Those of you following my blog in the recent weeks (months) probably have already noticed, since the start of the 2017 I've been building my retirement portfolio from scratch. It has been already more than 6 months since the start of this journey and the great news are following, I'm at 80.27% from this years goal to invest $8,561. (That's roughly about 31% from my annual earnings).

If at the start of year I thought that I will invest in mutual funds, stocks and peer to peer lending, and also I thought that to save $8,561 will be really tough (hard but doable), then now 6 month later I have found that it is quite possible to put some chunk of money from earnings month to month in savings and I'm more than sure that I will save more than $8,561 this year (I'm looking right now to save in total for 2017 $10,000).

Also for my investments I've extended portfolio to cash and crypto currencies.

As I like to think - it's all about finance discipline and smart decisions.

Now, when speaking about smart decisions and investments in crypto currencies, this is the part where I'm very uncertain - right now I'm not seeing investments in crypto currencies not at all as smart decisions, as they might be ponzi schemes or something. Here is the thing - I'm not using bitcoins to order pizza or buy electronics, I'm not using crypto currency by myself and I still don't see there a lot of use from it. I kind of understand crypto concept, but as I see it right now, while it wont go mainstream - there are a lot of unknown still.

On the other hand - I see a lot of opportunities here, and that's the reason I decided to allocate small space in my portfolio for investments in crypto currencies - right now I decided to allocate up to 5% from total investments in crypto currencies.

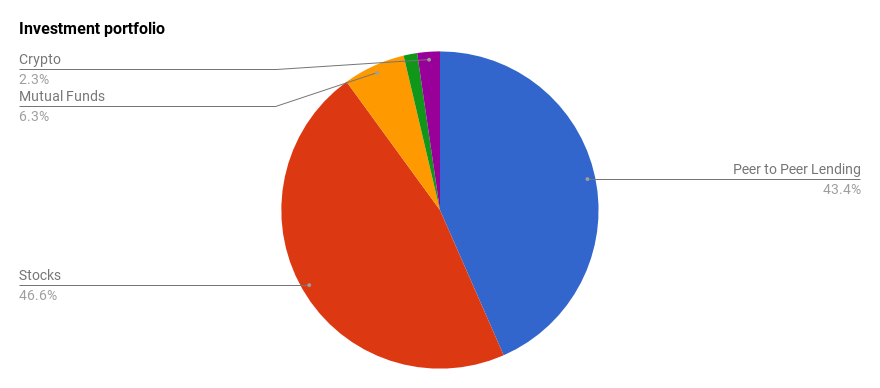

Portfolio with Crypto currency included, July 2017

By July 2017, crypto currencies takes 2.3% from my total net portfolio. Still a plenty of room to grow to 5%

It was at the end of June 2017, when after a small talk with a fellow affiliate guy about crypto currencies I thought I should start investing using dollar cost averaging, each month constantly buying some coins. I opened an account at coinbase. See: How & Why To Buy Crypto Currencies (bitcoin, ethereum, litecoin) Online - Coinbase

Once I was able to verify my ID on coinbase I bought first crypto currency - ethereum, see: First Investment In Crypto Currencies - Bought 0.2 ETH for EUR 50

To track my progress with crypto currencies I built a simple but powerful Google Spreadsheet, see: How To Track Your CryptoCurrencies Portfolio Automatically Using Google Spreadsheets

![]()

Tracking crypto currency portfolio

About 2 weeks later from my initial plan of acquiring digital coins - I can proudly report that I've bought not only ETH, but also bitcoin and litecon, by spending EUR 50 for each of the currencies. And I'm planing to spend about the same amount of money each month until the end of 2020. That's about 3,5 years or about EUR 6300 to be invested in crypto currencies by the end of 2020.

In the past two weeks value for my investments in three popular crypto currencies (Ethereum, Bitcoin and Litecoin) have lost value for -6.51% (and not counting in commission fees paid on Coinbase - total 6 EUR

I'm planing to purchase more coins after a month, and then again after a month and so on - dollar cost averaging:

Dollar cost averaging (DCA) is an investment strategy with the goal of reducing the impact of volatility on large purchases of financial assets such as equities. Dollar cost averaging is also called the constant dollar plan (in the US), pound-cost averaging (in the UK), and, irrespective of currency, as unit cost averaging or the cost average effect.

By dividing the total sum to be invested in the market (e.g. $100,000) into equal amounts put into the market at regular intervals (e.g. $1000 over 100 weeks), DCA hopes to reduce the risk of incurring a substantial loss resulting from investing the entire "lump sum" just before a fall in the market. Dollar cost averaging is not always the most profitable way to invest a large sum, but it is alleged to minimize downside risk. The technique is said to work in markets undergoing temporary declines because it exposes only part of the total sum to the decline. The technique is so-called because of its potential for reducing the average cost of shares bought. As the amount of shares that can be bought for a fixed amount of money varies inversely with their price, DCA effectively leads to more shares being purchased when their price is low and fewer when they are expensive. As a result, DCA possibly can lower the total average cost per share of the investment, giving the investor a lower overall cost for the shares purchased over time.

Now, if would stick with my 5% goal in portfolio for crypto currencies for next 3 and a half years, that would mean my portfolios total net worth would be at around EUR 120,000. Yes, sounds unreal, as of today, by writing these lines it stands just at ~ EUR 6,200 but time, discipline and decisions will show.

If you want learn more, make sure to subscribe to the investment e-mail newsletter bellow or read dividend income reports.