Greetings from Mumbai, India. For the past three years, we’ve spent our winter holidays in India, usually traveling to Goa via New Delhi. This time, however, we arrived and departed through Mumbai and had a few days to explore the city. I’m genuinely impressed. Mumbai is definitely a city where I could imagine living long-term. Beyond that, it stands out as one of Asia’s major financial centers.

One thing that really stands out when traveling around India is the prevalence of billboards advertising investments in mutual funds. Likewise, when visiting libraries, it’s not uncommon to find educational books on options trading. This suggests that India’s retail financial markets are not only growing, but already fairly mature.

That said:

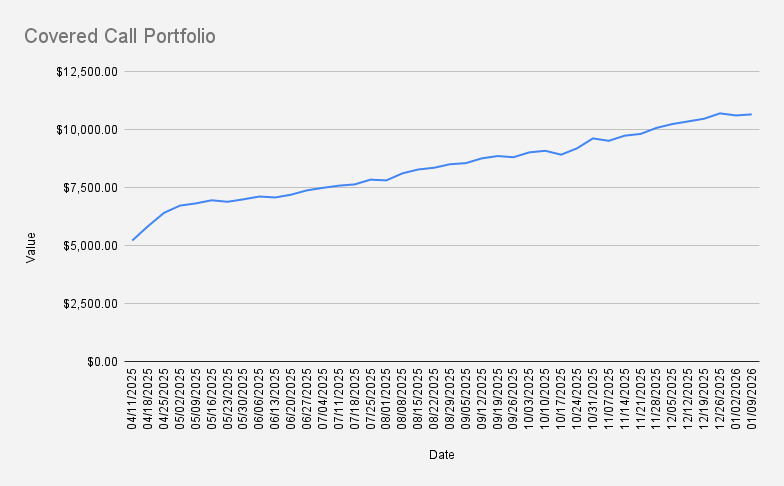

As of January 9, 2026, our covered-call stock portfolio has increased slightly by +0.44% and closed at $10,653. For the sake of transparency, it’s worth noting that the slight decline is due to USD/EUR exchange rate movements. The U.S. dollar kept appreciating against the euro, which reduced the total value when expressed in USD.

Our covered call portfolio is up 2.37%, modestly outperforming the S&P 500 (+0.84%). An encouraging start to the year.

Options trades:

At the end of the week, I also adjusted our NVDA bull put credit spread, rolling it down and forward to next week’s expiry for a net credit. If you’ve been following our journey, you already know this is my favorite strategy - rolling for a credit. Using the premium received, I purchased an additional 0.1 fractional share of NVDA, increasing our total holdings to 101 shares.

Current positions

- NVDA JAN 16, 2026 179/169 Bull Put Credit Spread

- 2X BMY JAN 30, 2026 51/47 Bull Put Credit spread

- SHELL FEB 20, 2026 29 Cash-Secured Put

- NVDA JUNE 18, 2026 $116 Covered Call

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $65 in options premium this week. If we can consistently average that amount, it would take approximately 63 weeks to fully eliminate our margin debt of $4,146. I’d be quite happy to eliminate this margin debt in 2026 without selling any stock - let’s see how it goes.

Another point worth noting: I’m exploring selling cash-secured puts instead of credit spreads to increase premium collection, though this comes with exposure to larger drawdowns. Using margin in the current environment doesn’t seem prudent, but after reducing margin usage by an additional ~$1,000 could be worth considering.

Looking ahead to next week, I will be closely monitoring the NVDA $179/169 put spread. Should any of our positions come under pressure, the plan is to roll them forward—ideally for a credit.

Never miss an update! Get weekly insights delivered to your inbox—subscribe to the Covered Calls with Reinis Fischer newsletter