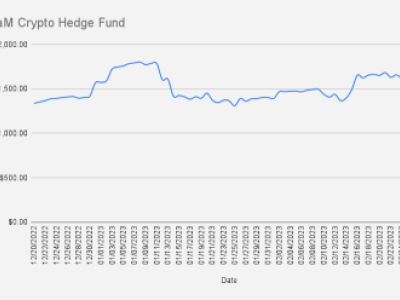

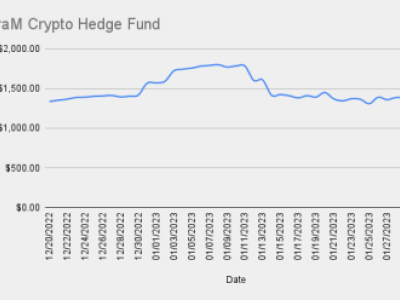

I minted 10,000 TerraM tokens back in 2022 with a very simple idea: raise $10,000 and trade Ethereum options. The plan was straightforward - tokenized participation, transparent backing, real trading activity. In practice, the initial capital raise never really materialised. There was no big launch, no rush of external capital, no instant liquidity.

What did happen over time, however, turned out to be more important.

Instead of relying on outside funding, I gradually raised capital organically and, more importantly, started generating income from our own options trading. That income gave TerraM something many small tokens never get: real economic activity behind it. Every TerraM token is backed by USDC value derived from actual trading results. Not a promise, not a narrative, but cash flow.

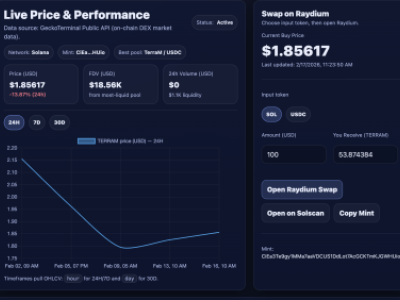

There are nuances here, of course. TerraM trades on Raydium, and liquidity has almost always been shallow. For most of its life, the liquidity pool rarely exceeded about 5% of total token value. This wasn’t accidental. The majority of funds were consistently deployed into actual trading rather than sitting idle in a pool. From a trading perspective, that made sense. From a token-design perspective, it made things complicated.

Running a trading strategy while also maintaining a token introduces constant trade-offs. Liquidity wants idle capital. Trading wants capital at work. For a long time, TerraM leaned heavily toward the latter. In hindsight, that slowed price discovery and discouraged participation, but it also ensured the token was backed by real performance rather than empty liquidity.

Over time, lessons accumulated.

A few months ago, we switched to a fixed distribution model. Instead of ad-hoc decisions, 20% of weekly options premium is now allocated specifically to support the TerraM token - liquidity additions, buybacks, and general market support. The remaining capital continues to work in trading. This single change had an effect I didn’t fully anticipate.

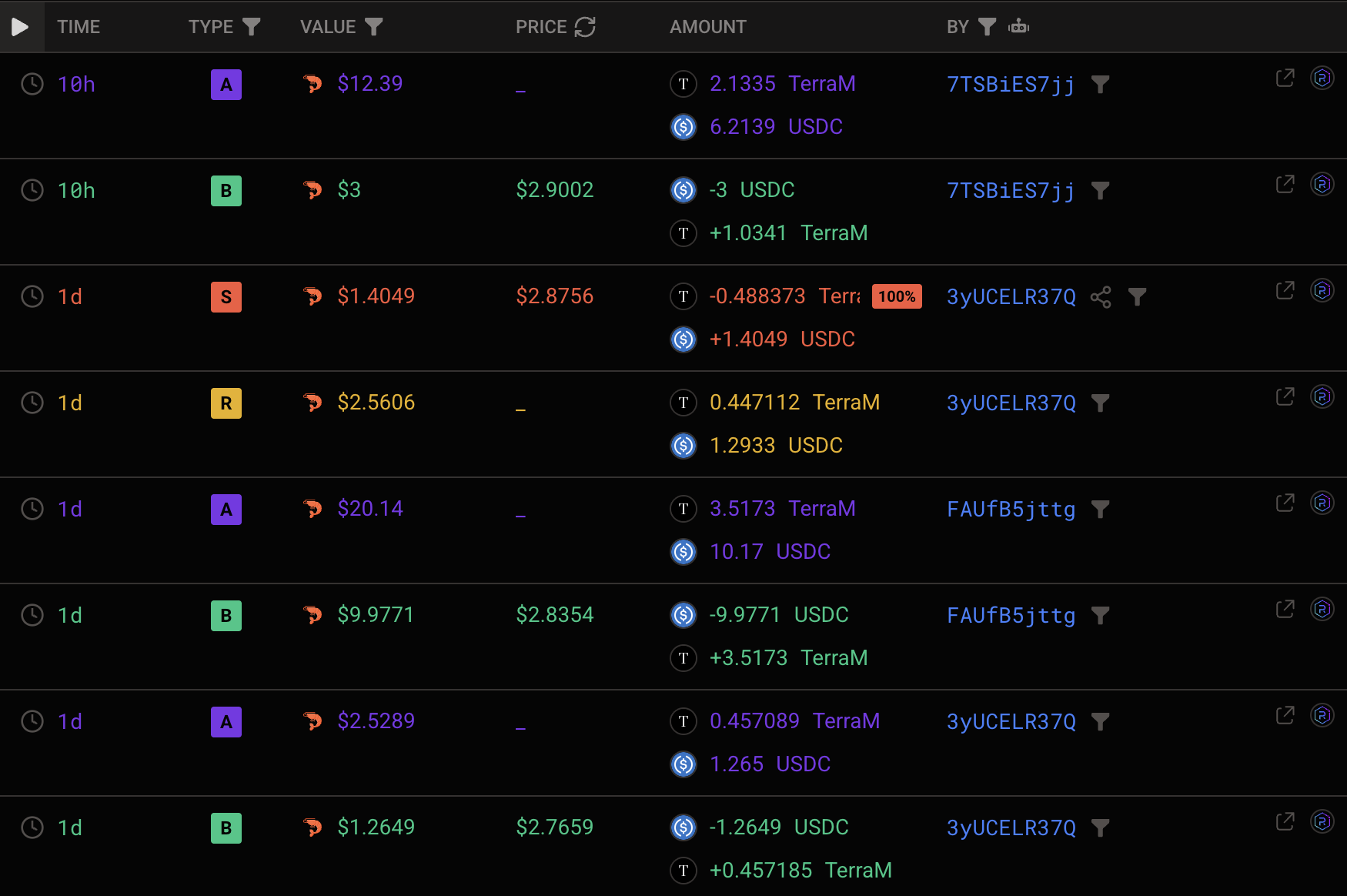

Bots appeared.

For more than two years, TerraM barely saw any automated trading activity. Then, shortly after the fixed distribution model went live, small but consistent bot trades started showing up. Buys and sells, usually just a few dollars, sometimes up to $20 per trade. Some bots even held positions for a while instead of immediately flipping. That may sound trivial, but in DeFi terms it’s a meaningful signal. Bots don’t care about stories. They care about incentives, structure, and predictable flows.

As long as bots are trading with real dollars, that’s real validation.

More recently, I experimented with Raydium rewards and launched our first staking reward campaign. This was the first time TerraM offered explicit yield for participation. Once again, bots returned almost immediately. Volume picked up, price responded, and TerraM moved to around $2.9 as of today.

With only 10,000 tokens in existence, that puts fully diluted valuation at roughly $29,000. Small, yes - but also extremely sensitive to incremental liquidity and demand. When supply is fixed and distribution is tight, even modest, sustained inflows matter. Combined with weekly liquidity additions from trading profits, the growth path becomes clearer.

Another important milestone is structural rather than market-based. TerraM has now been implemented under Terramatris LLC in Wyoming, giving the project a clearer legal and operational foundation in the US. That doesn’t magically solve liquidity or scale, but it reduces uncertainty around legitimacy and continuity.

One broader observation has become hard to ignore. In DeFi, bots likely account for 70–90% of activity. I suspect the number is not meaningfully lower in CeFi either. Human traders initiate narratives, but bots enforce market reality. If a token attracts bots, it usually means incentives are aligned well enough to justify attention. TerraM is now crossing that threshold.

Looking ahead, the next step is increasing actual liquidity to around 10%. Beyond that, token supply becomes a real question. One option is issuing additional TerraM tokens to target a market cap closer to $1 million. Another, less radical approach would be minting an additional 1,000 tokens, primarily for marketing, partnerships, and strategic distribution to accelerate growth without heavily diluting existing holders. No decision has been made yet, and any supply change has to be justified by underlying cash flow, not ambition.

What started as a failed capital raise has slowly turned into something more robust: a token with real trading income, observable market behaviour, and now even bot participation. That doesn’t guarantee success. But it does suggest TerraM has crossed from concept into system.

And that’s a meaningful place to be.