Blog Archive: September 2025

Week 25 / NVDA Covered Call, BMY Spread Risk, UBER Spread, MCD Added

| | 35 seen

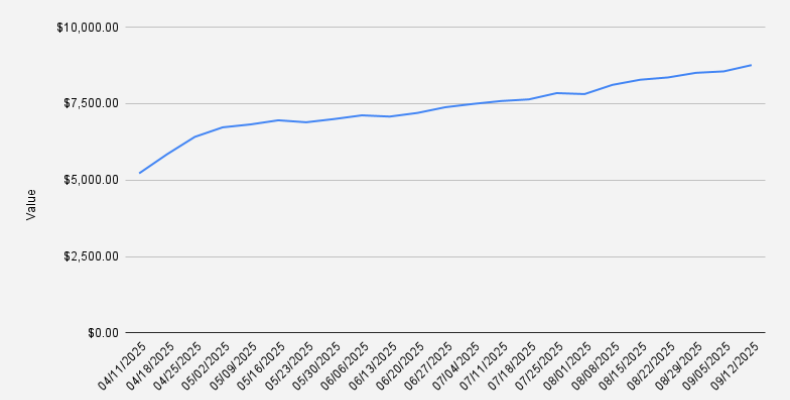

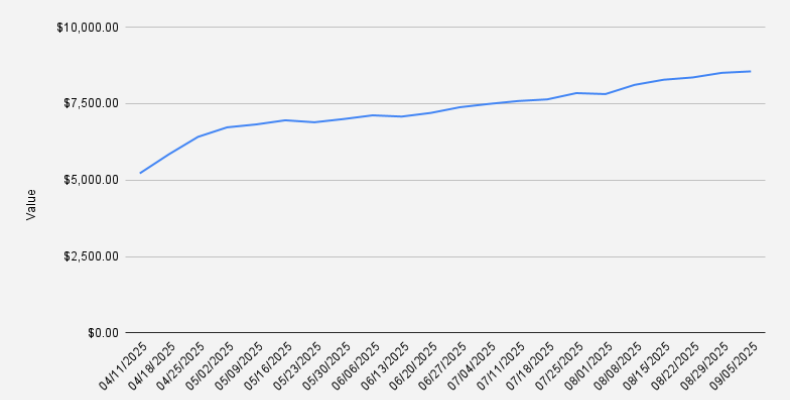

As of September 26, 2025, our covered call stock portfolio has reached $8,807, slightly decreasing by -0.58% (-$50). Year-to-date, the portfolio is up +12.75%. Technically, last week’s drop might be attributed to USD/EUR exchange rate fluctuations,…

As of September 26, 2025, our covered call stock portfolio has reached $8,807, slightly decreasing by -0.58% (-$50). Year-to-date, the portfolio is up +12.75%. Technically, last week’s drop might be attributed to USD/EUR exchange rate fluctuations,…

How To incorporate an LLC in Wyoming for a Crypto Hedge Fund

| Doing Business | 52 seen

When setting up Terramatris, our crypto hedge fund, one of the earliest strategic decisions we faced was choosing the right jurisdiction for incorporation. After weighing options like the Cayman Islands, British Virgin Islands or Panama, we…

When setting up Terramatris, our crypto hedge fund, one of the earliest strategic decisions we faced was choosing the right jurisdiction for incorporation. After weighing options like the Cayman Islands, British Virgin Islands or Panama, we…

Chateau Ateni. Gori

| Living in Georgia | 24 seen

This time (May 2025), our journey takes us to Gori and the enchanting Chateau Ateni - a hidden gem where authentic Georgian cuisine blends seamlessly with avant-garde natural wines, soulful traditional dance, and even the charming surprise of a…

This time (May 2025), our journey takes us to Gori and the enchanting Chateau Ateni - a hidden gem where authentic Georgian cuisine blends seamlessly with avant-garde natural wines, soulful traditional dance, and even the charming surprise of a…

Week 24 / BMY & NVDA Rolls Pay Off; Portfolio +1.15% This Week

| | 30 seen

As of September 19, 2025, our covered call stock portfolio has reached $8,858, marking another weekly gain of +1.15% (+$105). Year-to-date, the portfolio is up +12.39%. Technically, we’re slightly underperforming the S&P 500 (+13.31%), but I’m…

As of September 19, 2025, our covered call stock portfolio has reached $8,858, marking another weekly gain of +1.15% (+$105). Year-to-date, the portfolio is up +12.39%. Technically, we’re slightly underperforming the S&P 500 (+13.31%), but I’m…

Birthday in Thessaloniki, Greece

| Travel guides | 40 seen

Turning 40 is a milestone worth celebrating in style, and what better way than in Thessaloniki — a city that seamlessly blends history, culture, and cuisine. From affordable flights and boutique stays to seafood feasts and hidden beaches, our…

Turning 40 is a milestone worth celebrating in style, and what better way than in Thessaloniki — a city that seamlessly blends history, culture, and cuisine. From affordable flights and boutique stays to seafood feasts and hidden beaches, our…

Week 23 / BMY Roll & NVDA Rally: Covered Call Portfolio Update

| | 44 seen

Greetings from Kakheti’s Alazani Valley! This weekend we came here to enjoy the beauty of the region and to host a small office party with Caulingo, where I sometimes work when I’m not focused on fund operations at Terramatris or managing our…

Greetings from Kakheti’s Alazani Valley! This weekend we came here to enjoy the beauty of the region and to host a small office party with Caulingo, where I sometimes work when I’m not focused on fund operations at Terramatris or managing our…

Week 22 / Options Income Report: 1.25% Weekly ROI From NVDA & BMY Trades

| | 91 seen

As of September 5, 2025 ,our covered call stock portfolio stood at $8,552, what is another weekly increase of +0.56% (+$47). While Year-to-date, our portfolio is +8.41%. Awesome! For the record, our portfolio is influenced by EUR/USD…

As of September 5, 2025 ,our covered call stock portfolio stood at $8,552, what is another weekly increase of +0.56% (+$47). While Year-to-date, our portfolio is +8.41%. Awesome! For the record, our portfolio is influenced by EUR/USD…

Azeula Fortress, Tbilisi Sea, and Ateni Sioni

| Travel guides | 44 seen

August ended with yet another packed and memorable weekend in Georgia. This time, our journey took us from the hills near Kojori to the refreshing waters of the Tbilisi Sea, and finally to the historical town of Gori, where we enjoyed a hearty…

August ended with yet another packed and memorable weekend in Georgia. This time, our journey took us from the hills near Kojori to the refreshing waters of the Tbilisi Sea, and finally to the historical town of Gori, where we enjoyed a hearty…