Blog Archive: December 2025

Why I Don’t Like Selling Credit Spreads Without Owning the Underlying Asset

| Options trading | 88 seen

Credit spreads are popular for a reason. They look elegant on paper: defined risk, high probability, steady income. I trade them myself - regularly. But over the years, one conviction has become very clear to me: I do not like selling credit…

Credit spreads are popular for a reason. They look elegant on paper: defined risk, high probability, steady income. I trade them myself - regularly. But over the years, one conviction has become very clear to me: I do not like selling credit…

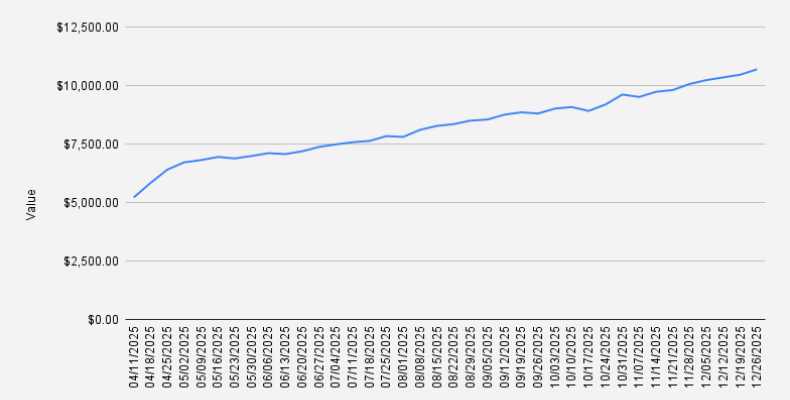

Week 38 / Road to $25K: Closing 2025 Above $10K with Covered Calls and NVDA

| | 133 seen

Greetings from India. This holiday season we’re in South Goa, staying near Palolem Beach — our third year in a row returning here. With temperatures above 30 °C and Kingfisher beer under $2 per bottle, the place is hard to beat. With a portfolio our…

Greetings from India. This holiday season we’re in South Goa, staying near Palolem Beach — our third year in a row returning here. With temperatures above 30 °C and Kingfisher beer under $2 per bottle, the place is hard to beat. With a portfolio our…

Chhatrapati Shivaji Maharaj (Mumbai) International Airport

| Airports | 100 seen

Chhatrapati Shivaji Maharaj International Airport is the international airport serving Mumbai, the capital of the Indian state of Maharashtra. It is the second-busiest airport in India in terms of total and international passenger traffic after…

Chhatrapati Shivaji Maharaj International Airport is the international airport serving Mumbai, the capital of the Indian state of Maharashtra. It is the second-busiest airport in India in terms of total and international passenger traffic after…

Gateway of India, Mumbai

| Travel guides | 33 seen

I first visited the Gateway of India at the end of December 2025, during our three-week trip to India. We spent only a few short days in Mumbai, and this stop was not planned in any deep or academic way. We arrived from The Lalit Hotel by Uber —…

I first visited the Gateway of India at the end of December 2025, during our three-week trip to India. We spent only a few short days in Mumbai, and this stop was not planned in any deep or academic way. We arrived from The Lalit Hotel by Uber —…

Road to a $25,000 Stock Portfolio with Options Trading

| Options trading | 122 seen

With the new year of 2026 fast approaching, I’ve decided to start another challenge.This one is deliberately smaller than my previous ambitions of building a $100K or even a $1M portfolio. Not because those goals are impossible, but because this…

With the new year of 2026 fast approaching, I’ve decided to start another challenge.This one is deliberately smaller than my previous ambitions of building a $100K or even a $1M portfolio. Not because those goals are impossible, but because this…

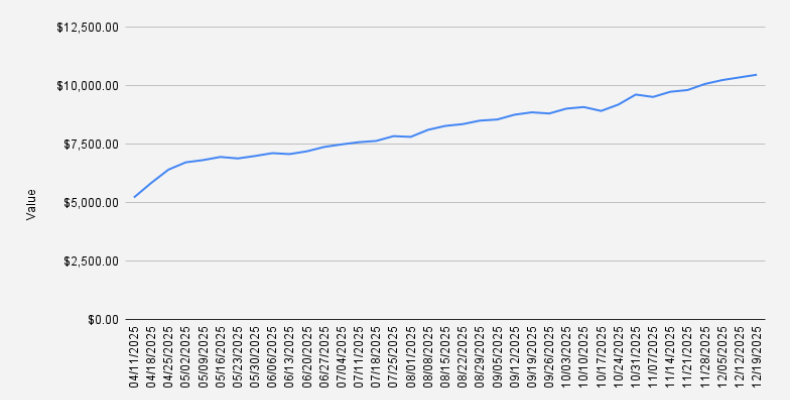

Week 37 / NVDA & BMY: Portfolio Up +1.11% as We Head from Tbilisi to India

| | 120 seen

As of December 19, 2025, our covered-call stock portfolio has grown by an additional 1.11% and reached $10,465. It’s genuinely exciting to be above $10K for the fourth week in a row. I was expecting to fall under $10K this week as volatility kicked…

As of December 19, 2025, our covered-call stock portfolio has grown by an additional 1.11% and reached $10,465. It’s genuinely exciting to be above $10K for the fourth week in a row. I was expecting to fall under $10K this week as volatility kicked…

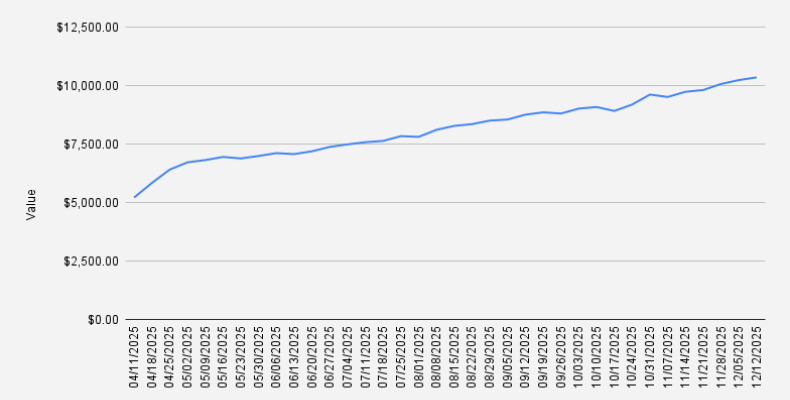

Week 36 / Defensive Roll on SHELL, New NVDA Weekly Spread

| | 116 seen

As of December 12, 2025, our covered-call stock portfolio has grown by an additional 1.12% and reached $10,350. It’s genuinely exciting to be above $10K for the third week in a row.Still, I’ve been in the stock market too long to rule out a possible…

As of December 12, 2025, our covered-call stock portfolio has grown by an additional 1.12% and reached $10,350. It’s genuinely exciting to be above $10K for the third week in a row.Still, I’ve been in the stock market too long to rule out a possible…

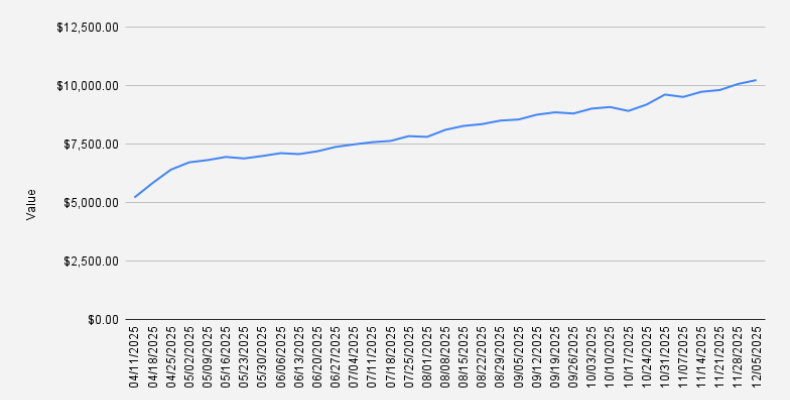

Week 35 / NVDA Spreads + McDonald’s Buys: Covered-Call Portfolio Hits $10,235

| | 158 seen

As of December 5, 2025, our covered-call stock portfolio has grown by an additional 1.65% and reached $10,235. It’s genuinely exciting to be above $10K for the second week in a row.Still, I’ve been in the stock market too long to rule out a possible…

As of December 5, 2025, our covered-call stock portfolio has grown by an additional 1.65% and reached $10,235. It’s genuinely exciting to be above $10K for the second week in a row.Still, I’ve been in the stock market too long to rule out a possible…

Mziuri Tennis Club in Tbilisi

| Living in Georgia | 55 seen

Our family has been attending Mziuri Tennis Club in Tbilisi since September 2025, after several recommendations from our BIST community. We signed up our 7-year-old for the junior program, which costs 300 GEL per month. After a few months of regular…

Our family has been attending Mziuri Tennis Club in Tbilisi since September 2025, after several recommendations from our BIST community. We signed up our 7-year-old for the junior program, which costs 300 GEL per month. After a few months of regular…