Blog Archive: June 2025

Week 12 / AI-Fueled NVDA Surge Lifts Portfolio +2.59% This week —But Is a Pullback Near?

| | 34 seen

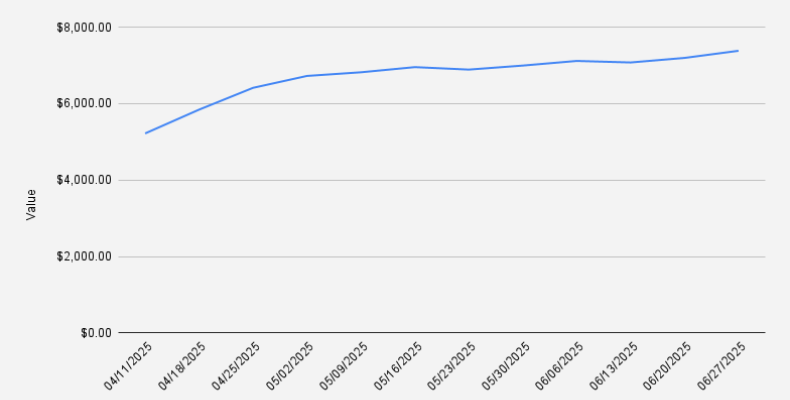

As of June 27, 2025, our covered call stock portfolio stood at $7,380, another g+2.59% week-over-week increase (+$186). Year-to-date, we are still down -5.50%.This week, we collected $46 from selling options, what is under with our goal to…

As of June 27, 2025, our covered call stock portfolio stood at $7,380, another g+2.59% week-over-week increase (+$186). Year-to-date, we are still down -5.50%.This week, we collected $46 from selling options, what is under with our goal to…

Week 11 / Beating the 1% Weekly Goal: How We Collected $101 in Options Premiums

| | 153 seen

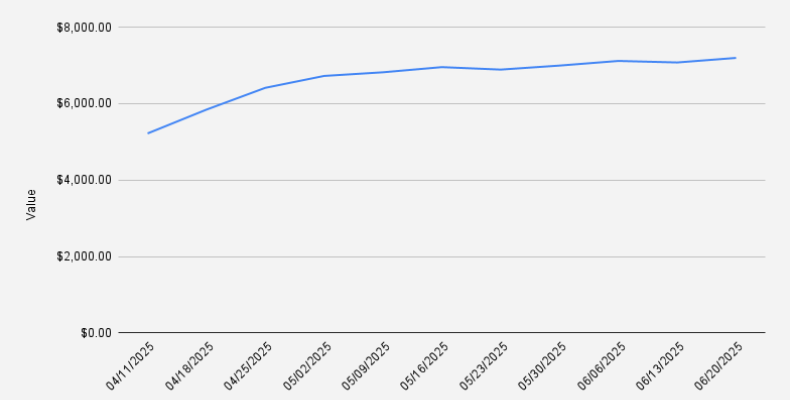

As of June 20, 2025, our covered call stock portfolio stood at $7,194, a small but important +1.68% week-over-week increase (+$119). Year-to-date, we are still down -6.18%.This week, we collected $101 from selling options, aligning with our goal to…

As of June 20, 2025, our covered call stock portfolio stood at $7,194, a small but important +1.68% week-over-week increase (+$119). Year-to-date, we are still down -6.18%.This week, we collected $101 from selling options, aligning with our goal to…

Week 10 / NVDA Weekly Option Trades: $67 Earned, $3,200 Unrealized Profit at Risk

| | 58 seen

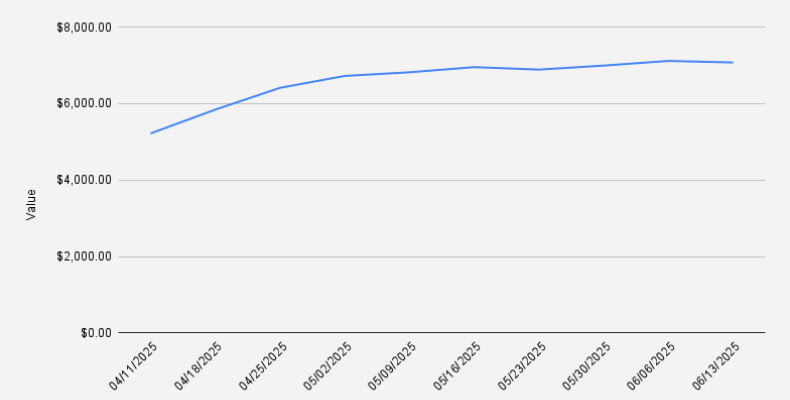

As of June 13, 2025, our covered call stock portfolio stood at $7,074, a minor -0.56% week-over-week decrease (-$39). Year-to-date, we are still down -7.85%, as we continue to navigate market volatility while optimizing our options income strategy.…

As of June 13, 2025, our covered call stock portfolio stood at $7,074, a minor -0.56% week-over-week decrease (-$39). Year-to-date, we are still down -7.85%, as we continue to navigate market volatility while optimizing our options income strategy.…

Israel & Cyprus 2025

| Travel guides | 50 seen

At the beginning of May 2025, we embarked on a 4-day trip to Israel to reconnect with the Fischer family. We explored beautiful beaches, savored delicious local cuisine, and enjoyed quality time together. From Tel Aviv, we continued our journey…

At the beginning of May 2025, we embarked on a 4-day trip to Israel to reconnect with the Fischer family. We explored beautiful beaches, savored delicious local cuisine, and enjoyed quality time together. From Tel Aviv, we continued our journey…

12 Rounds Boxing Club in Tbilisi

| Living in Georgia | 232 seen

Sometimes even the most loyal gym-goers need to shake things up—and that's exactly what I did this month. After years of training at the "luxurious Axis Tower gym", I decided to take a short break. Not because I had any complaints about the quality…

Sometimes even the most loyal gym-goers need to shake things up—and that's exactly what I did this month. After years of training at the "luxurious Axis Tower gym", I decided to take a short break. Not because I had any complaints about the quality…

Week 9 / Credit Spread Lessons: When Premiums Look Juicy but Risk Bites Back

| | 76 seen

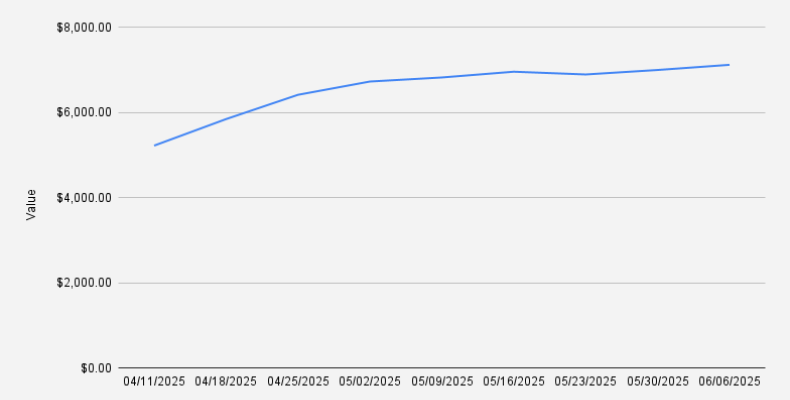

As of June 6, 2025, our covered call stock portfolio stood at $7,114, reflecting a +1.50% week-over-week increase (+$121). Year-to-date, we are still down -6.57%, as we continue to navigate market volatility while optimizing our options income…

As of June 6, 2025, our covered call stock portfolio stood at $7,114, reflecting a +1.50% week-over-week increase (+$121). Year-to-date, we are still down -6.57%, as we continue to navigate market volatility while optimizing our options income…

Spring Break in Latvia 2025

| Travel guides | 41 seen

Every year, it’s become a beloved tradition for us to head to Latvia during the Easter school holidays—our special spring break getaway. This isn’t just any vacation; it’s a hands-on family adventure packed with progress, nature, and unforgettable…

Every year, it’s become a beloved tradition for us to head to Latvia during the Easter school holidays—our special spring break getaway. This isn’t just any vacation; it’s a hands-on family adventure packed with progress, nature, and unforgettable…