Welcome to the seventh (#7) dividend income report, covering earnings I've made from dividend-paying stocks, peer to peer lending (both fiat and cryptocurrencies) in November 2017.

Surprisingly, but November, in terms of a passive income, turned out better, as I thought before, and generated me a dividend income of total $50.75. I didn't plan to make more than $40 this month, but increased lending rates and additional dividend payment helped to boost dividend earnings in November.

Also, a super hyped month with cryptocurrencies made a nice boost to the total portfolio value.

As usual, I was doing nothing much, just investing in great companies, playing a little bit with cryptocurrencies and lending out money via peer to peer marketplace. Most of the November was on autopilot, just at the start of the month I deposited some chunk of money to Mintos.com peer to peer lending marketplace, and at the end of the month - purchased additional shares of Vilniaus Baldai on Nasdaq Baltics.

About Portfolio November 2017

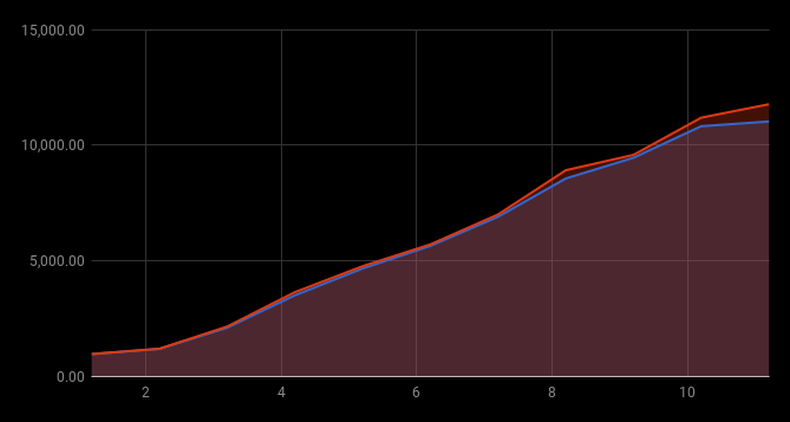

At the end of October, I've invested a total of $11,035.29 what greatly exceeds my initial plan for investments in 2017 and equals to 128.90% from this year's planned investments. Also, at the end of November, I've reached 1.18% from my ultimate one million dollar goal by the time I will turn 60 (in 2045).

All final/total currencies are converted to the US dollar, though I've investments in GEL, EUR and USD currencies.

Net Worth November 2017

For the past 11 months, it has been a steady value growth resulting in a total of +6.77% value growth for the entire portfolio at the end of November. Here is the breakdown of positions (year to date growth)

- Mintos.com peer to peer lending: -4.19%

- Stocks: +2.46%

- Mutual funds: +4.22%

- Crypto investments: +76.44%

For the fourth month in a row the value of my investments on Mintos marketplace has been declining, despite Mintos being the top performer of dividend payments (loan payments), and here is why - Georgian Lari currency continues to lose value against EUR. Be extra cautious when investing in international currencies.

Both individuals and entities can invest through Mintos. Individual investors must be at least 18 years old, have a bank account in the European Union or third countries currently considered to have AML/CFT systems equivalent to the EU, and have their identity successfully verified by Mintos. At the moment, US citizens or taxpayers cannot register as investors at Mintos.

Affiliate link here: Sign up to Mintos.com here. By using this affiliate link for registration both you and I will receive — 1% of your average daily balance which should be paid in 3 installments for the first 90 days.

Having a diversified portfolio helps, and it definitely helped me last November. Despite negative returns in some of the portfolio positions, the total value growth is with a positive +6.77% sign. Awesome.

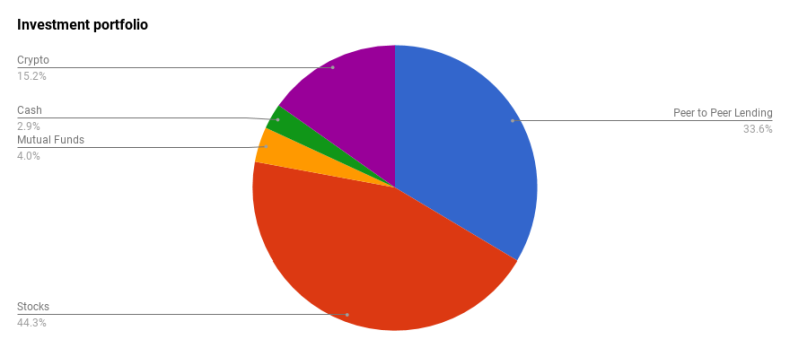

Investment portfolio structure November 2017

I keep investing in - stocks, peer-to-peer lending, mutual funds, cash, and cryptocurrencies. The vast majority remains invested in Nasdaq Baltics and Mintos.com peer to peer lending loans (in EUR and GEL currencies)

About Investments in November 2017

Last month I invested additional:

- Nasdaq Baltics stock market: EUR 340

- Cryptocurrencies: EUR 175

- Mintos.com: EUR 226.61

Total investments in October: EUR 741.61

It should be noted, that not all money put on investments last month is a fresh money put directly from my monthly income, most of the investments were funded from the Cash position in the portfolio. I love cash and tend to keep about 5% of the total portfolio in cash.

From money invested in Baltic equity market I bought following shares:

- Vilniaus Baldai (VBL1L ) - 25 Shares

This, Lithuanian company promises dividend payment in January 2018. I believe I overpaid a little bit for this stock, but I'm not worried about that, as I plan to hold them for a long term.

Interest income in November 2017

From investments in stocks, peer to peer lending marketplace Mintos.com and from cryptocurrency lending on Poloniex.com I got following income last month:

- Linas Agro Group: EUR 3.55

- Mintos.com: EUR 40.17

- Poloniex.com: EUR 1.27

Total: EUR 44.99 / USD 50.75

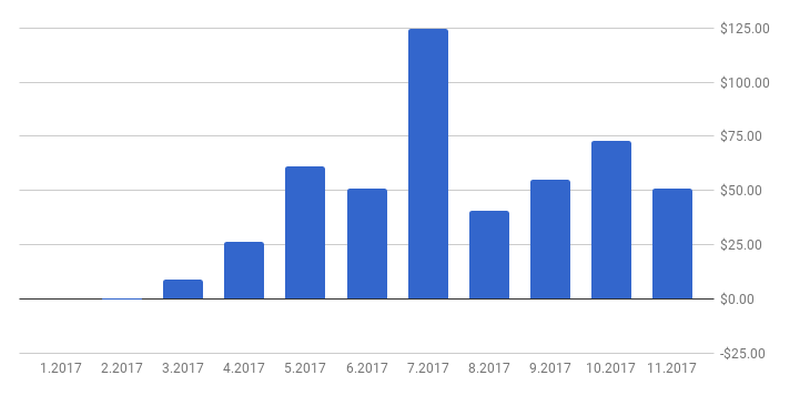

Monthly income to the date

During the past 11 months, dividend income from my portfolio have produced $490.36, or 4.44% year to the date yield

Monthly income chart for November 2017

A decent month if compared to the other months of the year. Sure, nothing impressive, I can only agree. Speaking about next months - I can already see that following December will be the best month of the year in terms of dividend income, looking on about $150 this December.

January should be similar to November, February and March probably will be the lowest in terms of income. Starting April I hope to reach at least $100/mo (still about 2 months later than I initially planned, see: Investment Goal #1 - $100/mo from Dividend Payments

Goals for November 2018 Dividend income

If looking from today's perspective I cannot see making more than $70 a year later. Still, a year is a plenty of time, and I will stick with a more optimistic $100/mo for November 2018