Week 22 / Options Income Report: 1.25% Weekly ROI From NVDA & BMY Trades

| | 91 seen

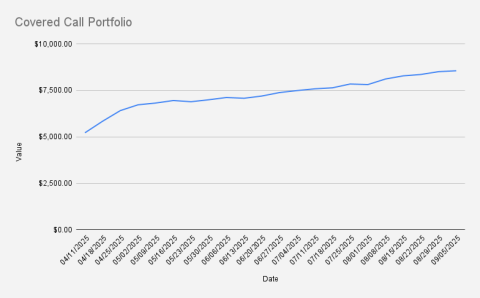

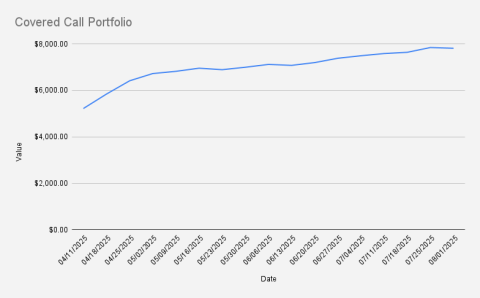

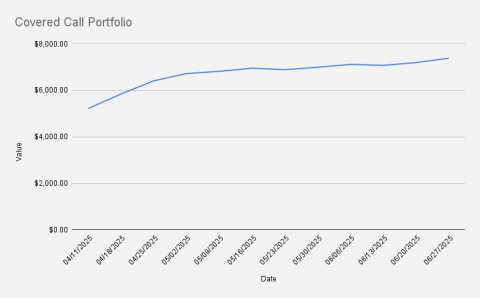

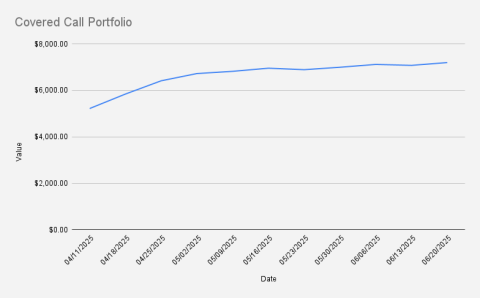

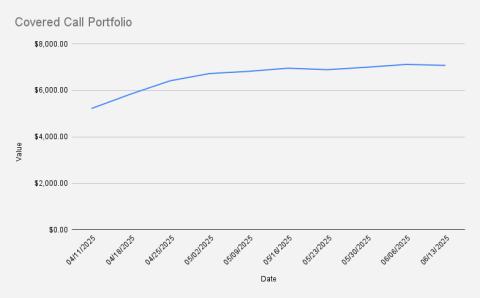

As of September 5, 2025 ,our covered call stock portfolio stood at $8,552, what is another weekly increase of +0.56% (+$47). While Year-to-date, our portfolio is +8.41%. Awesome!

For the record, our portfolio is influenced by EUR/USD exchange rates. If the euro hadn’t been trading at 1.18 against the dollar, our portfolio would actually be down a few dollars. Anyhow, cheers to the EUR/USD exchange rate this week!

This week, we collected $107 from selling options, what is slightly above my goal to generate at least 1% weekly in options premium (1.25% this week).

Our portfolio remains concentrated in NVDA stock, and this week proved to be another volatile one for the tech giant. At the beginning of the week, I rolled down and forward our 165 put.

Meanwhile, our experiment with DOCU stock options turned out positive—those options expired worthless. To boost this week’s options premium, I returned to selling put options on BMY stock. The strategy worked well, and I collected enough cash premium to purchase one share and add it to our long-term portfolio.…

Azeula Fortress, Tbilisi Sea, and Ateni Sioni

| Travel guides | 44 seen

August ended with yet another packed and memorable weekend in Georgia. This time, our journey took us from the hills near Kojori to the refreshing waters of the Tbilisi Sea, and finally to the historical town of Gori, where we enjoyed a hearty Sunday brunch and paid a visit to the ancient Ateni Sioni Church.

I had heard so much about Azeula Fortress (also known as Kojori Fortress) over the years, yet for some reason, I had never actually made the trip. That changed at the end of August, when we finally decided to explore it.

Perched high above Kojori, just a short drive from Tbilisi, the fortress is a fascinating blend of medieval history and natural beauty. The hike up is moderately challenging but completely worth it, with stunning panoramic views of the surrounding mountains and valleys. Walking among the ancient ruins felt like uncovering a long-awaited piece of Georgian history I had always wanted to see for myself.

After exploring Azeula, we headed back home and later in the evening for a cool-down session at the Tbilisi Sea. This large artificial lake, officially called the Tbilisi Reservoir, is a favorite summer…

Week 21 / $98 Premiums, NVDA Volatility, and DOCU Position

| | 56 seen

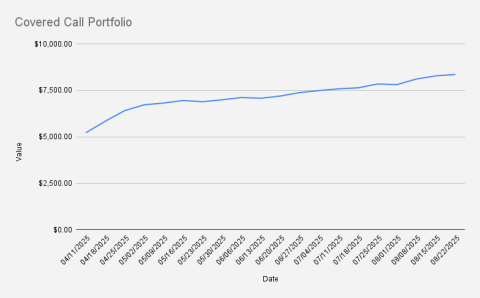

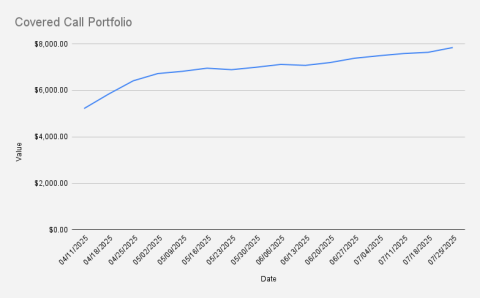

As of August 29, 2025, our covered call stock portfolio stood at $8,504, what is another weekly increase of +1.81% (+$150). While Year-to-date, our portfolio is +8.87%. Awesome!

This week, we collected $98 from selling options, what is slightly above my goal to generate at least 1% weekly in options premium (1.15% this week).

Our portfolio remains concentrated in NVDA stock, and this week proved especially volatile due to NVDA’s earnings report on August 27. Fortunately, all of our options positions expired worthless, allowing us to move forward without setbacks.

In addition, I explored DocuSign this week and decided to take a small position. We initiated a bull put spread to test the waters, while also adding 0.5 shares to our long-term portfolio.

I'm currently holding one covered call on NVDA with a $113 strike price expiring on December 19, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $6,100.

…

Week 20 / Tbilisi Life & NVDA Stock Update: Covered Calls Portfolio +0.9% This Week

| | 127 seen

Greetings from Tbilisi, Georgia! Today, we attended the open afternoon at the British International School of Tbilisi. Our kiddo is already in Year 3—time really flies! For the next academic year, the head teacher will be joining us from Wales. So instead of the usual leprechauns, we’ll now be surrounded by dragons and fairies. And with just a few more weeks left, summer will officially come to an end.

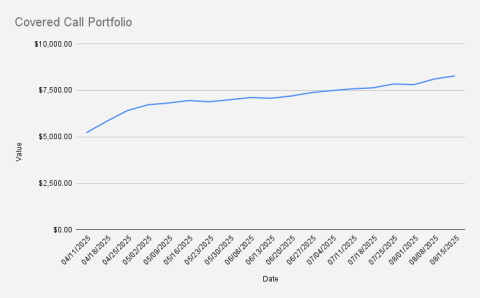

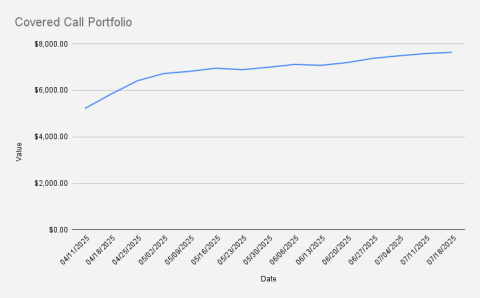

Besides that, this week was quite turbulent for our stock portfolio. With the upcoming earnings report for NVDA scheduled next week, there were noticeable price movements. To stay safe, I decided to roll out and forward positions already in the middle of the week. Nevertheless, the week ended strong, and we locked in some nice weekly gains for the portfolio.

As of August 22, 2025, our covered call stock portfolio stood at $8,353, what is a decent increase of +0.9% if compared to previous week (+$74). While Year-to-date, we our portfolio is +6.94%. Awesome!

This week, we collected $112 from selling options, what is well above my goal to generate at least 1% weekly in options premium (1.34…

Week 19 / $155 from NVDA & UBER Trades, Margin Debt Payoff in Sight

| | 127 seen

Greetings from Tsikhisdziri, Georgia! This week, we decided to extend our holiday with a five-day stay at a friend’s aparthotel on the Black Sea, near Batumi, after returning from Thessaloniki. Life is beautiful.

Besides that, it was another great week for my covered call stock portfolio, with exotic Swedish SEB Bank, Finnish Neste, and BMY put options expiring worthless — bringing me back to trading NVDA options.

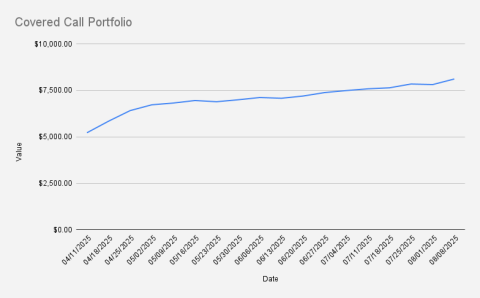

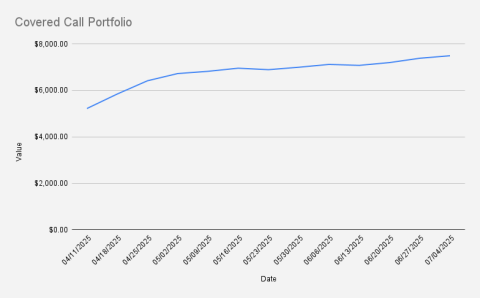

As of August 15, 2025, our covered call stock portfolio stood at $8,278, what is a decent increase of +2.07% if compared to previous week (+$168). While Year-to-date, we are already at +5.99%. Awesome!

This week, we collected $155 from selling options, what is well above my goal to generate at least 1% weekly in options premium (1.87% this week).

Our portfolio remains concentrated around NVDA stock.

I'm currently holding one covered call on NVDA with a $113 strike price expiring on December 19, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock…

Week 18 / 40th Birthday in Thessaloniki: BMY Credit Spreads, and a Heineken Twist

| | 104 seen

Greetings from Thessaloniki, Greece! This week, I’m celebrating my 40th birthday surrounded by fine cuisine, a light sea breeze, and surprisingly good house wine. If there’s a hidden gem in Europe, Thessaloniki is certainly one of them.

Travel brings inspiration—and new ideas. This week was one of those moments. I took a step back from my usual NVDA trades and instead opened new positions in Heineken and BMY. The result? Additional EUR income and an increased USD allocation in our dividend stock portfolio.

As of August 8, 2025, our covered call stock portfolio stood at $8,100, what is a decent increase of +3.85% if compared to previous week (+$300). While Year-to-date, we are already on positive +4.78%. Awesome!

This week, we collected $118 from selling options, what is above my goal to generate at least 1% weekly in options premium (1.45% this week).

Our portfolio remains concentrated around NVDA stock.

I'm currently holding one covered call on NVDA with a $113 strike price expiring on December 19…

Week 17 / Boring but Profitable: Weekly NVDA Credit Spread Expires Worthless, Again

| | 116 seen

As of August 1, 2025, our covered call stock portfolio stood at $7,810, what is a slight decrease of -0.4% if compared to previous week (-$31). While Year-to-date, we are still in positive territory with +1.69%. Awesome!

To be fully transparent, our portfolio's value is also influenced by EUR/USD exchange rate fluctuations. With the U.S. dollar strengthening to 1.15 against the euro, we experienced a decline in value when measured in dollar terms.

Aside from that, it was another boring week - our NVDA credit spread expired worthless, and we opened a new weekly credit spread. Boring is good; excitement often means risk.

This week, we collected $46 from selling options, what is below my goal to generate at least 1% weekly in options premium (0.58% this week).

Our portfolio remains concentrated around NVDA stock.

I'm currently holding one covered call on NVDA with a $113 strike price expiring on December 19, which is significantly deep in the money. If we allow the shares to be called away at…

Week 16 / Rolling Covered Calls: Why I Rolled NVDA to December for Higher Premium

| | 36 seen

As of July 25, 2025, our covered call stock portfolio stood at $7,841, another +2.69% week-over-week increase (+$205). Year-to-date, we are finally in positive territory with +0.37%. Awesome!

This week, I rolled forward and up our August 15 expiry covered call on NVIDIA, extending it to the December 19 expiry.

With this rollout, I increased the strike price by $3 and collected an additional premium of $0.60 per share. Given our long-term strategy to hold NVDA stock, I'm quite pleased with this adjustment - it aligns well with our overall goal of maximizing premium while maintaining upward exposure.

This week, we collected $101 from selling options, what is slightly above my goal to generate at least 1% weekly in options premium (1.28 % this week).

Our portfolio remains concentrated around NVDA stock.

I'm currently holding one covered call on NVDA with a $113 strike price expiring on December 19, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an…

Week 15 / Weekly Options Income Hits $66 as NVDA Credit Spreads Return

| | 17 seen

As of July 18, 2025, our covered call stock portfolio stood at $7,636, another +0.71% week-over-week increase (+$53). Year-to-date, we are still down -1.59%.

This week, we returned to selling credit spreads on NVDA, while also experimenting with Neste stock from the Helsinki Stock Exchange to boost our EUR-denominated income. From time to time, I enjoy trading in frontier markets.

This week, we collected $66 from selling options, what is slightly below my goal to generate at least 1% weekly in options premium (0.86 % this week).

Our portfolio remains concentrated around NVDA stock.

I'm currently holding one covered call on NVDA with a $110 strike price expiring on August 15, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $6,000.

Current positions

- NVDA Jul 25 165/155 Put Credit Spread

- NVDA Aug 15, 2025 $110 Covered Call

While…

Week 14 / WFC Credit Spread & NVDA Covered Call Strategy – Weekly Options Income Hits $83

| | 29 seen

As of July 11, 2025, our covered call stock portfolio stood at $7,582, another +1.26% week-over-week increase (+$94). Year-to-date, we are still down -2.94%.

Unlike previous weeks, this time I initiated a new credit spread on WFC (Wells Fargo), using the premium received to purchase shares of WFC itself. If not assigned, I’m considering selling additional credit spreads on WFC in the coming weeks, while using premium to offset the margin

Meanwhile, I continue to hold a deep in-the-money covered call position on NVDA.

This week, we collected $83 from selling options, what is slightly above my goal to generate at least 1% weekly in options premium (1.09 % this week).

Our portfolio remains concentrated around NVDA stock.

I'm currently holding one covered call on NVDA with a $110 strike price expiring on August 15, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $5,000.

…

Week 13 / Swedish Kronor & Premiums: SEB A Options Trade and NVDA Spread Fuel Gains

| | 47 seen

As of July 4, 2025, our covered call stock portfolio stood at $7,488, another +1.46% week-over-week increase (+$107). Year-to-date, we are still down -4.97%.

This week’s growth was driven by a combination of factors: the expiration of options trades on NVDA, favorable movement in the USD/EUR exchange rate (now at 1.18), and a strategic “revenge trade” on SEB A stock, which added a few Swedish Kronor to our portfolio.

This week, we collected $41 from selling options, what is under with our goal to generate at least 1% weekly in options premium (0.54 % this week).

Our portfolio remains concentrated around NVDA stock. On Thursday (Because of Independence Day) we successfully closed a put credit spread on NVDA that expired worthless, allowing us to retain the full premium. Continuing our premium collection strategy, we’ve initiated a new credit spread set to expire next week.

I'm currently holding one covered call on NVDA with a $110 strike price expiring on August 15, which is…

Week 12 / AI-Fueled NVDA Surge Lifts Portfolio +2.59% This week —But Is a Pullback Near?

| | 33 seen

As of June 27, 2025, our covered call stock portfolio stood at $7,380, another g+2.59% week-over-week increase (+$186). Year-to-date, we are still down -5.50%.

This week, we collected $46 from selling options, what is under with our goal to generate at least 1% weekly in options premium (0.62 % this week).

Our portfolio remains concentrated around NVDA stock. On Friday we successfully closed a put credit spread on NVDA that expired worthless, allowing us to retain the full premium. Continuing our premium collection strategy, we’ve initiated a new credit spread set to expire next week.

I'm currently holding one covered call on NVDA with a $110 strike price expiring on August 15, which is significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $4,700.

NVDA on Fire

NVDA stock is on fire—this week it surged well above the $155 mark, breaking through multiple resistance levels…

Week 11 / Beating the 1% Weekly Goal: How We Collected $101 in Options Premiums

| | 152 seen

As of June 20, 2025, our covered call stock portfolio stood at $7,194, a small but important +1.68% week-over-week increase (+$119). Year-to-date, we are still down -6.18%.

This week, we collected $101 from selling options, aligning with our goal to generate at least 1% weekly in options premium (1.4% this week).

Our portfolio remains concentrated around NVDA stock. On Friday we successfully closed a put credit spread on NVDA that expired worthless, allowing us to retain the full premium. Continuing our premium collection strategy, we’ve initiated a new credit spread set to expire next week.

Midweek, I decided to take a proactive stance and rolled up and away the June 27, $109 covered call on NVDA. The position was moved to a higher strike price of $110 with a new expiry of August 15. For this adjustment, we received an additional $48 in premium (net of commissions), and there's also potential to realize an extra $100 if NVDA stays above our strike price on expiry.

Our long-term strategy remains unchanged - we aim to…

Week 10 / NVDA Weekly Option Trades: $67 Earned, $3,200 Unrealized Profit at Risk

| | 57 seen

As of June 13, 2025, our covered call stock portfolio stood at $7,074, a minor -0.56% week-over-week decrease (-$39). Year-to-date, we are still down -7.85%, as we continue to navigate market volatility while optimizing our options income strategy.

This week, we collected $67 from selling options, which is slightly less from our goal to generate at least 1% weekly in options premium (0.96% this week).

Our portfolio remains concentrated around NVDA stock. On Friday we successfully closed a put credit spread on NVDA that expired worthless, allowing us to retain the full premium. Continuing our premium collection strategy, we’ve initiated a new credit spread set to expire next week.

I'm currently holding one covered call on NVDA with a $109 strike price expiring on June 27, which is now significantly deep in the money. If we allow the shares to be called away at expiry, this would lock in an unrealized profit of approximately $3,200.

Current positions

- NVDA 139/…

Israel & Cyprus 2025

| Travel guides | 49 seen

At the beginning of May 2025, we embarked on a 4-day trip to Israel to reconnect with the Fischer family.

We explored beautiful beaches, savored delicious local cuisine, and enjoyed quality time together. From Tel Aviv, we continued our journey to Cyprus to attend one of the largest conferences in the translation industry. While Sandra was actively engaged in networking at the event, we spent our time relaxing by the pools, making the most of the sunny Mediterranean atmosphere.

Also see: Israel Movie 2022 / 2023

Latest video

Hiking to Turtle Lake: A Winter Trail in Tbilisi

Last Sunday we did a hiking trip to Turtle Lake, starting from the stairs on Polikarpe Kakabadze street. I’ve been a big fan of hiking in Tbilisi for a long time. More than ten years ago, we used to do hiking trips almost every weekend, something I’ve written about on the blog many times. Back then it was routine.Last chance workout on the trails…

Tsikhisdziri & Batumi Botanical Garden

After returning from our amazing trip to Thessaloniki, we decided to extend our holiday a bit longer — this time in beautiful Tsikhisdziri. Huge thanks to Eto for kindly offering her cozy apartments at Bambo Beach, where we enjoyed a full week of relaxation by the sea.During our stay, we explored local gems like Shukura Tsikhisdziri (შუქურა…

Summer in Latvia 2025

Summer in Latvia movie is out - Join us on our July (2025) journey through Latvia: installing a bathtub in our countryside cottage, setting up a pop-up store at Bangotnes, celebrating a birthday in Vērbeļnieki, traveling via Riga to Jaunpiebalga, Vecpiebalga, Smiltene, and Valka. From sipping sparkling wine with swallows to running 4K morning…Living in Georgia

Tbilisi ETH Hackathon: Finally Making It (and Mostly Drinking Beer)

I first noticed ETH Chipmunks toward the end of 2025. They kept popping up on my radar via Luma links Ethereum meetups, hackathons, small community events in Tbilisi. I applied several times. Each time, something got postponed, rescheduled…

Mziuri Tennis Club in Tbilisi

Our family has been attending Mziuri Tennis Club in Tbilisi since September 2025, after several recommendations from our BIST community. We signed up our 7-year-old for the junior program, which costs 300 GEL per month. After a few months…

12 Rounds Boxing Club in Tbilisi

Sometimes even the most loyal gym-goers need to shake things up—and that's exactly what I did this month. After years of training at the "luxurious Axis Tower gym", I decided to take a short break. Not because I had any complaints about…

Tbilisi Circus: A Historic Landmark with a Surprising Past

Tbilisi Circus is an iconic part of the city's cultural landscape. Having lived in Georgia since 2011, I have passed by the Tbilisi Circus almost every day. However, it wasn’t until I attended a show that I truly appreciated its grandeur…

Piece of Life

Postcards from Marseille

It’s been nearly two years since our last trip to Marseille, a sun-drenched jewel on France’s southern coast that left an indelible mark on our memories. That summer of 2023, we set out to explore the city’s vibrant beaches and winding old town, arriving and departing through the bustling hub of Marseille St. Charles train station. As I sit…

Christmas Eve at Palolem Beach: Fire Shows, Old Monk

While we just celebrated Orthodox Christmas in Georgia, I can’t help but delve into the memories of our Western Christmas last year (2024), spent on the serene shores of Palolem Beach in Goa, India. That evening was magical in every way, filled with vibrant energy, beautiful scenery, and a new discovery that made the night unforgettable.Palolem…

A Family Guide to Borjomi: Hiking Trails and Sulfur Bath Tips

As summer came to a close, we continued our family's tradition of visiting Borjomi. This year marked yet another memorable trip at the end of August 2024, reaffirming our love for this beautiful Georgian town. Visiting Borjomi at least twice a year has become a cherished routine, a piece of life that we look forward to, blending relaxation,…

Hotel Reviews

Stays & Trails La Maison Hotel Review in Panaji

At the tail end of 2024, just before catching our flight back to Delhi, we decided to book a one-night stay at Stays & Trails La Maison Fontainhas in Panaji, Goa. After weeks staying in Palolem beach, we wanted to wrap up our trip with…

Schuchmann Wines Château: A Long-Awaited Stay in Georgia’s Premier Winery Hotel & Spa

It took us over a decade to finally make it to Schuchmann Wines Château & Spa, and it was well worth the wait! We’ve spent years recommending this stunning winery hotel to visiting friends and business partners, yet somehow, we had…

Hotel Belvedere Prague: A Practical Stay with Easy Access

During our recent trip to Prague in mid-October 2024, we stayed at Hotel Belvedere. My partner attended the MEET Central Europe Translators conference, and we were joined by one of our office employees, so we opted to book two rooms. …

Review: Art Hotel Prague – A Cozy Stay in a Tranquil Part of Prague

During our recent trip to Prague in October 2024, we opted for a one-night stay at the Art Hotel Prague. We arrived at the hotel via Bolt taxi from Václav Havel Airport, which was straightforward and efficient. At about EUR 120 per room…

Toursim objects

Plage des Catalans: A Shrinking Memory in Marseille

Plage des Catalans, a sandy crescent tucked along Marseille’s coastline, holds a special place in my travel tapestry. I first visited this beach in the summer of 2003, a carefree stop during my early adventures in the city. Back then, it felt like a haven—close to the bustling port yet offering a slice of Mediterranean calm. When I returned…

Colva Beach: Golden Sands and Tranquility in Goa

Colva Beach, located in South Goa, is known for its expansive golden sands and tranquil atmosphere. Stretching for several kilometers along the Arabian Sea, the beach offers a peaceful escape from the busier tourist hubs in the region. Its wide shoreline, framed by swaying palm trees, provides plenty of space for visitors to relax, stroll, or…

Charles Bridge: A Timeless Landmark in Prague

The Charles Bridge (Karlův most) in Prague is one of the most iconic and historic landmarks in Europe. Built in the 14th century under the reign of King Charles IV, this Gothic stone bridge spans the Vltava River, connecting Prague's Old Town with the Lesser Town (Malá Strana). Adorned with a series of 30 Baroque statues and surrounded by…

Macroeconomics

| GDP Growth in the Baltic States (2016–2025) | |

| Minimum Wages in European Union 2024 | |

| Minimum Wages Set to Increase in Baltic States in 2024 | |

| GDP Per Capita in OECD countries 2022 |

Servers and Drupal

Genealogy

| Baltic German DNA Uncovered: Tracing My Ancestry to the von Anrep Nobility | |

| MyHeritage DNA test result | |

| MyHeritage DNA test, flight to Tbilisi, Stock Recovery |