Blog Archive: July 2024

Real Estate vs. Bitcoin: A Comparative Analysis of Leveraged Investments

| Real Estate | 45 seen

Recently, I had an interesting conversation with a business associate about leveraging investments in real estate and Bitcoin.

He offered me an opportunity to purchase an apartment in Tbilisi using a bank loan with a 10-year term, requiring a 30% down payment. This essentially creates a leverage ratio of 3x. The idea is to rent out the apartment, which would cover the mortgage payments, a common and popular belief among real estate investors. While I'm not advocating against this approach, it got me thinking about how it compares to leveraging investments in Bitcoin, where the leverage can be significantly higher.

As the founder of a successful crypto hedge fund, Terramatris, I often explore various investment strategies. This particular offer in Tbilisi, a market I am quite familiar with, prompted me to compare real estate with Bitcoin investments. Although in the crypto market, leverage can go up to 10x, for a fair comparison, I will apply the same 3x leverage to both real estate and Bitcoin investments. Let's break down the numbers and see which investment strategy might be more profitable under similar conditions.

Real Estate Investment…

Frame House in Latvia: Outdoor Patio, Inner Walls, and More

| Frame House | 114 seen

As June came to an end, our family embarked on a journey from Tbilisi to Latvia, skipping Renee's school year for the last week and focus on our frame house project. Here's a glimpse into our busy but rewarding time working on the house.

We left Tbilisi with excitement and anticipation, knowing that a lot of work awaited us in Latvia. Skipping a week of Renee's school was a calculated decision, as we wanted to make the most of this opportunity to push our frame house project closer to completion.

Our first major task was finishing the outdoor patio. This space is crucial for us as it extends our living area and provides a beautiful spot to relax and enjoy the surrounding nature. We installed decking, ensuring a sturdy and aesthetically pleasing foundation.

Building Inner WallsInside the house, we focused on building a few inner walls. These walls are essential for creating defined living spaces and ensuring privacy. It was a meticulous process, involving precise measurements and careful construction.

The sense of accomplishment we felt after seeing the walls take shape was immense.

Installing the WCInstalling the WC was another…

Wine with Friends Night in Tbilisi: A Perfect Blend of Networking and Tasting

| Living in Georgia | 163 seen

Yesterday, I had the pleasure of attending a delightful wine-tasting event organized by my American friend, Colin. The evening was set in the charming ambiance of a wine gallery located at Irakli Abashidze 64. The event brought together a vibrant mix of expatriates from various industries, predominantly startups and founders, creating an excellent opportunity for networking and socializing.

The wine gallery on Irakli Abashidze 64 is an exquisite venue that exudes both elegance and warmth. Its cozy, inviting atmosphere set the perfect backdrop for a night dedicated to the appreciation of fine wines and engaging conversations. The gallery's carefully curated selection of wines offered a delightful journey through Georgia's rich viticultural heritage.

As we arrived, I was greeted by a familiar and friendly crowd of expats, some of whom I had the pleasure of knowing from previous encounters. The diversity of industries represented was impressive, with attendees hailing from tech startups, software developers, crypto traders, hedge funds, professionals from translation industry and various other entrepreneurial ventures. This mix of professionals created an enriching…

Average Monthly Salary in Georgia in 2024

| Living in Georgia | 1,000 seen

In the first quarter of 2024, the average nominal monthly salary in Georgia was 1,943.4 GEL. This figure includes income tax, meaning the net salary (take-home pay) is 20% less.

Compared to the same period last year, there was an increase of 226.8 GEL, or 13.2%. However, this is a decrease of 101 GEL compared to the fourth quarter of the previous year.

There remains a significant gender pay gap across all sectors. The average nominal salary for men is 2,343.2 GEL, while for women it is 1,540.0 GEL.

The highest average salaries, over 4,000 GEL, are found in the financial and insurance activities, as well as information and communication sectors.

The highest average salary is in Tbilisi, at 2,305 GEL, while the lowest is in the Racha Lechkhumi/Kvemo Svaneti region, at only 996.8 GEL.

Experts note that instead of the average salary, the median salary is a more telling indicator, but the statistics department does not regularly calculate this figure.

As an expat living in Georgia, I like following developments on how the average wage in Georgia has evolved over the years. Last time I checked was back in 2016, when the average…

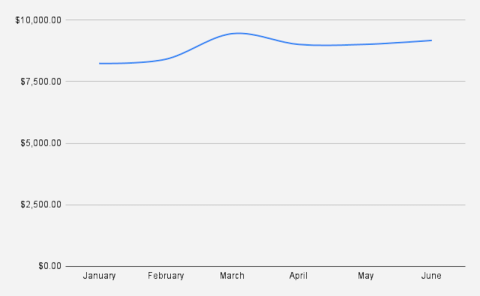

June 2024 Stock Portfolio Update ($9,173)

| Stock Portfolio | 62 seen

At the end of June 2024, the total value of our stock portfolio was USD 9,173 (EUR 8,431). What is a small, but increase of EUR 226, if compared to the previous month

Most of the June we spent in Georgia, enjoying Summer, taking part in trail runs, while at the end of June we traveled to Latvia to work with our frame house, did some good job, installing outdoor patio, wiring, and even installing drywall.

The increase in the stock portfolio comes from the market appreciation itself and additionally from options trades, while small part of the growth can be attributed to the dividends.

One of my short-term goals is to grow our portfolio to USD 10,000. With USD 827 to go, I believe this target is achievable in the next few months through a combination of selling options and stock appreciation.

The main longer-term goal for our portfolio is to grow it to 100 fully covered Morgan Stanley (MS) shares, supported by an additional 100 British Petroleum (BP) shares. This strategy will enable us to sell covered calls on these shares while also benefiting from dividend payments.

Stock PortfolioYear to Date (YTD) our stock portfolio was up +…

The Great Latvia Summer 2024: From Riga to Nīca

| Travel guides | 64 seen

As the warmth of summer envelops the Baltic region, there’s no better way to experience its charm than by embarking on a journey through the scenic landscapes of Latvia. This year, we invite you to join us on an unforgettable adventure in our latest film, "The Great Latvia Summer 2024." From the bustling streets of Riga to the tranquil shores of Nīca, and the historic town of Valka, this summer promises to be filled with exploration, local flavors, and hands-on projects.

We kicked off our adventure by skipping a week from the British International School in Tbilisi to travel to Latvia on June 21. We stayed until July 14, making memories that will last a lifetime. During our stay, we celebrated our kiddo’s 6th birthday at our charming frame house, adding a special touch to our summer journey.

Exploring Riga: The Heart of LatviaOur journey begins in Riga, the capital city known for its stunning Art Nouveau architecture and vibrant cultural scene. Whether you're wandering through the historic Old Town, enjoying the lively atmosphere of the Central Market, or taking a leisurely stroll along the Daugava River, Riga offers a perfect blend of the old and new. Don’t miss…

Exploring the Real Estate Market in Tbilisi in 2024: Bitcoin as a Buying Power

| Real Estate | 32 seen

As the CEO and Founder of TerraMatris Crypto Hedge Fund, I've often contemplated the potential of cryptocurrencies, especially Bitcoin, in various investment avenues. Recently, I received a proposal involving the use of leverage to purchase an apartment in Tbilisi using our hedge fund as collateral. This intriguing idea prompted me to explore the current real estate market in Tbilisi, particularly in terms of how many Bitcoins one would need to buy an apartment in 2024.

Real Estate Prices in TbilisiTbilisi, the capital of Georgia, has seen a robust real estate market over the past decade. The city offers a range of options, from high-end apartments in central districts like Vake and Saburtalo to more affordable options in outer neighborhoods like Digomi.

Vake-SaburtaloVake-Saburtalo is known for its upscale living conditions, modern infrastructure, and convenient amenities. As of summer 2024, turnkey apartments in these districts are priced between $130,000 to $200,000. The average price per square meter in these areas is approximately $2,000. These figures highlight the premium nature of real estate in central Tbilisi, catering to those seeking a…