1 ratio exchange ratio between TerraM and USD, on the Raydium network 1 TerraM was trading at $0.89165

Forecast / Goals For January 2023

I've no idea where the price of Ethereum will head in January 2023, but I'm looking to grow TerraM crypto hedge fund value close to $2,000, that would ask either additional investment or rock solid investment.

When focusing on growing naturally. I will be happy if will manage to repeat the 11% yield in the month of January. On 15 hundred that would be about +$165