Blog Archive: November 2025

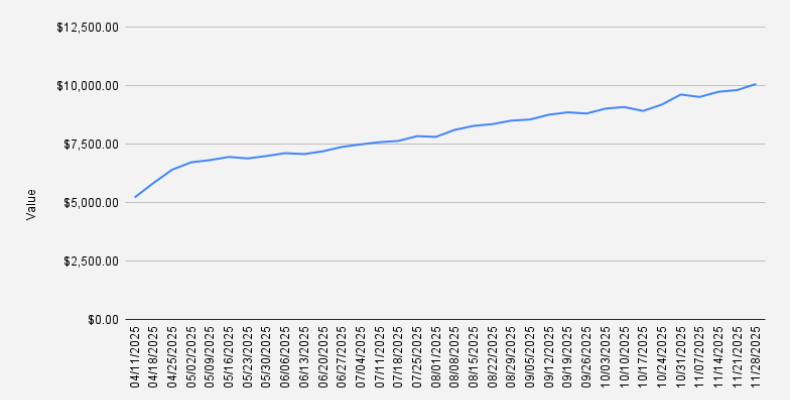

Week 34 / Covered Call Portfolio Breaks $10K and Beats the S&P 500

| | 112 seen

As of November 28, 2025, our covered-call stock portfolio has surpassed the $10K milestone for the first time, closing at $10,069 — a weekly gain of +2.64% (+$269 versus last week). We reached the $10K mark a few weeks earlier than expected.As…

As of November 28, 2025, our covered-call stock portfolio has surpassed the $10K milestone for the first time, closing at $10,069 — a weekly gain of +2.64% (+$269 versus last week). We reached the $10K mark a few weeks earlier than expected.As…

Week 33 / How We Earned $166 in Options Premium This Week with NVDA and BMY Credit Spreads

| | 158 seen

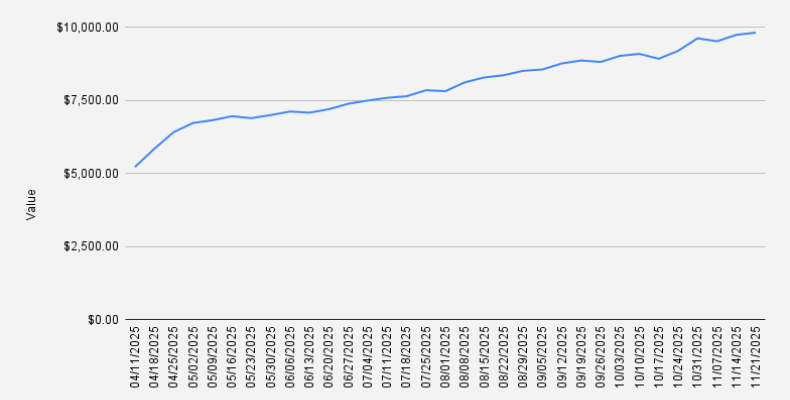

As of November 21, 2025, our covered call stock portfolio has slightly increased to $9,810, what is another minor weekly increase of +0.77% (+$74 if compared to the previous week. $10,000 feels so close. With disciplined risk management, we…

As of November 21, 2025, our covered call stock portfolio has slightly increased to $9,810, what is another minor weekly increase of +0.77% (+$74 if compared to the previous week. $10,000 feels so close. With disciplined risk management, we…

Week 32 / Weekly NVDA Options Income: $75 in Premiums and a 2.32% Portfolio Rise to $9,735

| | 155 seen

As of November 14, 2025, our covered call stock portfolio has slightly increased to to $9,735, what is a minor increase of +2.32% (+$220 if compared to the previous week. $10,000 feels within reach. With disciplined risk management, we should be…

As of November 14, 2025, our covered call stock portfolio has slightly increased to to $9,735, what is a minor increase of +2.32% (+$220 if compared to the previous week. $10,000 feels within reach. With disciplined risk management, we should be…

Week 31 / NVDA Dip Trims Covered-Call Portfolio to $9,514

| | 97 seen

As of November 7, 2025, our covered call stock portfolio has slightly dipped to to $9,514, what is a minor decrease of -1.07% (+$102 if compared to the previous week. The dip is mainly due to the retracement in NVDA’s price and our need to adjust…

As of November 7, 2025, our covered call stock portfolio has slightly dipped to to $9,514, what is a minor decrease of -1.07% (+$102 if compared to the previous week. The dip is mainly due to the retracement in NVDA’s price and our need to adjust…

Building a Deribit Options Scanner with Python and Streamlit

| Servers | 127 seen

I’m still amazed at how capable ChatGPT has become - it’s honestly wild. Today I spent several hours refining and deploying a fully functional Deribit Options Scanner, and the results exceeded my expectations.This project is originally built for the…

I’m still amazed at how capable ChatGPT has become - it’s honestly wild. Today I spent several hours refining and deploying a fully functional Deribit Options Scanner, and the results exceeded my expectations.This project is originally built for the…