Exploring Crypto Spread Trades With India: Lessons From the Kimchi Premium

| Investments | 83 seen

The idea of regional crypto arbitrage isn’t new. The most famous example remains the Kimchi Premium — a persistent price gap where Bitcoin and stablecoins traded at a premium on Korean exchanges due to capital controls, retail demand, and limited outbound liquidity.

India occasionally shows similar characteristics. During a recent vacation in Palolem Beach, Goa, I found myself regularly exchanging USD to INR at beach shack money changers. That on-the-ground exposure, combined with crypto P2P observations, sparked an idea worth examining — even if it ultimately proves impractical at scale.

The Observed SpreadWhat caught my attention was a USDT price discrepancy (as of January 2026)

Bybit P2P: USDT selling around ₹94…

Week 39 / Road to $25K: Rolled Up and Forward NVDA Covered Call, Adjusted Credit Spread

| | 104 seen

Greetings from South Goa, Palolem Beach, India. I hope you had a great New Year’s party - we certainly did.

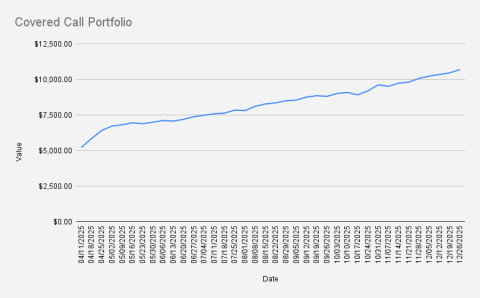

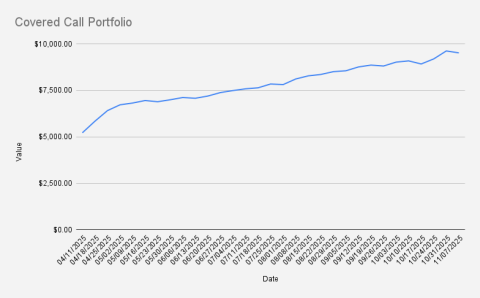

As of January 2, 2026, our covered-call stock portfolio has decreased slightly by -0.84% and closed at $10,607. For the sake of transparency, it’s worth noting that the slight decline is due to USD/EUR exchange rate movements. The U.S. dollar appreciated modestly against the euro, which reduced the total value when expressed in EUR and back.

This marks the first options week of 2026; however, all position adjustments were made back in 2025.

One of our short- to medium-term goals is to grow the portfolio to $25k using options trading alone. With a systematic approach — and some persistence (plus a bit of luck) — reaching that level in 2–3 years is realistic. See: Road to a $25,000 Stock Portfolio with Options Trading.

Options trades:This week, we adjusted our NVDA covered call, rolling the April $115 strike out to June while slightly increasing the strike to $116. We’ve been in this position since March 2025.

At the start of the week, I also adjusted our NVDA bull put credit spread, rolling it down and forward to next week’s…

Why I Don’t Like Selling Credit Spreads Without Owning the Underlying Asset

| Options trading | 85 seen

Credit spreads are popular for a reason. They look elegant on paper: defined risk, high probability, steady income. I trade them myself - regularly. But over the years, one conviction has become very clear to me: I do not like selling credit spreads (or iron condors) on assets I’m not willing to own.

This is not a theoretical opinion. It comes from real trades, real stress, and real tail-risk events.

A few years ago, I was actively trading 0 DTE SPX options.

Was it fun? Absolutely. Was it exciting? Without question. Was it powerful? That’s where things get murky.

0 DTE strategies feel surgical and sophisticated. You can stack small wins, day after day. But with time, I realized something uncomfortable: I could not clearly explain whether the strategy had a durable edge or whether I was simply harvesting volatility until the market decided otherwise.

SPX is cash-settled. No assignment. No ownership. No plan B. When you’re wrong, you’re just wrong. That experience planted the first seed of doubt about premium selling without an ownership fallback.

I had a similar experience trading options on…

Week 38 / Road to $25K: Closing 2025 Above $10K with Covered Calls and NVDA

| | 129 seen

Greetings from India. This holiday season we’re in South Goa, staying near Palolem Beach — our third year in a row returning here. With temperatures above 30 °C and Kingfisher beer under $2 per bottle, the place is hard to beat. With a portfolio our size, one could comfortably enjoy life here living off options income alone.

That said,

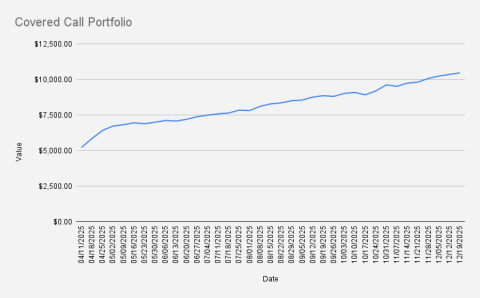

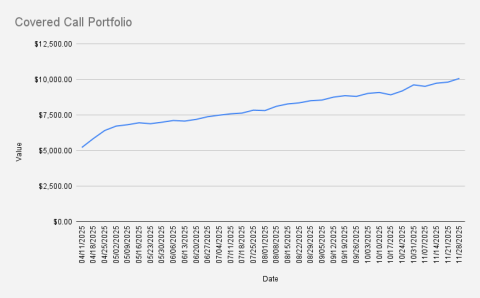

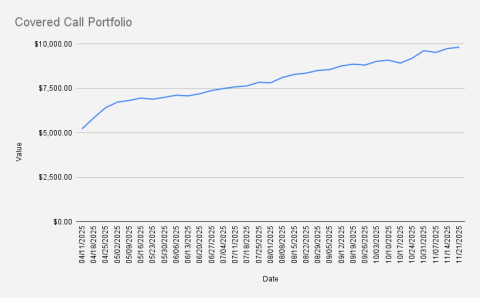

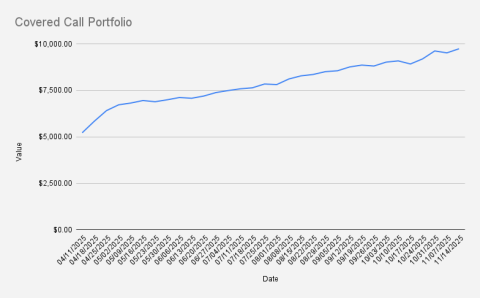

As of December 26, 2025, our covered-call stock portfolio has grown by an additional 2.21% and reached $10,696. As this is the final options expiry Friday of the year, I’m pleased to be closing 2025 with the portfolio above $10k.

One of our short- to medium-term goals is to grow the portfolio to $25k using options trading alone. With a systematic approach — and some persistence (plus a bit of luck) — reaching that level in 2–3 years is realistic. See: Road to a $25,000 Stock Portfolio with Options Trading.

With $10,696 on the books, we’re already 42.78% of the way there.

Before diving into this week’s options trades, I want to compare our performance against the S&P 500 and our anchor stock, NVDA.

Year to date, we’re up 35.82%, outperforming the S&P 500 by a wide margin (+18.09…

Chhatrapati Shivaji Maharaj (Mumbai) International Airport

| Airports | 95 seen

Chhatrapati Shivaji Maharaj International Airport is the international airport serving Mumbai, the capital of the Indian state of Maharashtra. It is the second-busiest airport in India in terms of total and international passenger traffic after Delhi, the 14th-busiest airport in Asia, and the 31st-busiest airport in the world by passenger traffic in 2024.

I first arrived at Mumbai’s Chhatrapati Shivaji Maharaj International Airport at the end of December 2025, flying IndiGo from Tbilisi. We stayed a few days in Mumbai before continuing onward to Goa with Air India.

Mumbai’s airport has a long history. It was originally built in 1942 during World War II and has since evolved into India’s second-busiest airport. The modern Terminal 2 (T2)—used for most international flights and some domestic ones—opened in 2014, replacing the older international terminal.

In recent years, CSMIA has handled around 45–52 million passengers annually (pre- and post-COVID recovery range), serving as a critical hub for both international traffic and domestic connections. Mumbai offers some of the best onward flight connectivity in India,…

Gateway of India, Mumbai

| Travel guides | 29 seen

I first visited the Gateway of India at the end of December 2025, during our three-week trip to India. We spent only a few short days in Mumbai, and this stop was not planned in any deep or academic way. We arrived from The Lalit Hotel by Uber — roughly a 28 km drive, costing under 700 Indian rupees. At that point, I had only a vague idea of what the place was, and almost no sense of its symbolic weight.

At first glance, it felt like another grand colonial monument by the sea. Busy, touristy, loud. But things changed quickly.

After taking a private boat trip from the harbor — the kind that locals casually offer — and seeing Mumbai’s waterfront from the water, the perspective shifted. Approaching the city from the Arabian Sea makes the Gateway feel less like a monument and more like a threshold. Reading the inscription on the arch, standing beneath the basalt structure, there was a strangely strong energy to the place — layered, unresolved.

Only later did I fully connect the historical dots. That made the feeling stronger, not weaker.

The Gateway of India…

Road to a $25,000 Stock Portfolio with Options Trading

| Options trading | 116 seen

With the new year of 2026 fast approaching, I’ve decided to start another challenge.

This one is deliberately smaller than my previous ambitions of building a $100K or even a $1M portfolio. Not because those goals are impossible, but because this time I want something more contained, measurable, and—hopefully—easier to execute with discipline.

By the way, I should clarify one thing. I first reached a $25,000 net worth back in 2019.

Nevertheless, my current net worth is well above $25,000. The challenge here is not about net worth in general, but specifically about building a $25,000 stock portfolio. At the moment, my stock portfolio is still below that level, which is why this goal remains relevant and worth pursuing.

The target: a $25,000 stock portfolio built primarily through options trading.

I’m starting this challenge at the end of 2025 with a stock portfolio valued at $10,450. That already represents 41.86% of the $25K goal, so the gap is meaningful but not extreme.

The timeline I’m aiming for is 2–3 years.

Could this be achieved in a single year? Technically, yes. Practically, doubling the portfolio in 2026…

Week 37 / NVDA & BMY: Portfolio Up +1.11% as We Head from Tbilisi to India

| | 118 seen

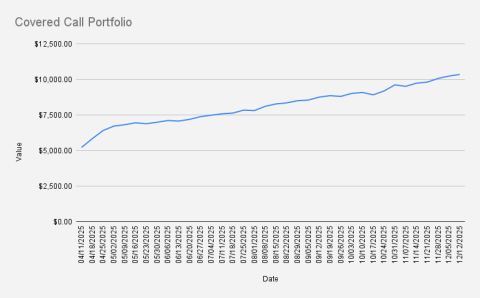

As of December 19, 2025, our covered-call stock portfolio has grown by an additional 1.11% and reached $10,465. It’s genuinely exciting to be above $10K for the fourth week in a row. I was expecting to fall under $10K this week as volatility kicked in, but the result is better than expected.

Year-to-date, we’re up 33.73%, outperforming the S&P 500 by a wide margin (+16.26%). With just one calendar week left in the year, it looks like this is shaping up to be one of the best-performing years for the stock market in recent memory.

Besides activities in financial markets, 0ur kiddo wrapped up Term 1 today, and we enjoyed a lovely Christmas concert at her school in Tbilisi - just before we head to Mumbai and Goa, India, for the next three weeks.

During the week, as volatility picked up, I rolled the NVDA credit spread out and down. While today, I opened a new BMY credit spread and used part of the credit received to buy one additional share for our dividend stock portfolio—a small but meaningful contribution.

Current positions

…Week 36 / Defensive Roll on SHELL, New NVDA Weekly Spread

| | 111 seen

As of December 12, 2025, our covered-call stock portfolio has grown by an additional 1.12% and reached $10,350. It’s genuinely exciting to be above $10K for the third week in a row.

Still, I’ve been in the stock market too long to rule out a possible pullback in the upcoming weeks.

Year-to-date, we’re up 27.64%, outperforming the S&P 500 by a wide margin (+17.18%).

As usual, we made no major moves throughout the week. Except I decided to roll our position in European SHELL stock down and out, buying back the 31 puts expiring on December 19, 2025 and selling new puts expiring on February 17, 2026. This adjustment brought in a small additional credit of EUR 7, while improving our downside protection by roughly EUR 200. As long as SHELL trades above 29, we should be fine.

Looking at the 50- and 200-day moving averages, the EUR 29 level appears to be a solid support area. Let’s see how well it holds over a longer time frame, though.

As our previous NVDA credit spread expired worthless, and today we opened a new weekly NVDA credit spread. I also used a small portion of the options premium to buy an additional 0.1…

Week 35 / NVDA Spreads + McDonald’s Buys: Covered-Call Portfolio Hits $10,235

| | 156 seen

As of December 5, 2025, our covered-call stock portfolio has grown by an additional 1.65% and reached $10,235. It’s genuinely exciting to be above $10K for the second week in a row.

Still, I’ve been in the stock market too long to rule out a possible pullback in the upcoming weeks.

Year-to-date, we’re up 31.87%, outperforming the S&P 500 by a wide margin (+17.41%).

As usual, we made no major moves throughout the week. At the start of the week, we bought 0.1 share of MCD - we have a tradition of buying 0.1 McDonald’s whenever the kiddo talks us into junk food. I’ll admit we ordered McD more than once this week, but 0.1 share is still a decent addition, and we now hold 3.9 MCD shares in our dividend stock portfolio.

During the week, I also tried to figure out whether a McDonald’s stock split could be on the table. From what I can tell, it’s unlikely in the near future. And while the stock should remain a solid, steady name, it’s probably not where we should expect dramatic price growth - so I’m treating this mostly as a side investment.

Our previous NVDA credit spread expired worthless, and today we opened a new…

Mziuri Tennis Club in Tbilisi

| Living in Georgia | 54 seen

Our family has been attending Mziuri Tennis Club in Tbilisi since September 2025, after several recommendations from our BIST community. We signed up our 7-year-old for the junior program, which costs 300 GEL per month. After a few months of regular training, here’s an honest, practical review.

Mizuri Tennis Club is located in Vake, on Nino Ramishvili Street, right next to Mziuri Park and directly opposite the police station.

The most important part: our daughter genuinely likes it. She looks forward to every session, which, for any parent, is the biggest indicator that the environment is good. The coaches work well with kids, balancing discipline with fun. There are several trainers available, and from what we’ve seen, they keep the groups active and engaged.

During the warmer months, classes take place on the outdoor courts. In winter, the club sets up a large inflated dome so training continues indoors without interruption. The setup is simple but effective — warm enough, dry, and perfectly…

Week 34 / Covered Call Portfolio Breaks $10K and Beats the S&P 500

| | 108 seen

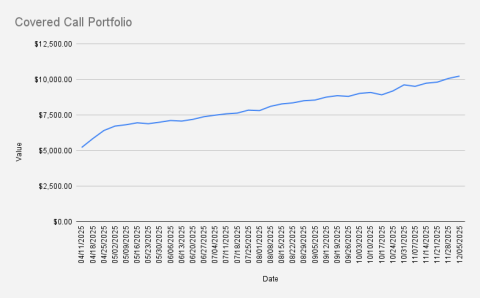

As of November 28, 2025, our covered-call stock portfolio has surpassed the $10K milestone for the first time, closing at $10,069 — a weekly gain of +2.64% (+$269 versus last week). We reached the $10K mark a few weeks earlier than expected.

As seasoned put sellers, we remain cautious and do not rule out a potential pullback in the coming weeks. Favorable EUR/USD exchange rate movements also contributed a small boost to the portfolio’s performance. Good progress overall.

Additionally, at the office in Tbilisi today, we lit the Christmas tree and are officially ready for the holiday season.

Year-to-date, we’re up 29.94%, outperforming the S&P 500 by a wide margin (+16%).

As usual, we made no major moves throughout the week. Our previous NVDA credit spread expired worthless, and today we opened a new weekly NVDA credit spread. I also used a small portion of the options premium to buy an additional 0.1 NVDA share for the portfolio.

Current positions

- NVDA DEC 5, 2025 165/155 Bull Put Credit Spread

- 2X BMY DEC 19,…

Week 33 / How We Earned $166 in Options Premium This Week with NVDA and BMY Credit Spreads

| | 153 seen

As of November 21, 2025, our covered call stock portfolio has slightly increased to $9,810, what is another minor weekly increase of +0.77% (+$74 if compared to the previous week. $10,000 feels so close. With disciplined risk management, we should be able to hit it by year-end — a solid springboard for 2026.

That said, our stock portfolio is performing significantly better than our crypto fund, which dropped 40% this week and is now more than 70% below its all-time high from just a few weeks ago. Surprisingly, but our NVDA-heavy covered-call portfolio continues to perform well.

As usual, most of the week we made no major moves in the portfolio. We followed NVDA’s earnings report and were prepared to roll our credit spread, but no adjustment was needed. Today we opened a new weekly NVDA credit spread. We also opened another BMY bull put credit spread with a December expiry, collecting enough premium to purchase additional BMY shares. This adds to the dividend portfolio — we now hold 5 BMY shares, all acquired using income from selling puts on the stock itself.

Current positions

- NVDA NOV…

Week 32 / Weekly NVDA Options Income: $75 in Premiums and a 2.32% Portfolio Rise to $9,735

| | 154 seen

As of November 14, 2025, our covered call stock portfolio has slightly increased to to $9,735, what is a minor increase of +2.32% (+$220 if compared to the previous week. $10,000 feels within reach. With disciplined risk management, we should be able to hit it by year-end — a solid springboard for 2026.

Surprisingly, our NVDA-heavy covered-call portfolio continues to perform well. Its steady premium income and reduced directional exposure contrast sharply with the crypto hedge fund, which has already dropped more than 50% from its September peak.

Most of the week went into building Python-powered machine learning bots for our options trading operations at Terramatris.

I keep saying I’m a bit exhausted from trading NVDA week after week, yet once again I kept credit spreads in the arsenal and sold another weekly spread, collecting a solid premium.

Current positions

- NVDA NOV 21, 2025 170/160 Bull Put Credit Spread

- 2X BMY NOV 21, 2025 43.5/38 Bull Put Credit spread

- SHELL DEC 19, 2025 31/28 Bull Put Credit Spread

- NVDA APR 17, 2026 $115 Covered Call

One of…

Week 31 / NVDA Dip Trims Covered-Call Portfolio to $9,514

| | 96 seen

As of November 7, 2025, our covered call stock portfolio has slightly dipped to to $9,514, what is a minor decrease of -1.07% (+$102 if compared to the previous week. The dip is mainly due to the retracement in NVDA’s price and our need to adjust the bull put credit spread on it this Friday.

Most of the week was quite slow and uneventful — which is usually a good thing. The exception was Friday, when NVDA briefly dipped below 180. I rolled our 185/175 credit spread to next week’s expiry.

Frankly, NVDA is starting to look oversold to me. I’m considering taking a break from it, as I wouldn’t rule out a deeper correction — and since we’re trading on margin, that could get costly. Depending on how things go next week, I might step away from NVDA weeklies and look for something a bit less volatile.

Current positions

- NVDA NOV 14, 2025 180/170 Bull Put Credit Spread

- 2X BMY NOV 21, 2025 43.5/38 Bull Put Credit spread

- SHELL DEC 19, 2025 31/28 Bull Put Credit Spread

- NVDA APR 17, 2026 $115 Covered Call

One of the primary goals of our covered call stock portfolio is to…

Latest video

Hiking to Turtle Lake: A Winter Trail in Tbilisi

Last Sunday we did a hiking trip to Turtle Lake, starting from the stairs on Polikarpe Kakabadze street. I’ve been a big fan of hiking in Tbilisi for a long time. More than ten years ago, we used to do hiking trips almost every weekend, something I’ve written about on the blog many times. Back then it was routine.Last chance workout on the trails…

Tsikhisdziri & Batumi Botanical Garden

After returning from our amazing trip to Thessaloniki, we decided to extend our holiday a bit longer — this time in beautiful Tsikhisdziri. Huge thanks to Eto for kindly offering her cozy apartments at Bambo Beach, where we enjoyed a full week of relaxation by the sea.During our stay, we explored local gems like Shukura Tsikhisdziri (შუქურა…

Summer in Latvia 2025

Summer in Latvia movie is out - Join us on our July (2025) journey through Latvia: installing a bathtub in our countryside cottage, setting up a pop-up store at Bangotnes, celebrating a birthday in Vērbeļnieki, traveling via Riga to Jaunpiebalga, Vecpiebalga, Smiltene, and Valka. From sipping sparkling wine with swallows to running 4K morning…Living in Georgia

Tbilisi ETH Hackathon: Finally Making It (and Mostly Drinking Beer)

I first noticed ETH Chipmunks toward the end of 2025. They kept popping up on my radar via Luma links Ethereum meetups, hackathons, small community events in Tbilisi. I applied several times. Each time, something got postponed, rescheduled…

Mziuri Tennis Club in Tbilisi

Our family has been attending Mziuri Tennis Club in Tbilisi since September 2025, after several recommendations from our BIST community. We signed up our 7-year-old for the junior program, which costs 300 GEL per month. After a few months…

12 Rounds Boxing Club in Tbilisi

Sometimes even the most loyal gym-goers need to shake things up—and that's exactly what I did this month. After years of training at the "luxurious Axis Tower gym", I decided to take a short break. Not because I had any complaints about…

Tbilisi Circus: A Historic Landmark with a Surprising Past

Tbilisi Circus is an iconic part of the city's cultural landscape. Having lived in Georgia since 2011, I have passed by the Tbilisi Circus almost every day. However, it wasn’t until I attended a show that I truly appreciated its grandeur…

Piece of Life

Postcards from Marseille

It’s been nearly two years since our last trip to Marseille, a sun-drenched jewel on France’s southern coast that left an indelible mark on our memories. That summer of 2023, we set out to explore the city’s vibrant beaches and winding old town, arriving and departing through the bustling hub of Marseille St. Charles train station. As I sit…

Christmas Eve at Palolem Beach: Fire Shows, Old Monk

While we just celebrated Orthodox Christmas in Georgia, I can’t help but delve into the memories of our Western Christmas last year (2024), spent on the serene shores of Palolem Beach in Goa, India. That evening was magical in every way, filled with vibrant energy, beautiful scenery, and a new discovery that made the night unforgettable.Palolem…

A Family Guide to Borjomi: Hiking Trails and Sulfur Bath Tips

As summer came to a close, we continued our family's tradition of visiting Borjomi. This year marked yet another memorable trip at the end of August 2024, reaffirming our love for this beautiful Georgian town. Visiting Borjomi at least twice a year has become a cherished routine, a piece of life that we look forward to, blending relaxation,…

Hotel Reviews

Stays & Trails La Maison Hotel Review in Panaji

At the tail end of 2024, just before catching our flight back to Delhi, we decided to book a one-night stay at Stays & Trails La Maison Fontainhas in Panaji, Goa. After weeks staying in Palolem beach, we wanted to wrap up our trip with…

Schuchmann Wines Château: A Long-Awaited Stay in Georgia’s Premier Winery Hotel & Spa

It took us over a decade to finally make it to Schuchmann Wines Château & Spa, and it was well worth the wait! We’ve spent years recommending this stunning winery hotel to visiting friends and business partners, yet somehow, we had…

Hotel Belvedere Prague: A Practical Stay with Easy Access

During our recent trip to Prague in mid-October 2024, we stayed at Hotel Belvedere. My partner attended the MEET Central Europe Translators conference, and we were joined by one of our office employees, so we opted to book two rooms. …

Review: Art Hotel Prague – A Cozy Stay in a Tranquil Part of Prague

During our recent trip to Prague in October 2024, we opted for a one-night stay at the Art Hotel Prague. We arrived at the hotel via Bolt taxi from Václav Havel Airport, which was straightforward and efficient. At about EUR 120 per room…

Toursim objects

Plage des Catalans: A Shrinking Memory in Marseille

Plage des Catalans, a sandy crescent tucked along Marseille’s coastline, holds a special place in my travel tapestry. I first visited this beach in the summer of 2003, a carefree stop during my early adventures in the city. Back then, it felt like a haven—close to the bustling port yet offering a slice of Mediterranean calm. When I returned…

Colva Beach: Golden Sands and Tranquility in Goa

Colva Beach, located in South Goa, is known for its expansive golden sands and tranquil atmosphere. Stretching for several kilometers along the Arabian Sea, the beach offers a peaceful escape from the busier tourist hubs in the region. Its wide shoreline, framed by swaying palm trees, provides plenty of space for visitors to relax, stroll, or…

Charles Bridge: A Timeless Landmark in Prague

The Charles Bridge (Karlův most) in Prague is one of the most iconic and historic landmarks in Europe. Built in the 14th century under the reign of King Charles IV, this Gothic stone bridge spans the Vltava River, connecting Prague's Old Town with the Lesser Town (Malá Strana). Adorned with a series of 30 Baroque statues and surrounded by…

Macroeconomics

| GDP Growth in the Baltic States (2016–2025) | |

| Minimum Wages in European Union 2024 | |

| Minimum Wages Set to Increase in Baltic States in 2024 | |

| GDP Per Capita in OECD countries 2022 |

Servers and Drupal

Genealogy

| Baltic German DNA Uncovered: Tracing My Ancestry to the von Anrep Nobility | |

| MyHeritage DNA test result | |

| MyHeritage DNA test, flight to Tbilisi, Stock Recovery |