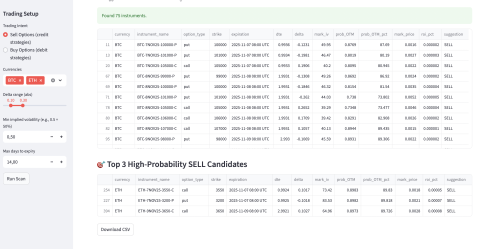

Building a Deribit Options Scanner with Python and Streamlit

| Servers | 124 seen

I’m still amazed at how capable ChatGPT has become - it’s honestly wild. Today I spent several hours refining and deploying a fully functional Deribit Options Scanner, and the results exceeded my expectations.

This project is originally built for the Terramatris crypto hedge fund, but I decided to make it available to everyone interested in crypto options trading. While it’s still an early-stage tool, it’s already turning into something quite powerful.

Architecture and StackThe scanner is hosted on a Linode VPS, behind NGINX for reverse proxy and static serving. The core application is written in Python, using Streamlit for the user interface — a lightweight yet capable framework for building interactive financial dashboards.

Under the hood, the scanner communicates directly with the Deribit API, fetching live data for both BTC and ETH options. It parses the full options chain, structures it for analysis, and displays it in a clear, sortable interface. Everything updates dynamically, giving a…

Week 30 / NVDA, BMY and SHELL Options: $161 Premium, +4.65% Return

| | 128 seen

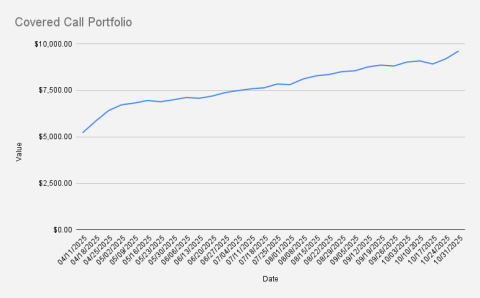

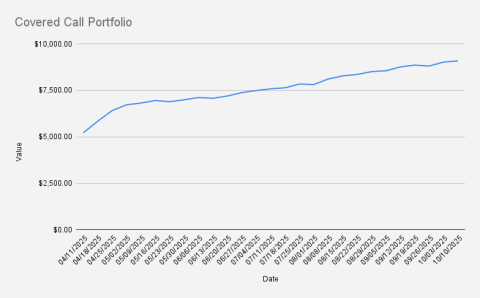

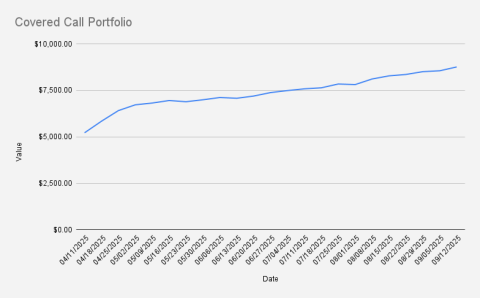

As of October 31, 2025, our covered call stock portfolio has grown to $9,617, what is a significant increase of +4.65% (+$426) if compared to the previous week. The strong performance in our portfolio was driven by a rebound in BMY’s share price and NVDA’s historic breakout above $200, making it the first company ever to surpass a $5 trillion market capitalization. An extraordinary week by any measure.

On a personal note, my mother visited me in Tbilisi, and we enjoyed a few short day trips to David Gareji and Kiketi Farm.

Last week, I rolled BMY options to the $43.50 strike, added a position in Royal Dutch Shell (Amsterdam) to strengthen our euro-denominated exposure, and initiated a new credit spread on NVDA.

Current positions

- NVDA NOV 7, 2025 185/175 Bull Put Credit Spread

- 2X BMY NOV 21, 2025 43.5/38 Bull Put Credit spread

- SHELL DEC 19, 2025 31/28 Bull Put Credit Spread

- NVDA APR 17, 2026 $115 Covered Call

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position…

Week 29 / Tbilisi Silk Road Forum & Weekly Portfolio Update: NVDA Options Roll, McDonald’s Purchase

| | 59 seen

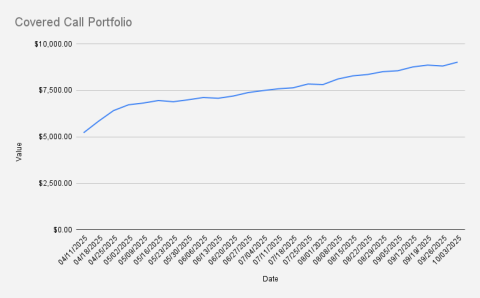

As of October 23, 2025, our covered call stock portfolio has grown to $9,190, what is a significant increase of +3.08% (+$272) if compared to the previous week.

Besides our activities in the equity markets, last week I had the honor of attending the Tbilisi Silk Road Forum. During the event, I had the opportunity to meet the Prime Ministers of Armenia, H.E. Nikol Pashinyan; Georgia, H.E. Irakli Kobakhidze (twice); and Azerbaijan, H.E. Ali Asadov.

Georgia truly is a wonderful place to be. I also had the chance to connect with the Governors of the National Banks of Georgia and Kazakhstan, and to befriend the former Minister of Economy of Armenia, among others.

One of the highlights of the forum was meeting and befriending a chess prodigy who has defeated Garry Kasparov and even played against my fellow Latvian, Mikhail Tal. Options trading and chess share a remarkable resemblance — both require strategy, patience, and precise timing.

Now, turning to the equity markets and derivatives — last week I made a few smaller purchases of McDonald’s and NVDA stock, providing a solid boost to our long-term portfolio. On the…

Tsikhisdziri & Batumi Botanical Garden

| Living in Georgia | 66 seen

After returning from our amazing trip to Thessaloniki, we decided to extend our holiday a bit longer — this time in beautiful Tsikhisdziri. Huge thanks to Eto for kindly offering her cozy apartments at Bambo Beach, where we enjoyed a full week of relaxation by the sea.

During our stay, we explored local gems like Shukura Tsikhisdziri (შუქურა ციხისძირი), savored delicious Georgian food, and took a peaceful stroll through the Batumi Botanical Garden.

The result? A short travel movie that captures the essence of our Tsikhisdziri escape — sun, sea, good food, and great vibes.

Week 28 / NVDA Roll to 180/160; $66 Premium Collected

| | 44 seen

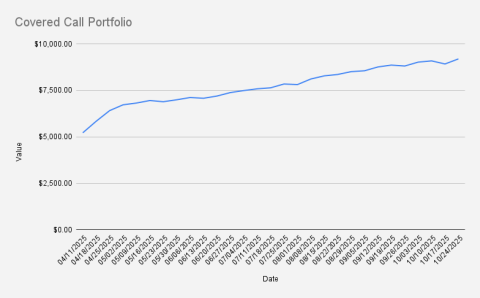

As of October 17, 2025, our covered call stock portfolio has dipped to $8,917, what is a decrease of -1.83% (-$166) if compared to the previous week. In our Terramatris crypto hedge fund, this week has been much rougher, with a sharp drop of more than 20% following the U.S. tariff announcement on China.

Due to increased volatility in the stock market earlier this week, I rolled down and forward our NVDA $182 put to a $180/$160 bull put spread with next week’s expiry, while still collecting a premium of $66. That was the only adjustment made to the portfolio last week.

Current positions

- NVDA Oct 24, 2025 180/160 Bull Put Credit Spread

- 2X BMY Oct 31, 2025 44/41 Bull Put Credit spread

- UBER Oct 24, 2025 89/85 Bull Put Credit Spread

- NVDA APR 17, 2026 $115 Covered Call

One of the primary goals of our covered call stock portfolio is to gradually reduce debt while maintaining a long position of 100 shares in NVDA. Notably, we earned $66 in options premium this week. If we can consistently average that amount, it would…

Unique newsreel footage of the Battle in the Courland Pocket. ‘The Baltic Verdun’ (1944–1945)

| Documentaries | 29 seen

Earlier today, YouTube unexpectedly recommended a Russian-language documentary titled “The Baltic Verdun (1944–1945)”, produced by Frontline Chronicles. The film presents rare archival footage from the Battle in the Courland Pocket, a series of fierce engagements fought in western Latvia during the final months of World War II.

It seems the algorithm did its job remarkably well — because this documentary touches directly on places connected to my own family history. My grandfather, Solomon Fischer (1913–1995) — a Holocaust survivor who later served in the Red Army (1941-1945)— fought in several of the very locations mentioned in the film: Blīdene, Saldus, and nearby areas.

The documentary traces the events across Tukums, Saldus, Priekuli, Liepaja, and other towns, depicting the desperate final battles where German forces were pushed toward the Baltic coast. One striking scene even references soldiers sending water from the Baltic Sea near Tukums to Stalin — a symbolic gesture marking the Red Army’s advance to the sea.

Watching this piece of history was both emotional and illuminating. It’s not just a war story — it’s a glimpse into the harsh realities my…

Week 27 / 12 Years Blogging from Tbilisi: Beating the S&P 500 in 2025

| | 40 seen

Greeting from Tbilisi, Georgia! Today is October 10, and it marks the 12th anniversary of my personal blog — wow, how time flies! For nearly a decade, I was very active in publishing daily content on almost everything: life in Georgia, restaurant reviews, travel experiences around the world, and finance.

Over the past two years, my focus has gradually shifted toward financial topics, with occasional travel posts and regular travel videos. And for the past six months, I’ve been writing exclusively about my covered call adventures with NVDA stock and other trades — a new chapter in my long blogging journey.

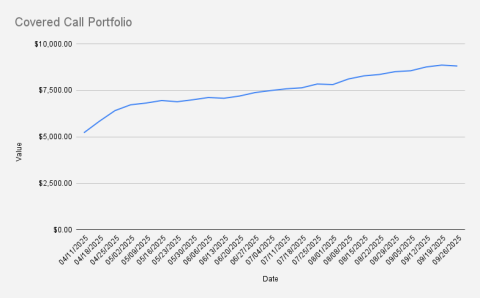

Without further ado, as of October 10, 2025, our covered call stock portfolio has reached $9,083, what is another minor increase of +0.74% (+$66) if compared to the previous week. While YTD, the portfolio is already up by +17.29%.

Wow, what a run it has been so far in 2025 — we’re finally ahead of the S&P 500 (+14.94%) by a few points!

Earlier this week, I rolled down and away a BMY credit spread, effectively lowering our…

Summer in Latvia 2025

| Travel guides | 47 seen

Summer in Latvia movie is out - Join us on our July (2025) journey through Latvia: installing a bathtub in our countryside cottage, setting up a pop-up store at Bangotnes, celebrating a birthday in Vērbeļnieki, traveling via Riga to Jaunpiebalga, Vecpiebalga, Smiltene, and Valka.

From sipping sparkling wine with swallows to running 4K morning runs, and so much more, this film captures the essence of a vibrant Latvian summer. Enjoy the video and thumbs up!

Week 26 / NVDA Covered Call Roll Adds ~$300 in Six Months (Update)

| | 40 seen

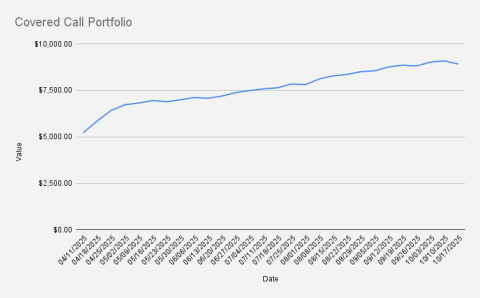

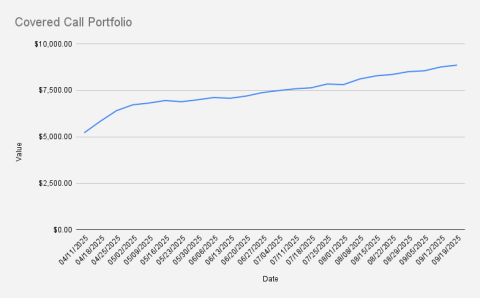

As of October 3, 2025, our covered call stock portfolio has reached $9,017, what is a decent increase of +2.38% (+$209) if compared to the previous week. While YTD, the portfolio is already up by +15.44%. Technically, we’re slightly outperforming the S&P 500 this year. Practically though, wouldn’t it be simpler to just buy and hold the SPY ETF?

On the other hand, I enjoy being in the market every day—generating options premium while steadily growing our dividend stock portfolio. This week alone, we collected $148 from selling options, well above my target of at least 1% in weekly premium, reaching 1.64%

This week I finally rolled up and forward our NVDA covered call, closing the $113 December call and opening a $115 April 26 call. The adjustment is expected to add roughly $300 to the portfolio over the next six months, or about $50 per month.

As NVDA continues breaking milestones, I decided to reinvest part of the income into an additional 0.25 shares of NVDA. While this does increase our margin balance, which I’m working to reduce as quickly as possible - I see it as a worthwhile long-term move.

Now…

Week 25 / NVDA Covered Call, BMY Spread Risk, UBER Spread, MCD Added

| | 35 seen

As of September 26, 2025, our covered call stock portfolio has reached $8,807, slightly decreasing by -0.58% (-$50). Year-to-date, the portfolio is up +12.75%. Technically, last week’s drop might be attributed to USD/EUR exchange rate fluctuations, as our base currency is set to EUR and we are therefore affected by forex movements.

This week, we collected $92 from selling options, what is well above my goal to generate at least 1% weekly in options premium (1.04% this week).

This was a relatively slow week with no major swings, unlike in the Terramatris crypto hedge fund, where we experienced a 17% drop. One troubled trade appears to be the credit spread on BMY, with the price falling below our strike. Since there are still about two weeks until expiry, I will monitor it closely and, if necessary, roll it down and forward, preferably for a credit.

Last week also put some pressure on our MCD shares. In general, I am against buying stocks on margin while we are still paying off debt, but this week I decided it wouldn’t do much harm to add 0.1 MCD shares to the portfolio.…

How To incorporate an LLC in Wyoming for a Crypto Hedge Fund

| Doing Business | 48 seen

When setting up Terramatris, our crypto hedge fund, one of the earliest strategic decisions we faced was choosing the right jurisdiction for incorporation. After weighing options like the Cayman Islands, British Virgin Islands or Panama, we ultimately decided on Wyoming, USA. Here’s why.

Many hedge funds gravitate toward Caribbean jurisdictions because of their established offshore structures and global recognition. However, for Terramatris, Wyoming offered three key advantages:

While Cayman or BVI entities remain popular for large-scale funds, Wyoming proved a better fit for our structure and current operational needs.

Taxation in WyomingWyoming is widely regarded as one of the most tax-friendly states in the U.S. Key points:

- No state corporate income…

Chateau Ateni. Gori

| Living in Georgia | 23 seen

This time (May 2025), our journey takes us to Gori and the enchanting Chateau Ateni - a hidden gem where authentic Georgian cuisine blends seamlessly with avant-garde natural wines, soulful traditional dance, and even the charming surprise of a small chick farm.

What makes this trip extra special is sharing it with our Latvian/Georgian friends, Soso and Ilva, whose warm hospitality turned the visit into a memory to treasure. We stayed in their lovely cottages, cozy retreats surrounded by nature, and had the joy of sipping on their very own pet-nat wine under the Georgian skies.

It was a weekend filled with laughter, storytelling, and the simple pleasures of food, and wine - proof once again that the best adventures are those shared with people you love.

Week 24 / BMY & NVDA Rolls Pay Off; Portfolio +1.15% This Week

| | 30 seen

As of September 19, 2025, our covered call stock portfolio has reached $8,858, marking another weekly gain of +1.15% (+$105). Year-to-date, the portfolio is up +12.39%. Technically, we’re slightly underperforming the S&P 500 (+13.31%), but I’m very satisfied with the progress - the $10K milestone with every week comes closer.

Surprisingly, for most of the week it seemed we would end with a negative return, but it ultimately turned out better than expected.

This week, we collected $162 from selling options, what is well above my goal to generate at least 1% weekly in options premium (1.82% this week).

This was quite a turbulent week for our options trades, and mid-week I rolled out and forward the put spreads on NVDA and BMY.

I rolled the NVDA 172.5 put down to 170 and out to next week’s expiry, while BMY looked more troubled, so I extended it further out to the October 10 expiry, capturing a heftier options premium.

We keep holding one covered call on NVDA with a $113 strike price expiring on December 19…

Birthday in Thessaloniki, Greece

| Travel guides | 39 seen

Turning 40 is a milestone worth celebrating in style, and what better way than in Thessaloniki — a city that seamlessly blends history, culture, and cuisine. From affordable flights and boutique stays to seafood feasts and hidden beaches, our journey turned into an unforgettable week-long adventure.

Getting There: Kutaisi to ThessalonikiOur adventure began in Kutaisi, Georgia, with a direct Wizzair flight to Thessaloniki. Wizzair’s budget-friendly routes made the trip smooth and convenient, a reminder that Europe’s treasures are often closer (and cheaper) than we think. Just a couple of hours in the air, and we landed in the heart of northern Greece — the gateway to the Mediterranean.

Where We Stayed: Boutique Comfort & Local AirbnbFor the first part of the trip, we checked into the charming S Hotel, nestled right in the heart of Thessaloniki’s Old Town. With narrow cobblestone streets, colorful facades, and plenty of history, it was the perfect backdrop for celebrating a big birthday. The boutique hotel offered a cozy yet stylish stay, surrounded by authentic tavernas and lively cafés.

Later, we switched gears and tried a local …

Week 23 / BMY Roll & NVDA Rally: Covered Call Portfolio Update

| | 44 seen

Greetings from Kakheti’s Alazani Valley! This weekend we came here to enjoy the beauty of the region and to host a small office party with Caulingo, where I sometimes work when I’m not focused on fund operations at Terramatris or managing our covered call portfolio.

Jokes aside:

As of September 12, 2025, our covered call stock portfolio has reached $8,757, marking another weekly gain of +2.4% (+$205). Year-to-date, the portfolio is up +12.12%. Technically, we’re slightly underperforming the S&P 500 (+12.365), but I’m very satisfied with the progress - the $10K milestone feels just around the corner.

This week, we collected $122 from selling options, what is slightly above my goal to generate at least 1% weekly in options premium (1.39% this week).

Our portfolio remains concentrated in NVDA stock. This week turned out to be a bounce-back, though at one point we were concerned about adjusting the $162.5 put we had sold last week—until NVDA suddenly surged past $177.

Our position in BMY didn…

Latest video

Hiking to Turtle Lake: A Winter Trail in Tbilisi

Last Sunday we did a hiking trip to Turtle Lake, starting from the stairs on Polikarpe Kakabadze street. I’ve been a big fan of hiking in Tbilisi for a long time. More than ten years ago, we used to do hiking trips almost every weekend, something I’ve written about on the blog many times. Back then it was routine.Last chance workout on the trails…

Tsikhisdziri & Batumi Botanical Garden

After returning from our amazing trip to Thessaloniki, we decided to extend our holiday a bit longer — this time in beautiful Tsikhisdziri. Huge thanks to Eto for kindly offering her cozy apartments at Bambo Beach, where we enjoyed a full week of relaxation by the sea.During our stay, we explored local gems like Shukura Tsikhisdziri (შუქურა…

Summer in Latvia 2025

Summer in Latvia movie is out - Join us on our July (2025) journey through Latvia: installing a bathtub in our countryside cottage, setting up a pop-up store at Bangotnes, celebrating a birthday in Vērbeļnieki, traveling via Riga to Jaunpiebalga, Vecpiebalga, Smiltene, and Valka. From sipping sparkling wine with swallows to running 4K morning…Living in Georgia

Tbilisi ETH Hackathon: Finally Making It (and Mostly Drinking Beer)

I first noticed ETH Chipmunks toward the end of 2025. They kept popping up on my radar via Luma links Ethereum meetups, hackathons, small community events in Tbilisi. I applied several times. Each time, something got postponed, rescheduled…

Mziuri Tennis Club in Tbilisi

Our family has been attending Mziuri Tennis Club in Tbilisi since September 2025, after several recommendations from our BIST community. We signed up our 7-year-old for the junior program, which costs 300 GEL per month. After a few months…

12 Rounds Boxing Club in Tbilisi

Sometimes even the most loyal gym-goers need to shake things up—and that's exactly what I did this month. After years of training at the "luxurious Axis Tower gym", I decided to take a short break. Not because I had any complaints about…

Tbilisi Circus: A Historic Landmark with a Surprising Past

Tbilisi Circus is an iconic part of the city's cultural landscape. Having lived in Georgia since 2011, I have passed by the Tbilisi Circus almost every day. However, it wasn’t until I attended a show that I truly appreciated its grandeur…

Piece of Life

Postcards from Marseille

It’s been nearly two years since our last trip to Marseille, a sun-drenched jewel on France’s southern coast that left an indelible mark on our memories. That summer of 2023, we set out to explore the city’s vibrant beaches and winding old town, arriving and departing through the bustling hub of Marseille St. Charles train station. As I sit…

Christmas Eve at Palolem Beach: Fire Shows, Old Monk

While we just celebrated Orthodox Christmas in Georgia, I can’t help but delve into the memories of our Western Christmas last year (2024), spent on the serene shores of Palolem Beach in Goa, India. That evening was magical in every way, filled with vibrant energy, beautiful scenery, and a new discovery that made the night unforgettable.Palolem…

A Family Guide to Borjomi: Hiking Trails and Sulfur Bath Tips

As summer came to a close, we continued our family's tradition of visiting Borjomi. This year marked yet another memorable trip at the end of August 2024, reaffirming our love for this beautiful Georgian town. Visiting Borjomi at least twice a year has become a cherished routine, a piece of life that we look forward to, blending relaxation,…

Hotel Reviews

Stays & Trails La Maison Hotel Review in Panaji

At the tail end of 2024, just before catching our flight back to Delhi, we decided to book a one-night stay at Stays & Trails La Maison Fontainhas in Panaji, Goa. After weeks staying in Palolem beach, we wanted to wrap up our trip with…

Schuchmann Wines Château: A Long-Awaited Stay in Georgia’s Premier Winery Hotel & Spa

It took us over a decade to finally make it to Schuchmann Wines Château & Spa, and it was well worth the wait! We’ve spent years recommending this stunning winery hotel to visiting friends and business partners, yet somehow, we had…

Hotel Belvedere Prague: A Practical Stay with Easy Access

During our recent trip to Prague in mid-October 2024, we stayed at Hotel Belvedere. My partner attended the MEET Central Europe Translators conference, and we were joined by one of our office employees, so we opted to book two rooms. …

Review: Art Hotel Prague – A Cozy Stay in a Tranquil Part of Prague

During our recent trip to Prague in October 2024, we opted for a one-night stay at the Art Hotel Prague. We arrived at the hotel via Bolt taxi from Václav Havel Airport, which was straightforward and efficient. At about EUR 120 per room…

Toursim objects

Plage des Catalans: A Shrinking Memory in Marseille

Plage des Catalans, a sandy crescent tucked along Marseille’s coastline, holds a special place in my travel tapestry. I first visited this beach in the summer of 2003, a carefree stop during my early adventures in the city. Back then, it felt like a haven—close to the bustling port yet offering a slice of Mediterranean calm. When I returned…

Colva Beach: Golden Sands and Tranquility in Goa

Colva Beach, located in South Goa, is known for its expansive golden sands and tranquil atmosphere. Stretching for several kilometers along the Arabian Sea, the beach offers a peaceful escape from the busier tourist hubs in the region. Its wide shoreline, framed by swaying palm trees, provides plenty of space for visitors to relax, stroll, or…

Charles Bridge: A Timeless Landmark in Prague

The Charles Bridge (Karlův most) in Prague is one of the most iconic and historic landmarks in Europe. Built in the 14th century under the reign of King Charles IV, this Gothic stone bridge spans the Vltava River, connecting Prague's Old Town with the Lesser Town (Malá Strana). Adorned with a series of 30 Baroque statues and surrounded by…

Macroeconomics

| GDP Growth in the Baltic States (2016–2025) | |

| Minimum Wages in European Union 2024 | |

| Minimum Wages Set to Increase in Baltic States in 2024 | |

| GDP Per Capita in OECD countries 2022 |

Servers and Drupal

Genealogy

| Baltic German DNA Uncovered: Tracing My Ancestry to the von Anrep Nobility | |

| MyHeritage DNA test result | |

| MyHeritage DNA test, flight to Tbilisi, Stock Recovery |