Investments

Here I share my journey with stocks, options, and real estate, offering insights from building a dividend stock portfolio, trading covered calls for income, and investing in properties for growth

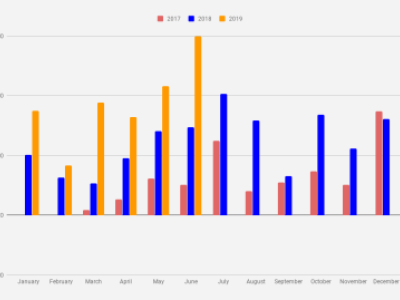

Income Goal For Dividends and Option Trading Q1 2020 ($1,200/mo)

| 24 viewsI have a goal to make at least $1,200 per month for the next 3 months of the year in dividend income + selling options. Every quarter I create a brief income plan/goal laying out plans for…

December 2019 Dividend Income Report - $235.94

| 24 viewsWelcome to the thirty-second (#32) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in December 2019.Last December we spent…

2019 in Review and Financial Goals for 2020

| 18 viewsI'm 34 years old now and I have a goal to save one million dollars by the time I will turn 60. Just 26 years to go. I've been documenting my journey towards financial independence…

How to Setup Charts with Interactive Brokers

| 82 viewsThis is a quick tutorial on how to setup / enable charts in Interactive Brokers to trade stocks, ETFs, indexes e.t.c.For the last couple of months I've been trading 0 DTE SPX, for charting using…

November 2019 Dividend Income Report - $260.41

| 24 viewsWelcome to the thirty-first (#31) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in November 2019.Last November we spent a…

October 2019 Dividend Income Report - $201.36

| 23 viewsWelcome to the thirty (#30) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in October 2019.Wow, thirty income reports so far,…

September 2019 Dividend Income Report - $260.36

| 25 viewsWelcome to the twenty-ninth (#29) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in September 2019.Last September we…

Income Plan From Dividends and Option Trading Q4 2019 ($1,000/mo)

| 12 viewsI have a plan to make at least $1,000 per month for the next 3 months of the year in dividend income + selling options. Here is the long story short - I've been investing in dividend…

August 2019 Dividend Income Report - $259.58

| 12 viewsWelcome to the twenty-eight (#28) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in August 2019.Last August, I turned 34. For…

July 2019 Dividend Income Report - $247.06

| 20 viewsWelcome to the twenty-seventh (#27) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in July 2019.Hawk-eyed blog…

One Year Anniversary for the Child's Stock Investment Portfolio

| 13 viewsToday, on July 13th, we are celebrating both 1-year anniversaries for our baby daughter and her stock investment portfolio. In today's article, I will shed some light on the second (investment…

June 2019 Dividend Income Report - $299.51

| 18 viewsWelcome to the twenty-sixth (#26) dividend income report, covering earnings I've made from dividend-paying stocks, peer to peer lending (both fiat and cryptocurrencies)…

Net Worth $25,000 Reached

| 23 viewsOn April 2nd, 2019, my net worth for the first time reached $25,000 Milestone.It took me 2 years and 3 months since I originally started my million dollar journey, and I was 33 years old.…

May 2019 Dividend Income Report - $216.17

| 17 viewsWelcome to the twenty-fifth (#25) dividend income report, covering earnings I've made from dividend-paying stocks, peer to peer lending (both fiat and cryptocurrencies)…

Opted for 3rd Pension Pillar

| 10 viewsOn May 22, 2019, I opted for the 3rd pension pillar at SEB bank Latvia. The main reason to sign up to this voluntary pension pillar is the hefty 20% tax refund once a year for the sums invested…