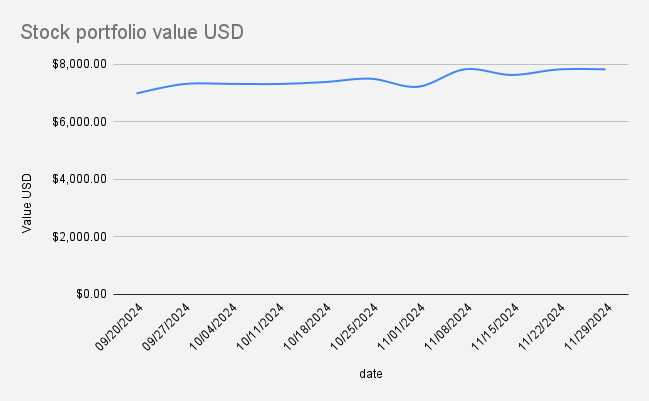

Last week marked another milestone for our investment portfolio, demonstrating resilience and steady growth despite some strategic adjustments. By the week's close, our portfolio value stood at $7,827.75, reflecting a modest but positive 0.04% increase compared to the previous week.

This growth comes despite the need to adjust our credit spread on MS (Morgan Stanley) stock, a tactical move aimed at mitigating risk while maintaining exposure to potential upside. Additionally, fluctuations in the EUR/USD exchange rate worked in our favor, giving the portfolio a slight boost.

These adjustments underline the importance of staying nimble in a dynamic market. Whether it's tweaking credit spreads or monitoring currency fluctuations, every small decision contributes to the bigger picture of portfolio performance.

One highlight of the week was the addition of two shares of Cognyte Software Ltd. (CGNT) to our portfolio. This Israeli-based company holds a personal connection for me, as I have relatives working there. The decision to buy into CGNT wasn't just sentimental—it was also a strategic bet on a company with solid potential in the cybersecurity and analytics sector.

Looking ahead, I'm considering increasing our position in CGNT and potentially selling covered calls on this stock. Covered calls could provide an excellent opportunity to generate income while reducing downside risk, making this a win-win scenario.

While the 0.04% growth might seem small, it's a reminder that even incremental progress adds up over time. A disciplined approach to adjustments, new buys, and leveraging market opportunities keeps the portfolio on a growth trajectory.

Since September 17, 2024, the total income generated from our options trading has reached $840.41. Which already represents 0.84% from our 100K options trading challenge.