I’m launching a new series on Options Trading, where I’ll be sharing insights built from more than seven years of hands-on experience in the markets. We’ll cover everything from the fundamentals to advanced premium-income strategies.

To kick things off, I’m starting with one of my favorite topics and one of the least risky yet capital-intensive strategies in the entire options landscape: Covered Calls.

If you want to follow along and never miss an update, feel free to subscribe to my newsletter

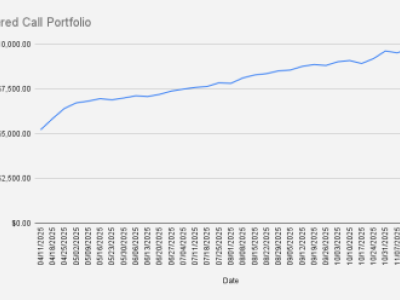

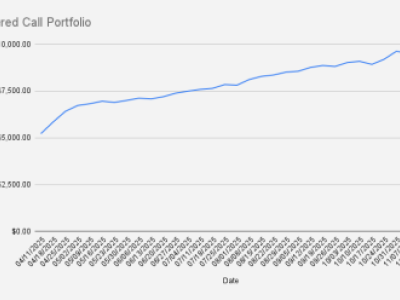

Covered call selling remains one of the most reliable ways to generate stable income from an equity portfolio. The key is pairing strong companies with elevated implied volatility (IV) so you receive premium without excessive risk.

My own preferred covered call underlyings for 2026 are NVIDIA (NVDA) for high-frequency weekly income, and Bristol-Myers Squibb (BMY) for conservative, low-IV stability. In this article, we’ll walk through the Top 10 stocks specifically screened for covered call performance.

Selection Criteria

- IV 25–55% – high enough for premium, low enough to avoid instability

- Strong fundamentals – revenue growth, profitability, strong balance sheet

- High options liquidity – tight spreads, weekly expiries, strong open interest

This mix produces consistent covered call income.

Top 10 Stocks for Covered Calls in 2026

1. NVIDIA (NVDA)

NVIDIA is the global leader in AI GPUs, data-center compute, and accelerated cloud infrastructure. Their hardware is now essential to every major AI and LLM buildout.

Why it works for covered calls:

- Extremely liquid options market

- Persistent elevated IV due to growth expectations

- Strong fundamentals and recurring data center contracts

Best use: Weekly far-OTM covered calls (delta 10–15).

Personal favorite: One of my main income-producing tickers.

2. Tesla (TSLA)

Tesla is an EV manufacturer transitioning into robotics, AI autonomy, and energy storage. Sentiment swings heavily around production, margins, and new tech announcements.

Why it works for covered calls:

- Naturally high IV around earnings, deliveries, and macro headlines

- Deep options liquidity

- Underlying stock tends to move enough to justify wider call strikes

Best use: Monthly calls with wider OTM range to reduce assignment risk.

3. Meta Platforms (META)

Meta owns Facebook, Instagram, WhatsApp, and is building long-term AI infrastructure and VR/AR technologies via Reality Labs.

Why it works for covered calls:

- Strong cash flow and stable long-term fundamentals

- IV stays moderately elevated due to regulatory and metaverse spending cycles

- Tight spreads make entries cheap and efficient

Best use: 2-week or monthly calls during IV spikes for optimal yield.

4. Advanced Micro Devices (AMD)

AMD is a major semiconductor competitor producing CPUs, GPUs, and increasingly AI accelerators for data centers.

Why it works for covered calls:

- Semiconductor volatility = premium

- Rapid growth in AI server markets

- Extremely liquid options market

Best use: Weekly calls slightly OTM. Ideal candidate for the Wheel.

5. Palantir Technologies (PLTR)

Palantir is a data analytics and AI software company heavily integrated with defense, intelligence, and enterprise customers.

Why it works for covered calls:

- High IV due to retail interest and rapid growth narrative

- Improving margins and long-term government contracts

- Lower share price suits smaller portfolios

Best use: Monthly calls with conservative deltas.

6. Coinbase (COIN)

Coinbase is the largest U.S. regulated crypto exchange, increasingly diversified into institutional custody, blockchain infrastructure, and on-chain finance.

Why it works for covered calls:

- Crypto exposure keeps IV structurally elevated

- Huge options liquidity

- Strong premium during crypto market volatility

Best use: Short-dated covered calls during IV spikes. Rewarding but higher risk.

7. Exxon Mobil (XOM)

Exxon is one of the world’s largest integrated energy companies, operating upstream (oil/gas production) and downstream (refining, chemicals).

Why it works for covered calls:

- Energy prices are cyclical, keeping IV above average

- One of the strongest balance sheets in the sector

- Low assignment risk with steady dividends

Best use: Monthly calls for conservative, stable income.

8. Alibaba (BABA)

Alibaba is a major Chinese e-commerce, cloud, and logistics platform with deep infrastructure across Asia.

Why it works for covered calls:

- IV remains high due to geopolitical and regulatory uncertainty

- Fundamentally undervalued by most valuation models

- Options are cheap and liquid

Best use: Monthly calls. Attractive for long-term holders willing to tolerate volatility.

9. SoFi Technologies (SOFI)

SoFi is a modern digital bank offering lending, credit, investing, and fintech services. Strong growth but still not fully matured.

Why it works for covered calls:

- Naturally high IV in fintech mid-caps

- Tight spreads despite lower share price

- Significant retail participation

Best use: Monthly calls with low deltas.

10. PayPal (PYPL)

PayPal is a global digital payments provider undergoing cost optimization and platform simplification.

Why it works for covered calls:

- Improved balance sheet + strong cash flow

- IV elevated from competitive pressures

- Smooth options chains with weekly expiries

Best use: 2–4 week calls. Good balance between premium and safety.

Risks to Watch

- Earnings weeks: Biggest IV + biggest price swings.

- Trend reversals: High-IV stocks drop 20–40% fast—stay delta-aware.

- Early assignment: Especially around dividends or deep ITM calls.

- Capped upside: Covered calls sacrifice moon-shot gains.

The Bottom Line

For 2026, the strongest covered call candidates sit at the intersection of AI (NVDA, AMD, META), energy (XOM), crypto-linked equities (COIN), and volatile mid-caps with improving fundamentals (PLTR, SOFI).

For conservative long-term income: BMY and XOM

For aggressive weekly premium: NVDA, COIN, TSLA

Subscribe to the Covered Calls with Reinis Fischer newsletter