Blog Archive: January 2026

Week 43: Boring but Profitable — BMY Credit Spread Brings in $65 Options Premium

| | 49 seen

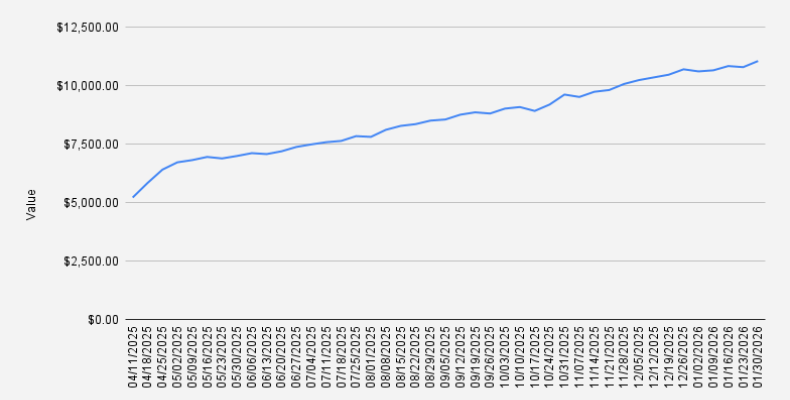

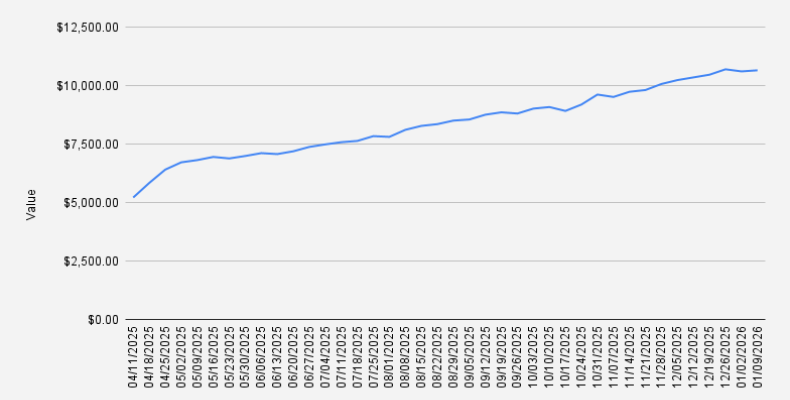

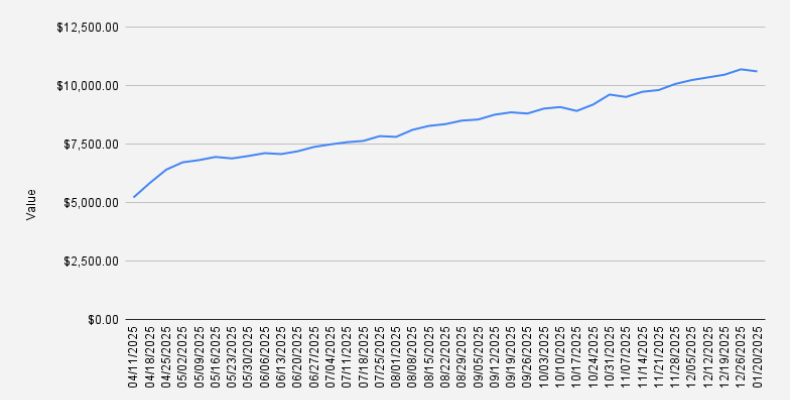

As of January 30, 2026, our covered-call stock portfolio has once again increased by +2.43% and closed at $11,050. For the first time, we’ve cracked the $11K milestone. Awesome. Interestingly, we kept activity minimal this week the only…

As of January 30, 2026, our covered-call stock portfolio has once again increased by +2.43% and closed at $11,050. For the first time, we’ve cracked the $11K milestone. Awesome. Interestingly, we kept activity minimal this week the only…

How the NVDA Strategy Became the Backbone of Our Stock Portfolio

| Stock Portfolio | 37 seen

The NVDA strategy didn’t start as a master plan. It emerged out of necessity.About a year ago (2025), after the DeepSeek-related volatility shock that briefly crushed NVDA and other AI names, our stock portfolio was under pressure. I was using…

The NVDA strategy didn’t start as a master plan. It emerged out of necessity.About a year ago (2025), after the DeepSeek-related volatility shock that briefly crushed NVDA and other AI names, our stock portfolio was under pressure. I was using…

Bots, Rewards, and TerraM: Unexpected Signals from DeFi Liquidity

| Crypto | 30 seen

I minted 10,000 TerraM tokens back in 2022 with a very simple idea: raise $10,000 and trade Ethereum options. The plan was straightforward - tokenized participation, transparent backing, real trading activity. In practice, the initial capital raise…

I minted 10,000 TerraM tokens back in 2022 with a very simple idea: raise $10,000 and trade Ethereum options. The plan was straightforward - tokenized participation, transparent backing, real trading activity. In practice, the initial capital raise…

Hiking to Turtle Lake: A Winter Trail in Tbilisi

| Living in Georgia | 91 seen

Last Sunday we did a hiking trip to Turtle Lake, starting from the stairs on Polikarpe Kakabadze street. I’ve been a big fan of hiking in Tbilisi for a long time. More than ten years ago, we used to do hiking trips almost every weekend, something I’…

Last Sunday we did a hiking trip to Turtle Lake, starting from the stairs on Polikarpe Kakabadze street. I’ve been a big fan of hiking in Tbilisi for a long time. More than ten years ago, we used to do hiking trips almost every weekend, something I’…

How to Borrow Against Solana on Bybit to Boost Covered Call Income

| Crypto | 42 seen

On September 4, 2025, we launched the Solana Covered Call Growth Fund at Terramatris. The fund’s objective is to grow our SOL holdings primarily through selling covered calls, with most initial positions entered via cash-secured puts.Although the…

On September 4, 2025, we launched the Solana Covered Call Growth Fund at Terramatris. The fund’s objective is to grow our SOL holdings primarily through selling covered calls, with most initial positions entered via cash-secured puts.Although the…

Week 42 / $107 Options Income From Rolling NVDA Credit Spreads During the Greenland Shock

| | 87 seen

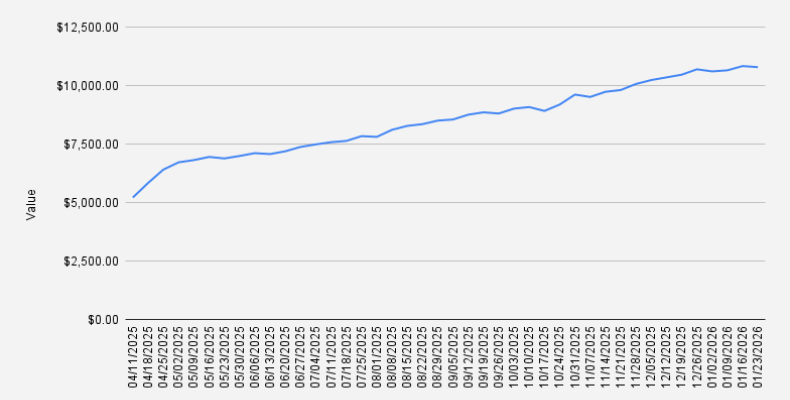

As of January 23, 2026, our covered-call stock portfolio has dipped slightly by -0.43% and closed at $10,788.The previous week was highly turbulent. As the market opened on Tuesday, NVDA briefly dipped below my call strike levels. Given the elevated…

As of January 23, 2026, our covered-call stock portfolio has dipped slightly by -0.43% and closed at $10,788.The previous week was highly turbulent. As the market opened on Tuesday, NVDA briefly dipped below my call strike levels. Given the elevated…

Week 41 / NVDA Credit Spread Strategy: 0.43% Weekly Return if Expires Worthless

| | 72 seen

Greetings from Tbilisi. After more than three weeks in India, we are finally back—welcomed by temperatures below 0°C and already missing Goa and its +31°C.Last week, we also held our annual office party (Caucasus Translations) at Babilo Music Hall,…

Greetings from Tbilisi. After more than three weeks in India, we are finally back—welcomed by temperatures below 0°C and already missing Goa and its +31°C.Last week, we also held our annual office party (Caucasus Translations) at Babilo Music Hall,…

TerraM 52‑Week Saving Challenge: Commitment, Liquidity, and Skin in the Game

| Investments | 41 seen

I have attempted the classic 52‑week saving challenge several times over the years. I tried it with cash, mutual funds, and even speculative assets like meme coins. Results were mixed. Sometimes the discipline worked, sometimes it failed - …

I have attempted the classic 52‑week saving challenge several times over the years. I tried it with cash, mutual funds, and even speculative assets like meme coins. Results were mixed. Sometimes the discipline worked, sometimes it failed - …

Week 40 / NVDA Strategy, $65 Premium Income, and Margin Reduction

| | 58 seen

Greetings from Mumbai, India. For the past three years, we’ve spent our winter holidays in India, usually traveling to Goa via New Delhi. This time, however, we arrived and departed through Mumbai and had a few days to explore the city. I’m…

Greetings from Mumbai, India. For the past three years, we’ve spent our winter holidays in India, usually traveling to Goa via New Delhi. This time, however, we arrived and departed through Mumbai and had a few days to explore the city. I’m…

Exploring Crypto Spread Trades With India: Lessons From the Kimchi Premium

| Investments | 92 seen

The idea of regional crypto arbitrage isn’t new. The most famous example remains the Kimchi Premium — a persistent price gap where Bitcoin and stablecoins traded at a premium on Korean exchanges due to capital controls, retail demand, and limited…

The idea of regional crypto arbitrage isn’t new. The most famous example remains the Kimchi Premium — a persistent price gap where Bitcoin and stablecoins traded at a premium on Korean exchanges due to capital controls, retail demand, and limited…

Week 39 / Road to $25K: Rolled Up and Forward NVDA Covered Call, Adjusted Credit Spread

| | 116 seen

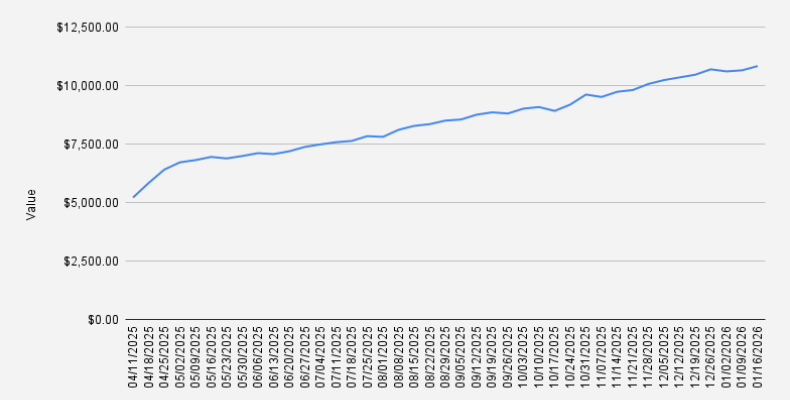

Greetings from South Goa, Palolem Beach, India. I hope you had a great New Year’s party - we certainly did.As of January 2, 2026, our covered-call stock portfolio has decreased slightly by -0.84% and closed at $10,607. For the sake of transparency,…

Greetings from South Goa, Palolem Beach, India. I hope you had a great New Year’s party - we certainly did.As of January 2, 2026, our covered-call stock portfolio has decreased slightly by -0.84% and closed at $10,607. For the sake of transparency,…