Why I Added Pfizer (PFE) Back to My Portfolio

| Stock Portfolio | 12 seen

Pfizer (PFE) is not a new name in my investing history. I was investing in PFE well before Covid, with fairly high expectations for the stock as a stable pharmaceutical blue-chip with strong cash flows and a reliable dividend profile. During the Covid years, Pfizer became a market favorite, but paradoxically that period also marked the beginning of my loss of interest in the stock.

Once PFE was excluded from the Dow Jones Industrial Average, the broader market narrative around the company changed. Momentum faded, expectations were reset lower, and the stock gradually lost attention. During one of my early margin liquidation events (2020), I let the position go entirely not because of fundamentals, but because of portfolio mechanics and capital pressure at the time.

Over the following years, Pfizer stayed on my radar in a mostly passive way. I occasionally looked at it from an options-trading perspective and sometimes as a dividend-income candidate, but it was never a priority allocation.

That changed on February 9, 2026.

After closing a short put position on Shell, I was looking for a replacement trade that offered liquidity, depressed or sideways…

Why Invest in MicroStrategy (MSTR) When You Can Buy Bitcoin Directly?

| Crypto | 15 seen

Like everyone in crypto should have heard about MicroStrategy by now. It’s impossible to miss it — Michael Saylor, massive debt issuance, billions in Bitcoin on the balance sheet, and MSTR trading like a leveraged BTC ticker. But what has always personally puzzled me is simple: why bother investing in MSTR at all, when you can just buy Bitcoin directly?

If the core thesis is that Bitcoin goes up over time, then spot BTC feels like the cleanest and most honest expression of that belief. No management risk, no dilution, no debt, no equity market correlation, no corporate structure layered on top. Just Bitcoin. And yet, MSTR keeps attracting capital and often trades at a premium to the Bitcoin it actually holds. That disconnect is worth examining.

The first mistake is to think MSTR is competing with spot Bitcoin. It isn’t. MicroStrategy exists because a large portion of capital cannot buy BTC directly, cannot custody it, cannot trade crypto derivatives, and cannot actively manage volatility. For those investors, MSTR is not optimal it is permitted. It wraps Bitcoin exposure inside a US-listed equity and solves a compliance problem, not an…

A Poor Man’s Buy/Write With XRP (Yes, It Exists)

| Crypto | 31 seen

On February 6, I opened a tiny XRP trade. Not because it will move markets. Not because it will fund early retirement. But because it’s a clean, honest example of how a buy/write strategy can work even in crypto.

Think of this as poor man’s crypto hedge fund experimentation: low stakes, existing collateral, mostly for fun but with real mechanics and real money.

On February 6, I bought 66 XRP at $1.51 and immediately sold 66 call options with a $1.70 strike and March 27, 2026 expiry.

This is a classic covered call. The XRP itself serves as collateral. No leverage, no margin, no liquidation nightmares. Capital involved is laughably small which is exactly why it’s useful as an example.

The math is refreshingly simple.

Buying 66 XRP at $1.51 cost $99.66.

For selling the calls, I received a premium of $0.09 per XRP, or $5.94 total.

That premium immediately reduces my effective cost basis from $1.51 to $1.42 per XRP. Before anything else happens, I’m already paid.

If XRP is…

Tbilisi ETH Hackathon: Finally Making It (and Mostly Drinking Beer)

| Living in Georgia | 30 seen

I first noticed ETH Chipmunks toward the end of 2025. They kept popping up on my radar via Luma links Ethereum meetups, hackathons, small community events in Tbilisi. I applied several times. Each time, something got postponed, rescheduled, or quietly disappeared. Timing never worked.

That changed in early February 2026, when the Tbilisi ETH Hackathon (Season 2 or something) finally happened—and I finally made it.

I showed up prepared. Laptop in the suitcase, a few rough AI-related ideas in mind, and at least a vague intention to build something. Reality, as usual, had other plans.

The event itself was solid. Well organized, relaxed, no unnecessary hype. A real hacker crowd. Most people were there to code - and they did. From what I could tell, 80–90% of the participants were Russian-speaking, which isn’t surprising given the large influx over the past few years. The focus was clearly Ethereum-native: smart contracts, infra, tooling, experiments.

I did open my MacBook. Briefly.

But instead of hacking, I mostly ended up talking - with the host (Italian guy), with…

Week 44 / $94 Options Premium Earned Amid NVDA Volatility and Tech Sell-Off

| | 41 seen

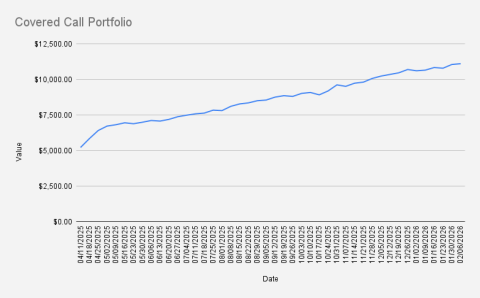

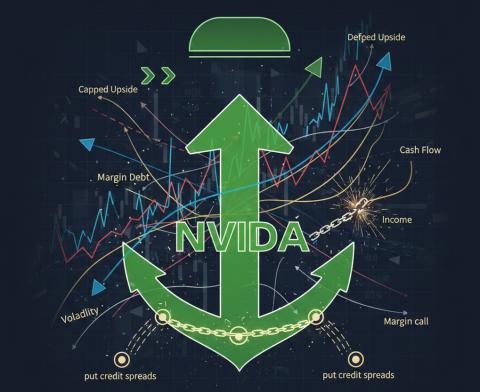

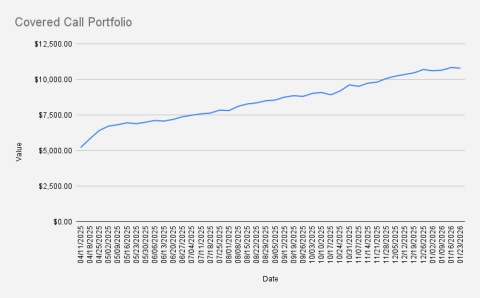

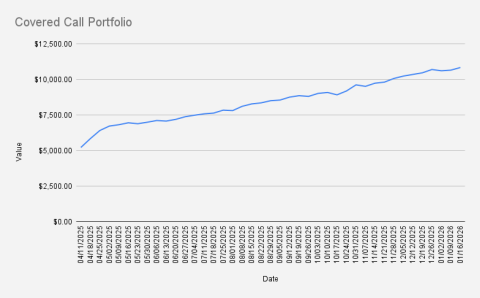

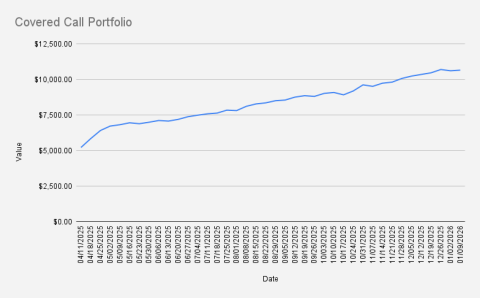

As of February 6, 2026, our covered-call stock portfolio has increased by another +0.51% and closed at $11,106.

Wow, what a week - this has been a very tough week for tech stocks and crypto. Our Ethereum strategy fell by an additional 15%, and we ultimately capitulated on our current leveraged positions. A clear takeaway: avoid leverage at all costs.

Unlike the calmer weeks before, this week we were more active in our stock portfolio, placing new trades and actively managing NVDA credit spreads. I rolled NVDA puts twice during the week—first rolling the 177.5 put down and out, and then rolling again to the 170 strike with expiry at the end of February.

Given the ongoing sell-off in tech stocks and NVDA’s upcoming earnings around February 22, we expect elevated volatility in the portfolio. As a result, we will not place new trades until current positions are fully managed, which means lower options premium income for this month.

Our covered call portfolio is up 5.08% YTD, slightly outperforming the S&P 500 (+0.68%) and NVDA (-2.08%) YTD.

Besides options trading, we have a small habit: every time our…

The Fisherman's Wharf Calangute

| Restaurant reviews | 47 seen

Some places just stick with you.The Fisherman’s Wharf in Calangute (Goa) is one of those restaurants we keep coming back to and not by accident. We first discovered it during our first India trip in 2023/2024, when we spent a few days staying in Calangute at Hotel Renest (seems I have forgot to review it here)

Back then we were exploring the area, trying different food spots, and The Fisherman’s Wharf instantly stood out, also it was closely located to our hotel.

On our most recent trip, we once again made a stop at The Fisherman’s Wharf and this time it was perfectly timed.

After spending a few hours shopping at our favorite boutique shop, Boutique Eternal, we were hungry, tired, and ready for something truly satisfying. The Fisherman’s Wharf was the obvious choice. It’s one of those restaurants where you don’t need to think too much - you already know you’ll eat well.

If you’re into seafood, this place is a no-brainer. The menu is packed with classic coastal options, and they do it properly. The highlight for us? Seafood and jumbo prawns — the kind that actually feel like jumbo prawns, not just a marketing trick.

And of course, nothing pairs…

Week 43: Boring but Profitable — BMY Credit Spread Brings in $65 Options Premium

| | 47 seen

As of January 30, 2026, our covered-call stock portfolio has once again increased by +2.43% and closed at $11,050. For the first time, we’ve cracked the $11K milestone. Awesome.

Interestingly, we kept activity minimal this week the only new trades were BMY credit spreads opened today. Despite that, the NVDA-centered portfolio is clearly outperforming the crypto portfolio, which suffered another sharp -30% drop this week. Definitely worth noting.

This week, I also published an article explaining our NVDA strategy - you can read it here: How the NVDA Strategy Became the Backbone of Our Stock Portfolio.

Our covered call portfolio is up 3.71% YTD, slightly outperforming the S&P 500 (+1.1%). Since NVDA is our core underlying - used for selling credit spreads and covered calls, while gradually accumulating shares through option premiums it is also appropriate to compare performance against NVDA itself. Notably, NVDA is up +1.97% YTD.

Options trades:As mentioned earlier, I opened a new bull put credit spread on BMY. With the premium received, I also bought an additional BMY share, increasing our total position…

How the NVDA Strategy Became the Backbone of Our Stock Portfolio

| Stock Portfolio | 35 seen

The NVDA strategy didn’t start as a master plan. It emerged out of necessity.

About a year ago (2025), after the DeepSeek-related volatility shock that briefly crushed NVDA and other AI names, our stock portfolio was under pressure. I was using margin across multiple positions, volatility expanded fast, and I faced a margin call. That was the moment I decided to abandon complexity and build the entire portfolio around a single, highly liquid asset. I chose NVIDIA.

I bought 100 shares of NVDA on margin around the $110 level. Immediately after the trade, our account showed roughly –$6,700 in margin debt. From the start, this was not a “long and forget” position -it was a position that had to work, structurally.

Very shortly after, NVDA did what it often does: it exploded higher. The stock ran from ~110 into the 160–170 range, then 180, and at one point traded above 220. However, because I began selling calls early - primarily to reduce margin stress - I had already capped most of the upside. That wasn’t an accident. It was the trade-off I consciously accepted in exchange for…

Bots, Rewards, and TerraM: Unexpected Signals from DeFi Liquidity

| Crypto | 25 seen

I minted 10,000 TerraM tokens back in 2022 with a very simple idea: raise $10,000 and trade Ethereum options. The plan was straightforward - tokenized participation, transparent backing, real trading activity. In practice, the initial capital raise never really materialised. There was no big launch, no rush of external capital, no instant liquidity.

What did happen over time, however, turned out to be more important.

Instead of relying on outside funding, I gradually raised capital organically and, more importantly, started generating income from our own options trading. That income gave TerraM something many small tokens never get: real economic activity behind it. Every TerraM token is backed by USDC value derived from actual trading results. Not a promise, not a narrative, but cash flow.

There are nuances here, of course. TerraM trades on Raydium, and liquidity has almost always been shallow. For most of its life, the liquidity pool rarely exceeded about 5% of total token value. This wasn’t accidental. The majority of funds were consistently deployed into actual trading rather than sitting idle in a pool. From a trading perspective, that made sense. From a…

Hiking to Turtle Lake: A Winter Trail in Tbilisi

| Living in Georgia | 85 seen

Last Sunday we did a hiking trip to Turtle Lake, starting from the stairs on Polikarpe Kakabadze street. I’ve been a big fan of hiking in Tbilisi for a long time. More than ten years ago, we used to do hiking trips almost every weekend, something I’ve written about on the blog many times. Back then it was routine.

- Last chance workout on the trails around Turtle Lake before Tbilisi Marathon

- Hiking trails near Turtle lake, Tbilisi in Winter

- Remote and Abandoned Hipster Party Place with Great views of Tbilisi (Hiking near Turtle Lake)

- and more

Recently we moved to a new apartment on Pavle Ingorovka Street, and from our window we can clearly see hiking trails cutting through the hills. That alone was enough motivation. One evening I pinged Jeff, a Belgian acquaintance, asking if he was up for a hike. He immediately suggested starting from the location, not far from our place, he even sent me location name in Georgian, so I can find the spot - ლამაზი ხედი თბილისზე ხის კიბეები. Decision made.

The next morning at 9:30 we met at the spot and started the trip. With a seven-year-old along, the whole route took us a bit…

How to Borrow Against Solana on Bybit to Boost Covered Call Income

| Crypto | 41 seen

On September 4, 2025, we launched the Solana Covered Call Growth Fund at Terramatris. The fund’s objective is to grow our SOL holdings primarily through selling covered calls, with most initial positions entered via cash-secured puts.

Although the fund is still small, over time we accumulated 6 SOL from option premiums. This led me to explore a leverage extension: using earned SOL as collateral to borrow stablecoins, acquire additional SOL, and sell more covered calls to increase income.

After accumulating 6 SOL over the past 5 months, I used them as collateral on Bybit and borrowed 390 USDT. At the time, SOL was trading around $130, so the borrowed amount was sufficient to purchase 3 SOL.

- Borrowed: 390 USDT

- Interest rate: ~4.5% annual

- Annual interest cost: ~$17.55

- Interest for ~35 days: ~$1.67

I bought 3 SOL at $128 and immediately sold 3 covered call options with:

- Expiry: February 27, 2026

- Strike: $130

- …

Week 42 / $107 Options Income From Rolling NVDA Credit Spreads During the Greenland Shock

| | 82 seen

As of January 23, 2026, our covered-call stock portfolio has dipped slightly by -0.43% and closed at $10,788.

The previous week was highly turbulent. As the market opened on Tuesday, NVDA briefly dipped below my call strike levels. Given the elevated volatility, I decided not to wait and took an early roll, pushing the position several weeks (February 6) out to reduce near-term risk.

Volatility remained elevated throughout the week and only began to ease after President Trump’s speech in Davos, which I followed closely on CNBC. Once he stated that no force was planned to be used regarding Greenland, both equity and crypto markets reacted positively and turned green again.

That relief, however, was short-lived. While stocks stabilized, overall market conditions remained unstable, and our crypto-funds ultimately took a hit by the end of the week (-23% week over week for TerraM Multi Asset Fund)

The positive development for our NVDA strategy is that the stock has turned decisively green again and, at the time of writing, is trading around 187.

Our covered call portfolio is up 2.81%…

Week 41 / NVDA Credit Spread Strategy: 0.43% Weekly Return if Expires Worthless

| | 69 seen

Greetings from Tbilisi. After more than three weeks in India, we are finally back—welcomed by temperatures below 0°C and already missing Goa and its +31°C.

Last week, we also held our annual office party (Caucasus Translations) at Babilo Music Hall, enjoying excellent Georgian cuisine, wine, and traditional Georgian dance. I skipped the food due to intermittent fasting (no eating after 14:00), but it was a great evening nonetheless.

As of January 16, 2026, our covered-call stock portfolio has increased again by additional +1.71% and closed at $10,835.

It has been an excellent start to 2026, and we are positioning for further growth while remaining cautious. A market correction around earnings season cannot be ruled out. With NVDA scheduled to report earnings at the end of February, we are comfortable selling credit spreads, as they provide downside protection.

Our covered call portfolio is up 4.31% YTD, outperforming the S&P 500 (+1.28%). Since NVDA is our core underlying - used for selling credit spreads and covered calls, while gradually accumulating shares through option premiums it is also appropriate to compare performance…

TerraM 52‑Week Saving Challenge: Commitment, Liquidity, and Skin in the Game

| Investments | 36 seen

I have attempted the classic 52‑week saving challenge several times over the years. I tried it with cash, mutual funds, and even speculative assets like meme coins. Results were mixed. Sometimes the discipline worked, sometimes it failed - usually not because of returns, but because of inconsistency and lack of long‑term conviction.

This time, the setup is different.

I am launching the TerraM 52‑Week Saving Challenge, centered entirely on the TerraM token, the native token of the Terramatris crypto hedge fund.

The structure is intentionally simple:

- Week 1: invest $1 in TerraM

- Week 2: invest $2 in TerraM

- Each week, increase the investment by $1

- Week 52: invest $52 in TerraM

By the end of the year:

- Total invested capital: $1,378

- Number of buys: 52 separate on‑chain purchases

No timing, no optimization, no skipping weeks.

This challenge is biased by design. I am the CEO and founder of Terramatris, and TerraM…

Week 40 / NVDA Strategy, $65 Premium Income, and Margin Reduction

| | 50 seen

Greetings from Mumbai, India. For the past three years, we’ve spent our winter holidays in India, usually traveling to Goa via New Delhi. This time, however, we arrived and departed through Mumbai and had a few days to explore the city. I’m genuinely impressed. Mumbai is definitely a city where I could imagine living long-term. Beyond that, it stands out as one of Asia’s major financial centers.

One thing that really stands out when traveling around India is the prevalence of billboards advertising investments in mutual funds. Likewise, when visiting libraries, it’s not uncommon to find educational books on options trading. This suggests that India’s retail financial markets are not only growing, but already fairly mature.

That said:

As of January 9, 2026, our covered-call stock portfolio has increased slightly by +0.44% and closed at $10,653. For the sake of transparency, it’s worth noting that the slight decline is due to USD/EUR exchange rate movements. The U.S. dollar kept appreciating against the euro, which reduced the total value when expressed in USD.

Our covered call portfolio is up 2.37%, modestly outperforming the S&P 500…

Latest video

Hiking to Turtle Lake: A Winter Trail in Tbilisi

Last Sunday we did a hiking trip to Turtle Lake, starting from the stairs on Polikarpe Kakabadze street. I’ve been a big fan of hiking in Tbilisi for a long time. More than ten years ago, we used to do hiking trips almost every weekend, something I’ve written about on the blog many times. Back then it was routine.Last chance workout on the trails…

Tsikhisdziri & Batumi Botanical Garden

After returning from our amazing trip to Thessaloniki, we decided to extend our holiday a bit longer — this time in beautiful Tsikhisdziri. Huge thanks to Eto for kindly offering her cozy apartments at Bambo Beach, where we enjoyed a full week of relaxation by the sea.During our stay, we explored local gems like Shukura Tsikhisdziri (შუქურა…

Summer in Latvia 2025

Summer in Latvia movie is out - Join us on our July (2025) journey through Latvia: installing a bathtub in our countryside cottage, setting up a pop-up store at Bangotnes, celebrating a birthday in Vērbeļnieki, traveling via Riga to Jaunpiebalga, Vecpiebalga, Smiltene, and Valka. From sipping sparkling wine with swallows to running 4K morning…Living in Georgia

Tbilisi ETH Hackathon: Finally Making It (and Mostly Drinking Beer)

I first noticed ETH Chipmunks toward the end of 2025. They kept popping up on my radar via Luma links Ethereum meetups, hackathons, small community events in Tbilisi. I applied several times. Each time, something got postponed, rescheduled…

Mziuri Tennis Club in Tbilisi

Our family has been attending Mziuri Tennis Club in Tbilisi since September 2025, after several recommendations from our BIST community. We signed up our 7-year-old for the junior program, which costs 300 GEL per month. After a few months…

12 Rounds Boxing Club in Tbilisi

Sometimes even the most loyal gym-goers need to shake things up—and that's exactly what I did this month. After years of training at the "luxurious Axis Tower gym", I decided to take a short break. Not because I had any complaints about…

Tbilisi Circus: A Historic Landmark with a Surprising Past

Tbilisi Circus is an iconic part of the city's cultural landscape. Having lived in Georgia since 2011, I have passed by the Tbilisi Circus almost every day. However, it wasn’t until I attended a show that I truly appreciated its grandeur…

Piece of Life

Postcards from Marseille

It’s been nearly two years since our last trip to Marseille, a sun-drenched jewel on France’s southern coast that left an indelible mark on our memories. That summer of 2023, we set out to explore the city’s vibrant beaches and winding old town, arriving and departing through the bustling hub of Marseille St. Charles train station. As I sit…

Christmas Eve at Palolem Beach: Fire Shows, Old Monk

While we just celebrated Orthodox Christmas in Georgia, I can’t help but delve into the memories of our Western Christmas last year (2024), spent on the serene shores of Palolem Beach in Goa, India. That evening was magical in every way, filled with vibrant energy, beautiful scenery, and a new discovery that made the night unforgettable.Palolem…

A Family Guide to Borjomi: Hiking Trails and Sulfur Bath Tips

As summer came to a close, we continued our family's tradition of visiting Borjomi. This year marked yet another memorable trip at the end of August 2024, reaffirming our love for this beautiful Georgian town. Visiting Borjomi at least twice a year has become a cherished routine, a piece of life that we look forward to, blending relaxation,…

Hotel Reviews

Stays & Trails La Maison Hotel Review in Panaji

At the tail end of 2024, just before catching our flight back to Delhi, we decided to book a one-night stay at Stays & Trails La Maison Fontainhas in Panaji, Goa. After weeks staying in Palolem beach, we wanted to wrap up our trip with…

Schuchmann Wines Château: A Long-Awaited Stay in Georgia’s Premier Winery Hotel & Spa

It took us over a decade to finally make it to Schuchmann Wines Château & Spa, and it was well worth the wait! We’ve spent years recommending this stunning winery hotel to visiting friends and business partners, yet somehow, we had…

Hotel Belvedere Prague: A Practical Stay with Easy Access

During our recent trip to Prague in mid-October 2024, we stayed at Hotel Belvedere. My partner attended the MEET Central Europe Translators conference, and we were joined by one of our office employees, so we opted to book two rooms. …

Review: Art Hotel Prague – A Cozy Stay in a Tranquil Part of Prague

During our recent trip to Prague in October 2024, we opted for a one-night stay at the Art Hotel Prague. We arrived at the hotel via Bolt taxi from Václav Havel Airport, which was straightforward and efficient. At about EUR 120 per room…

Toursim objects

Plage des Catalans: A Shrinking Memory in Marseille

Plage des Catalans, a sandy crescent tucked along Marseille’s coastline, holds a special place in my travel tapestry. I first visited this beach in the summer of 2003, a carefree stop during my early adventures in the city. Back then, it felt like a haven—close to the bustling port yet offering a slice of Mediterranean calm. When I returned…

Colva Beach: Golden Sands and Tranquility in Goa

Colva Beach, located in South Goa, is known for its expansive golden sands and tranquil atmosphere. Stretching for several kilometers along the Arabian Sea, the beach offers a peaceful escape from the busier tourist hubs in the region. Its wide shoreline, framed by swaying palm trees, provides plenty of space for visitors to relax, stroll, or…

Charles Bridge: A Timeless Landmark in Prague

The Charles Bridge (Karlův most) in Prague is one of the most iconic and historic landmarks in Europe. Built in the 14th century under the reign of King Charles IV, this Gothic stone bridge spans the Vltava River, connecting Prague's Old Town with the Lesser Town (Malá Strana). Adorned with a series of 30 Baroque statues and surrounded by…

Macroeconomics

| GDP Growth in the Baltic States (2016–2025) | |

| Minimum Wages in European Union 2024 | |

| Minimum Wages Set to Increase in Baltic States in 2024 | |

| GDP Per Capita in OECD countries 2022 |

Servers and Drupal

Genealogy

| Baltic German DNA Uncovered: Tracing My Ancestry to the von Anrep Nobility | |

| MyHeritage DNA test result | |

| MyHeritage DNA test, flight to Tbilisi, Stock Recovery |