Blog Archive: July 2017

Athens International Airport

| Airports | 28 seen

Athens International Airport "Eleftherios Venizelos", commonly initialized as "AIA", began operation on 28 March 2001 and is the primary international airport that serves the city of Athens and the region of Attica.

It is Greece's busiest airport and it serves as the hub and main base of Aegean Airlines as well as other Greek airlines. Athens International is the 28th busiest airport in Europe.

I had a chance to visit Athens airport, during a short connecting flight by Aegean Airlines from Tbilisi to Chania (see: About Tbilisi - Athens - Chania (Greece) flight by Aegean Airlines ) at the start of June 2017.

Athens International Airport

AIA is located between the towns of Markopoulo, Koropi, Spata and Loutsa, about 20 km (12 mi) to the east of central Athens (30 km (19 mi) by road, due to intervening hills). The airport is named after Elefthérios Venizélos, the prominent Cretan political figure and Prime Minister of Greece, who made a significant contribution to the development of Greek aviation and the Hellenic Air Force…

Chania International Airport (Greece)

| Airports | 23 seen

Chania International Airport, "Daskalogiannis" is an international airport located near Souda Bay on the Akrotiri Peninsula of the Greek island of Crete, serving the city of Chania, 14 kilometres (8.7 mi) away.

Moreover, it is a gateway to western Crete for an increasing amount of tourists. The airport is named after Daskalogiannis, a Cretan rebel against Ottoman rule in the 18th century and is a joint civil–military airport. It is the fifth busiest airport in Greece and 8th in Balkan peninsula in terms of passengers. From 2010 to 2016 has a great increase about 100% in passengers arrivals. The airport is connected with many countries (about 30) from Europe and Asia especially in summer season and with flights connections in Greece and Cyprus whole year.

I traveled to Chania with connecting flight through Athens from Tbilisi and back with another connecting flight to Riga via Copenhagen in June 2017. We headed to Crete for about 3 week vacation.

Chania International Airport

The focus on civil aviation for the west of Crete has not always been on the current location. It…

Postcards from Athens

| | 18 seen

Just like in the case of postcards from Istanbul, we had just a few hours to spend in Athens, Greece, between layover flight to Chania (Crete).

Equipped with camera and adventurous spirit we dive in the narrow streets of Athens to discover it's beauty and visit some ancient sites.

Square in Athens

One of our first stops in the city center arriving from Athens airport.

Graffiti in Athens

View towards Athens

From distance Athens seems very similar to Tbilisi, the place from above picture reminded me some scenes from our hiking trips in Tbilisi near Turtle lake. See: Hiking in Tbilisi - Turtle lake (Kus Tba) - Vake Park

Archeological excavations in Athens

Streets of Athens

There is a metro station somewhere around, here I bought a sim card from Vodafone, see Planing a trip to Greece: How to get a Prepaid SIM Card with Internet

Ancient site of Agora

Read more here: Ancient Agora of Athens

Modern architecture in Athens

That said - another city, another postcards from!

Ancient Agora of Athens

| Tourism objects | 19 seen

The Ancient Agora of Classical Athens is the best-known example of an ancient Greek agora, located to the northwest of the Acropolis and bounded on the south by the hill of the Areopagus and on the west by the hill known as the Agoraios Kolonos, also called Market Hill.

It was at the start of June, when I first visited Athens, Greece during a brief layover flight to the island of Crete, see About Tbilisi - Athens - Chania (Greece) flight by Aegean Airlines. We had about 10 hours between our connecting flight, once we left Athens airport we took the metro to the city center and just explored, without any particular goal or something.

We found ourselves visiting Ancient Agora of Athens site, pretty cool right?

View towards Ancient Agora of Athens

After an hour of wanderings around narrow streets of Athens, we finally noticed this place.

Excavations at Athenian Agora

The ancient Athenian agora has been excavated by the American School of Classical Studies at Athens since 1931 under the direction of T. Leslie Shear, Sr. They continue to the present…

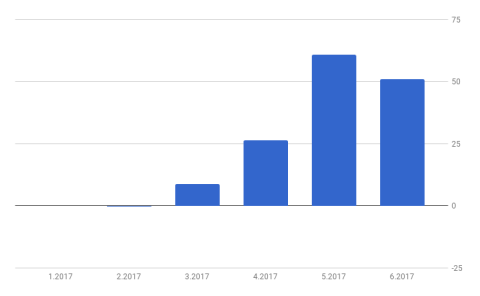

Q2 2017 Online Income Report - $6,116.98

| Blogging | 9 seen

Wow - that was fast, another quarter of year just passed and we are already in the middle of year. Last three months have disappeared as another flicker. Time flies.

Now let' s see how did it go for my online ventures in Q2 2017 (April, May and June).

During past three months I've traveled a lot - in mid May we went for a short trip to Germany (Dortmund area), then after about a week returned to Georgia for a week via Istanbul, Turkey. And in the start of June we fled to Crete, Greece and spent amazing 3 weeks there. That's a lot of countries in just 3 months.

Despite my concerns after Amazon Associates reduced commission fees for select product categories (starting March), last quarter managed to beat first quarter of the year by $154. And here is why - diversification of online income streams. Since the start of 2017 I've launched tour booking platform in Georgia - tourgeorgia.eu and I'm starting to make first earnings from dividend paying stocks and peer to peer lending.

I cover separate series on dividends and peer to peer lending, make sure to check them out also: Dividend…

Dollar-Cost Averaging as part of Cryptocurrency Portfolio

| Crypto | 59 seen

Those of you following my blog in the recent weeks (months) probably have already noticed, since the start of the 2017 I've been building my retirement portfolio from scratch. It has been already more than 6 months since the start of this journey and the great news are following, I'm at 80.27% from this years goal to invest $8,561. (That's roughly about 31% from my annual earnings).

If at the start of year I thought that I will invest in mutual funds, stocks and peer to peer lending, and also I thought that to save $8,561 will be really tough (hard but doable), then now 6 month later I have found that it is quite possible to put some chunk of money from earnings month to month in savings and I'm more than sure that I will save more than $8,561 this year (I'm looking right now to save in total for 2017 $10,000).

Also for my investments I've extended portfolio to cash and crypto currencies.

As I like to think - it's all about finance discipline and smart decisions.

Now, when speaking about smart decisions and investments in crypto currencies, this is the part where I'm very uncertain - right now…

Phidias Lounge Bar in Athens

| Restaurant reviews | 13 seen

Phidias lounge bar in Athens was mine second cafe / restaurant in Greece, as just early in the morning we arrived from Tbilisi to Athens and had a few hours before our connecting flight to Chania, Creete.

We used spare hours and from Athens airport went directly to the city center by metro.

Phidias lounge bar in Athens

Since we hadn't been to Athens before and were kind of limited in time, we decided to visit only things that will be close to our route, that's how we turned out near to the Ancient Agora of Athens site, after wondering around (and not inside) for about 2 hours first cafeteria that crossed our route was Phidias lounge bar.

Just now, when writing these lines and using Google maps to locate this place, I learned that there is actually a hotel Phidias, and lounge bar is just an extension. Maybe next time when going to Athens, it' s good idea to book hotel Phidias, price seems fair - about EUR 90 per night. And a lovely sight towards Ancient Agora of Athens site.

While I was bussy ordering cold frappe, my seat was already taken:

Greek cat

What a lovely mate to enjoy coffee…

How To Track Your CryptoCurrencies Portfolio Automatically Using Google Spreadsheets

| Macroeconomics | 220 seen

It was just recently I made my first investment in cryptocurrencies, I spent EUR 50 to acquire about 0.2 Ethereum. As I bought them for a long term (buy and hold) and actually I'm planning to acquire more coins every month using dollar cost averaging and decided to build a separate Google Spreadsheet to track value changes, gains, or losses.

For support please visit the Terramatris website: Custom Google Spreadsheet Development for Crypto Currency Portfolio Tracking

I see investments in crypto currencies as a great alternative to diversify my portfolio. Right now crypto currencies stand at about 0.8% in my portfolio and I'm looking to increase it to about 5% by the end of 2017.

Update: This article originally was written back in 2017, the formula(s) listed in this article have changed several times. If not working look into the comments section for any help

The idea of the following spreadsheet was inspired from a regular stock tracking sheet, see: Simple Google Spreadsheet to Track Stock Portfolio Changes Using GOOGLEFINANCE

Here is a catch, to get real-time updates in Google…

First Investment In Crypto Currencies - Bought 0.2 ETH for EUR 50

| Crypto | 38 seen

It was in the late evening of July 3d, 2017 when I finally successfully bought my first crypto currency - I paid EUR 50 and get for that - 0.2 ETH. ETH stands for ethereum. Wonder what the heck is that? Don't worry, me neither.

Or let' s say this way - I know there have been bitcoin around for about a decade or something, though I don't see any practical reason for using that, while real money is in power. Right? It was so until about two weeks ago, while sipping freshly squeezed orange juice in rental apartment in Crete, a fellow affiliate marketer contacted me and we started to speak about investments, stocks, peer to peer lending and ... crypto currencies. My buddy told me he is doing some kind of arbitrage day trading stuff with crypto currencies.

As I'm quite opposite - buy and hold investor, and since the start fo 2017 I've been building my wealth portfolio from scratch by investing in stocks and peer to peer lending, idea of having long term investments sounded very appealing to me and I decided to allocate about 5% space in my portfolio for crypto currencies.

Investment Portfolio July 2017

…About Tbilisi - Athens - Chania (Greece) flight by Aegean Airlines

| Travel guides | 8 seen

There is a pretty convenient option when traveling from Tbilisi to the island of Crete (Greece), probably there are some direct charter flights, but at the start of June we opted for a connecting flight Tbilisi - Athens - Chania by Aegean airlines. Bought online tickets about a month prior, and in fact didn't paid too much (about 200 EUR for two persons)

This was the first time for me traveling to Greece, and I quite enjoyed option to spend few hours in Athens and visit some of the Ancient world sites. Really cool.

Now, that said - I've another airline company on my radar, when traveling to or from Georgia. Aegean is is the largest Greek airline by total number of passengers carried, by number of destinations served and by fleet size. A Star Alliance member since June 2010, it operates scheduled and charter services from Athens and Thessaloniki to other major Greek destinations as well as to a number of European and Middle Eastern destinations. Its main hubs are Athens International Airport in Athens, Thessaloniki International Airport in Thessaloniki and Larnaca…

Simple Google Spreadsheet to Track Stock Portfolio Changes Using GOOGLEFINANCE

| Macroeconomics | 338 seen

There is a super simple and easy way to track your stock portfolio with real-time price, cost basis, market value, value gain, even individual stock weight in the portfolio, net yield on cost and current net yield from dividend payouts, and of course total gain values using Google Spreadsheets and GOOGLEFINANCE function.

For support with this Spreadsheet please visit the Terramatris website: Custom Google Spreadsheet Development for Crypto Currency Portfolio Tracking

Currently, I hold 9 stocks in the Baltic equity market (Nasdaq Baltics), I add about one or two new stocks each month, I started simple creating a really simple spreadsheet and manually entering stock data, I like to keep an eye on my stock portfolio few times during the week. For actual stock prices, I'm looking on Nasdaq Baltic's website. Though in my manual spreadsheet pretty much of the rest is automated, still entering the actual stock price is time-consuming and can result in an error.

I decided to try GOOGLEFINANCE function and see if can Google fetch data for the Baltic market. It can.

As…

June 2017 Dividend Income Report - $53.42

| Investments | 15 seen

Welcome to the second (#2) dividend income report, covering earnings I've made from dividend paying stocks and peer to peer lending in June 2017.

I started my wealth building adventure (portfolio) in January 2017 with a simple goal to invest $8,561 this year in several batches. Now, six months latter I'm publishing my second dividend income report.

In this article you will learn both how much I've received in dividend income also I will publish my net worth, with few tables.

Make sure to check out first dividend income report: May 2017 Dividend Income Report - $65.45 and subscribe to the latest dividend income report updates at the end of this article

About Portfolio in June 2017Most of my investments right now are concentrated in the Baltic states and Georgia. My portfolio consists of investments in Georgian Lari and EUR currencies. For the sake of this and all future articles I've converted all final/total currencies to the US dollar, although currently there is no position in my portfolio with direct investments in US dollar.

At the end of June I've…