Blog Archive: May 2025

Week 8 / How We Collected $47 in Premiums This Week with NVDA Credit Spreads

| | 84 seen

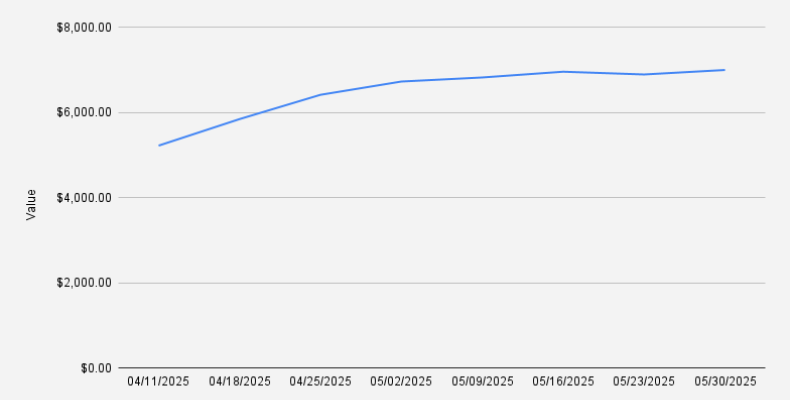

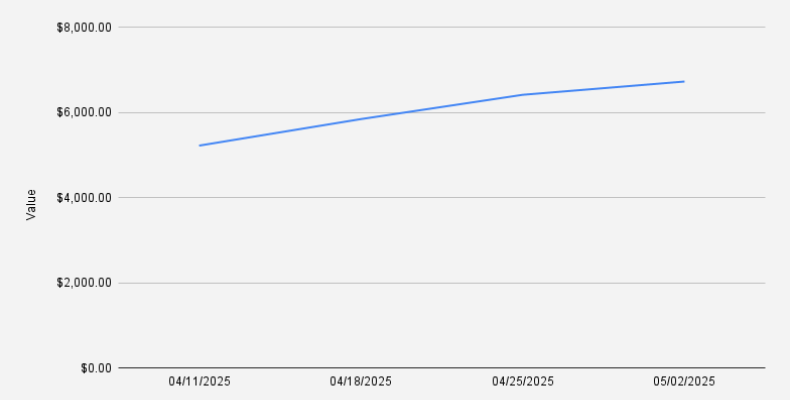

As of May 30, 2025, our covered call stock portfolio stood at $6,993, showing a +1.53% week-over-week increase (+$105). While Year-to-date, we are still down -7.26%, as we navigate volatility while optimizing our options income strategy.This week…

As of May 30, 2025, our covered call stock portfolio stood at $6,993, showing a +1.53% week-over-week increase (+$105). While Year-to-date, we are still down -7.26%, as we navigate volatility while optimizing our options income strategy.This week…

Larnaca International Airport

| Airports | 23 seen

This spring, I took a memorable trip that involved connecting through three countries in less than two weeks—starting in Tbilisi, Georgia, spending a few days in Israel, and finally heading to Cyprus for a short but enriching stay. What stood out…Frame House Upgrades: Big Windows, New Porch, and Apple Trees Planted in Latvia

| Frame House | 289 seen

In mid-April, during our kiddo’s Easter school break, we traveled to Latvia for about 10 days — a trip packed with projects, energy, and transformation. A lot of pre-planning had gone into it before we even arrived: we ordered the windows, sourced…

In mid-April, during our kiddo’s Easter school break, we traveled to Latvia for about 10 days — a trip packed with projects, energy, and transformation. A lot of pre-planning had gone into it before we even arrived: we ordered the windows, sourced…

Week 7 / How I’m Using Covered Calls and Credit Spreads to Pay Off Margin on NVDA Stock

| | 122 seen

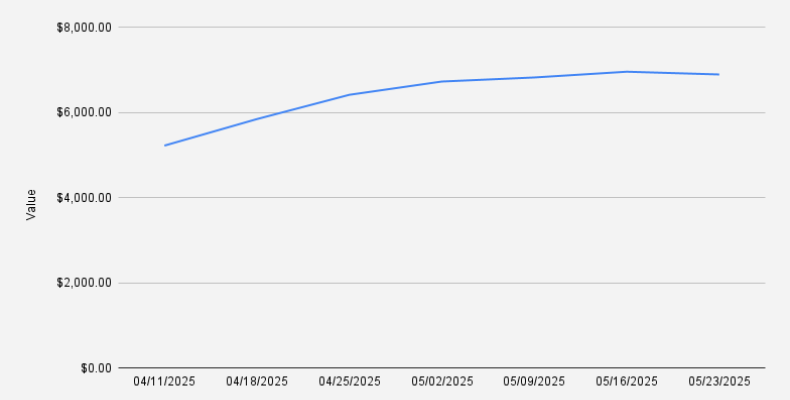

As of May 23, 2025, our covered call stock portfolio stands at $6,888, reflecting a -0.93% week-over-week decline (down $64.48). Year-to-date, we are down -9.33%, as we navigate volatility while optimizing our options income strategy.Rolling NVDA…

As of May 23, 2025, our covered call stock portfolio stands at $6,888, reflecting a -0.93% week-over-week decline (down $64.48). Year-to-date, we are down -9.33%, as we navigate volatility while optimizing our options income strategy.Rolling NVDA…

Pūre Horticultural Research Station

| Shopping Venues | 36 seen

In mid-April 2025, we took an exciting step toward our vision of a Latvian craft cider brewery by purchasing several Antonovka apple trees and other varieties from the renowned Pūre Horticultural Experimental Station (Latvian: Pūres dārzkopības…

In mid-April 2025, we took an exciting step toward our vision of a Latvian craft cider brewery by purchasing several Antonovka apple trees and other varieties from the renowned Pūre Horticultural Experimental Station (Latvian: Pūres dārzkopības…

Week 6 / Doing Nothing, Gaining 1.98%: A Covered Call Strategy That Pays

| | 71 seen

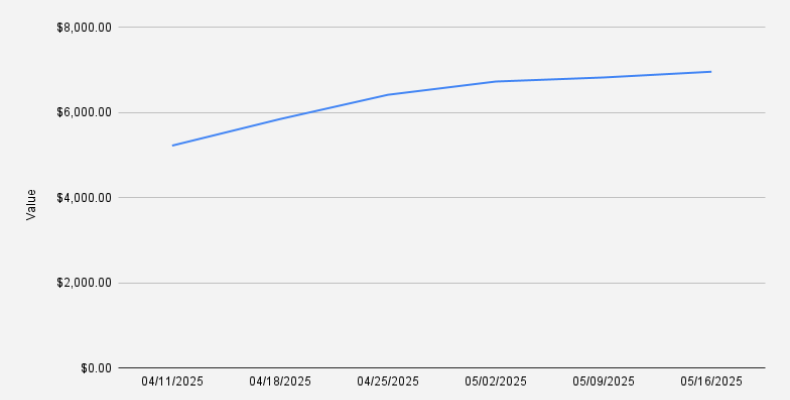

In the world of trading, action often feels like progress. Placing new trades, adjusting positions, chasing setups—these behaviors can give us the illusion of control. But sometimes, the most profitable move is to simply do nothing.As of May 16,…

In the world of trading, action often feels like progress. Placing new trades, adjusting positions, chasing setups—these behaviors can give us the illusion of control. But sometimes, the most profitable move is to simply do nothing.As of May 16,…

Samshvilde Canyon Hiking

| Living in Georgia | 58 seen

Our go-to hiking spot in Georgia has always been Birtvisi Canyon. With its striking rock formations, narrow passages, and unbeatable views, it’s a place we return to again and again. But last Sunday, we felt like trying something new.So we picked a…

Our go-to hiking spot in Georgia has always been Birtvisi Canyon. With its striking rock formations, narrow passages, and unbeatable views, it’s a place we return to again and again. But last Sunday, we felt like trying something new.So we picked a…

Week 5 / NVDA Rally Forces Covered Call Adjustment: Rolling Up and Out for a Credit

| | 65 seen

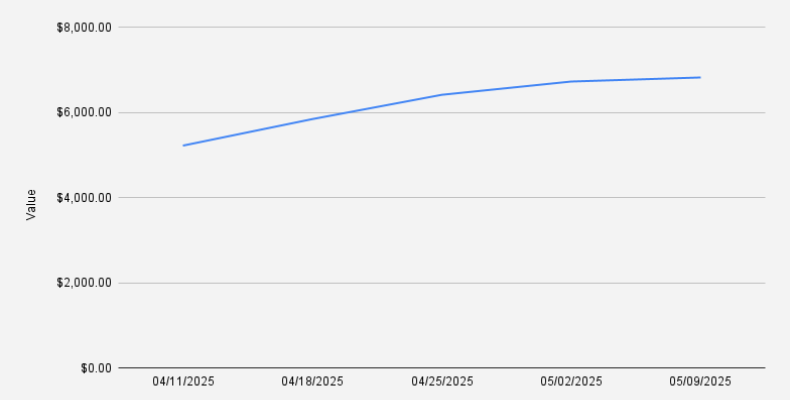

As of May 9, 2025, our covered call stock portfolio was valued at $6,818, reflecting another 1.42% week-over-week gain (+$95.42). Despite the recent uptick, we remain down -9.63% year-to-date.Currently, the entire covered call portfolio is…

As of May 9, 2025, our covered call stock portfolio was valued at $6,818, reflecting another 1.42% week-over-week gain (+$95.42). Despite the recent uptick, we remain down -9.63% year-to-date.Currently, the entire covered call portfolio is…

How I Upgraded XTRF on Ubuntu with PostgreSQL 14 (and Fixed Every Broken Dependency)

| Servers | 59 seen

Upgrading an XTRF instance—especially one that has aged alongside older OS and database stacks—is never a walk in the park. In this article, I’ll walk you through the real-world path I took, upgrading from Ubuntu 18.04 all the way to 22.04, aligning…

Upgrading an XTRF instance—especially one that has aged alongside older OS and database stacks—is never a walk in the park. In this article, I’ll walk you through the real-world path I took, upgrading from Ubuntu 18.04 all the way to 22.04, aligning…

David Baazov Museum of History of the Jews of Georgia and Georgian-Jewish Relations

| Museums | 100 seen

Tbilisi is a city full of hidden corners, rich history, and quiet treasures, one of which I recently discovered: the David Baazov Museum of History of the Jews of Georgia and Georgian-Jewish Relations.Over the years, I've gradually learned that…

Tbilisi is a city full of hidden corners, rich history, and quiet treasures, one of which I recently discovered: the David Baazov Museum of History of the Jews of Georgia and Georgian-Jewish Relations.Over the years, I've gradually learned that…

Week 4 / NVDA Covered Call Strategy: Earning $83 This Week To Pay of Margin Debt

| | 56 seen

As of May 2, 2025, our covered call stock portfolio was valued at $6,722, reflecting another strong 4.85% week-over-week gain. However, we still remain down -11.61% year-to-date. Our covered call portfolio at the moment is centered around NVDA…

As of May 2, 2025, our covered call stock portfolio was valued at $6,722, reflecting another strong 4.85% week-over-week gain. However, we still remain down -11.61% year-to-date. Our covered call portfolio at the moment is centered around NVDA…

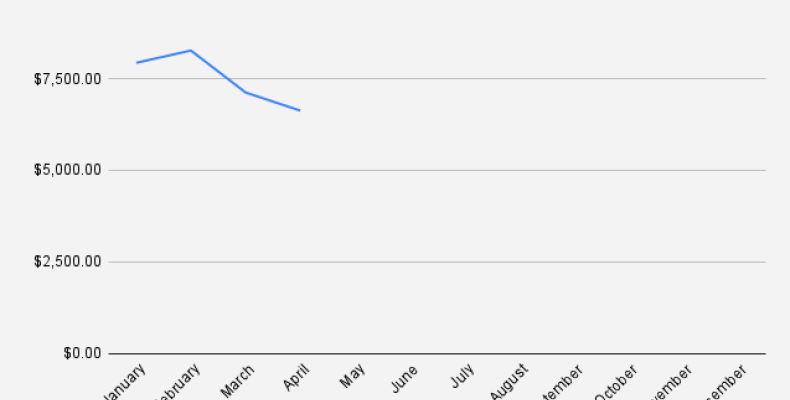

April 2025 Stock Portfolio Update ($6,629)

| Stock Portfolio | 40 seen

At the end of April 2025, the total value of our stock portfolio stood at $6,629 (€6,594), down from $7,124 a month earlier. That’s a -6.94% decrease in portfolio value, or -$495 in dollar terms.Yes, it stings — ouch — but it’s also part of a larger…

At the end of April 2025, the total value of our stock portfolio stood at $6,629 (€6,594), down from $7,124 a month earlier. That’s a -6.94% decrease in portfolio value, or -$495 in dollar terms.Yes, it stings — ouch — but it’s also part of a larger…