Welcome to the forty-seventh (#47) dividend income report, covering earnings I've made from dividend-paying stocks in March 2021.

The last March we spent in Latvia, but on the last day of March, we returned back to Georgia. There is some progress with our apartment renovation works in Vilgāle. But works have started to slow down.

Vilgāle apt update: Window Casing, Drywall ceiling

From the perspective of dividend income - Last March was decent. The thing is it is about a year already I'm not focusing on dividends at all, instead, I'm growing my total portfolio using options trades.

In total, we took some shy $91.06 in dividend income last month. Which is quite OK, for doing nothing

Compared to the previous March in 2020, when we took $163.01 in dividend income, our monthly dividend has decreased by -44.14% (-$71.95). A year ago we did set a goal to take at least $250 this month, now this didn't happen.

Luckily, an additional $5,928.44 was made from options trading.

As options trading is not a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income reports.

Check out our options income report here: March 2021 Options Income Report - $5,928.44; Net Liquidity EUR 19,451

Interest income in March 2021

From the stocks we got the following income last month:

Ticker | Dividend |

PFE | $33.15 |

USA | $20.83 |

O | $12.75 |

INTC | $10.35 |

RA | $8.46 |

EDF | $5.44 |

WFC | $0.08 |

Total: $91.06

I like what I see here, mos are good dividend stocks. from now on seems that every quarter will deliver better results, waiting for some bump in June, September, and December, as more O and INTC stock is planned to add

Monthly income

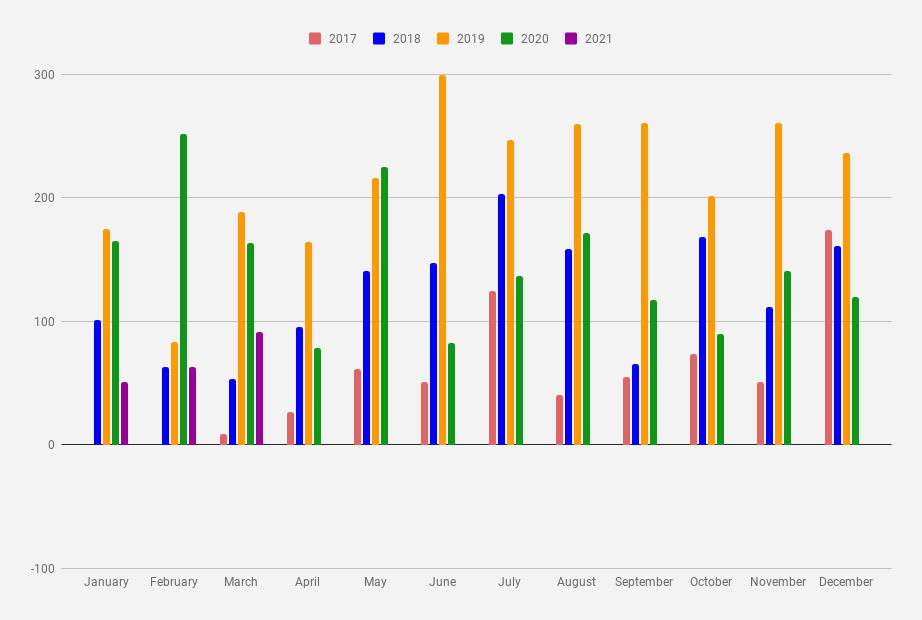

I've been tracking my journey towards million dollars in a savings account since January 2017. More than 4 years already.

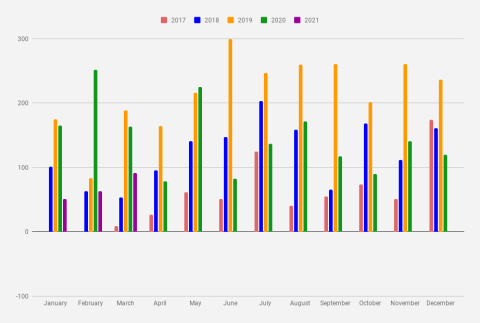

Monthly dividend Income chart as of March 2021

The cumulative earnings for 2021 now are $204.70 which is exactly 7.87% from my goal of 2021 ($2,600). On average, it would ask me to generate $266.14 every month for the next 9 months to reach my goal. Right, now this goal looks pretty hard.

2020 in Review and Financial Goals for 2021

Goals for March 2022

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2022, let's see what I forecasted/said a year ago (March 2020)

When looking at March 2021 I will say $250 is what I'm looking on, It's going to be very tough now, there are more dividend trims planned ahead, but I will keep adding some quality stocks to get there.

Yup, as I forecasted it was very hard to get there, dividends were slashed awfully. Now, when looking on March 2020, I will be quite optimistic I say USD 150 is what I'm looking at.

Now, there is one more fun thing I would like to do - reinvest all dividends in quality dividend aristocrat stock, more on that in other articles.